Hess Corporation (NYSE: HES) on Wednesday reported a net loss of $106 million, or $0.38 per common share, in the first quarter of 2018, compared to a net loss of $324 million, or $1.07 per common share, in the first quarter of 2017. Nevertheless, the company says the focus this year is on execution and the more than 3.2 billion barrels of oil discovered off the Guyana coast is playing a key role in that regard.

On an adjusted basis Hess reported an after-tax net loss of $72 million, or $0.27 per common share, in the first quarter of 2018. The improved after-tax adjusted results reflect higher realized crude oil selling 2 prices, lower operating costs and depreciation, depletion and amortization expense, partially offset by lower production volumes, primarily due to asset sales.

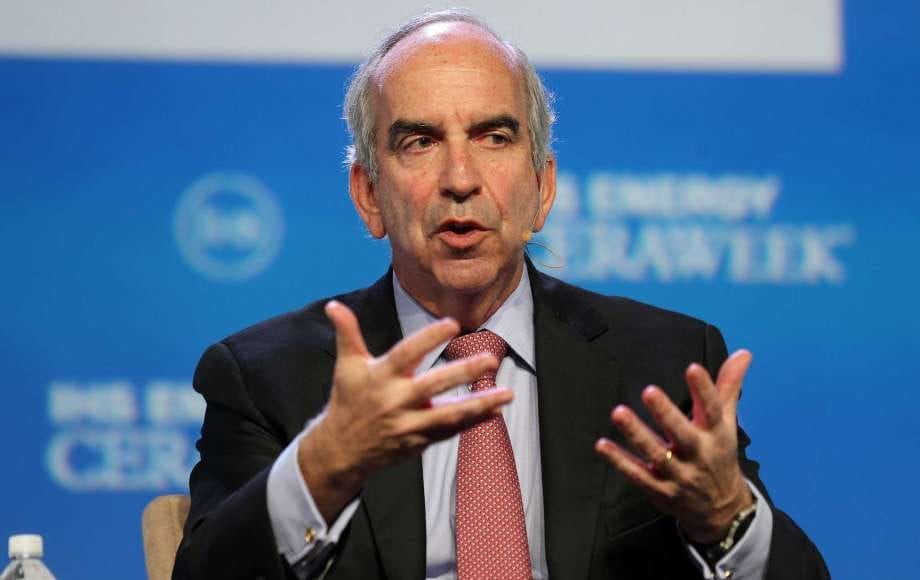

“Our focus for 2018 is on execution and we believe we are off to a very strong start to the year,” Chief Executive Officer John Hess said. “In the first quarter, we increased cash returns to shareholders, reduced debt, exceeded our production guidance, continued to lower our costs and announced two significant oil discoveries offshore Guyana – Ranger and Pacora.”

Exploration and Production (E&P) net loss in the first quarter of 2018 was $25 million, compared to a net loss of $233 million in the first quarter of 2017. On an adjusted basis, first quarter 2018 net income was $12 million. The Corporation’s average realized crude oil selling price, including the effect of hedging, was $59.32 per barrel in the first quarter of 2018, up from $48.58 per barrel in the year-ago quarter. The average realized natural gas liquids selling price in the first quarter of 2018 was $21.11 per barrel, versus $18.71 per barrel in the prior-year quarter, while the average realized natural gas selling price was $3.86 per mcf, compared to $3.20 per mcf in the first quarter of 2017.

In its operational highlights for the first quarter of 2018, Hess said ExxonMobil affiliate Esso Exploration and Production Guyana Limited, the Operator in the Stabroek Block, completed drilling at the Liza-5 well with the Stena Carron drillship, and is conducting a series of production tests. In April, drilling commenced at the Sorubim-1 well with the Noble Bob Douglas drillship.

Development activities for Liza Phase 1, which include a floating, production, storage, and offloading vessel (FPSO) with a gross capacity of 120,000 bopd, are on schedule and first production is expected by 2020. Planning continues for a second phase of development that is expected to include a larger FPSO with a gross capacity of approximately 220,000 bopd, with first production planned by mid-2022, the company said.

Hess holds a 30 percent stake in the 6.6 million acres Stabroek Block.