With close to US$100 million sitting in its Natural Resources Fund (NRF) account at the Federal Reserve Bank of New York, new oil producer Guyana has already began earning interest on some of that revenue even as the global economy contracted during the first quarter of the year, thus affecting negatively commodity prices and interest rates.

The Fund received its first revenue of US$54.93 million (GY$11.4 billion) on March 11 from the country’s initial million-barrel oil cargo. Royalty payments for the first quarter closely followed, amounting to US$4,909,505 (GY$1.035 billion). Then on June 10, an additional sum of US$35,063,582 was deposited into the NRF account. All told, the country has so far received US$94,921,803 from oil sales and royalty, since production began last December.

The Ministry of Finance said on Friday in its first NRF Quarterly Report that the profit earned in Q1 2020, based on the balance that was in the account as at the end of March (US$54.93 million or GY$11.4 billion), amounted to almost US$7,800 (GY$1.6 million). This comprise interest earned on deposits held with the Federal Reserve Bank of New York.

“This represented a return of 0.014% during the quarter reflecting the decline in interest rates,” the Ministry said.

Brent crude oil price per barrel was US$66.25 at the beginning of the quarter falling to US$26.35 at the end as the effects of a price war and the COVID-19 pandemic kicked in. The US interest rate was lowered from a range of 1.50% – 1.75% to a range of 0% – 0.25% over the same period.

The Ministry of Finance reminded that the performance of the Global economy is very important to Guyana’s new and emerging sector with respect to cash flows due to changes in prices and interest rates. The Global economy, it stated, slowed in the first quarter of 2020 as many countries around the world faced economic decline as a result of the COVID-19 pandemic.

In an effort to limit the spread of the coronavirus, nations, including Guyana, went into lockdown and closed their borders, imposing travel restrictions and halting the operations of many businesses. Total net returns declined across major financial markets around the world.

Globally, consumption and investments declined, exports and imports decreased, tourism declined, risk aversion increased in financial markets and global supply chains have been disrupted.

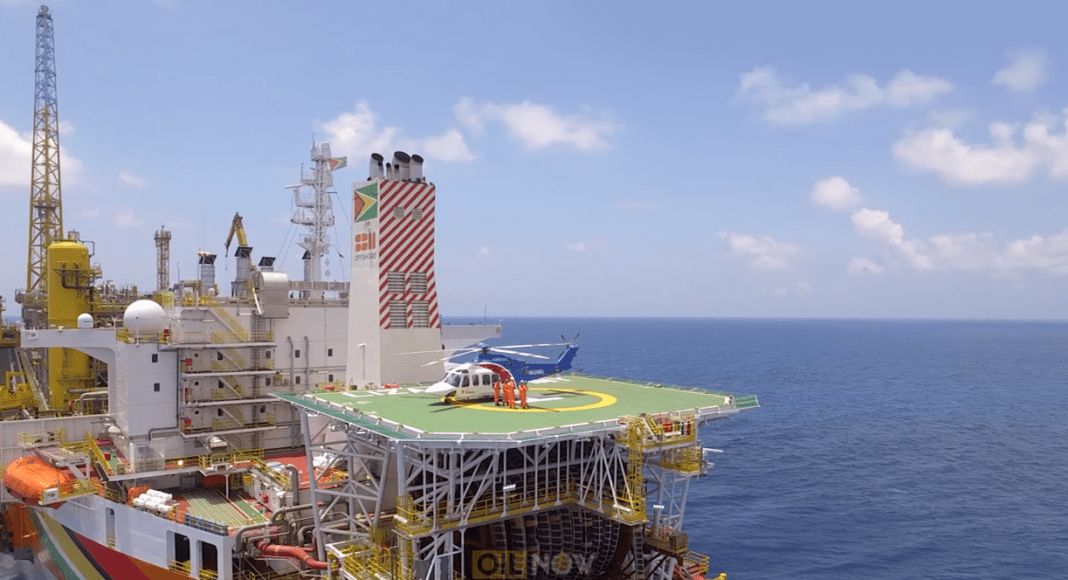

Despite these global challenges, oil production continues in earnest offshore Guyana and US oil major, ExxonMobil, operator at the prolific Stabroek Block, has said it will continue to forge ahead with its exploration and production plans in the South American country.