HAMILTON, Bermuda–(BUSINESS WIRE)–Long-Term Incentive Plan – 2022 – first tranche vesting

In accordance with its Long-Term Incentive Program (the “LTIP”) for employees, management, and board members of Cool Company Ltd. (the “Company” or “CoolCo”) and its affiliate, the first tranche of the restricted stock units (“RSUs”) awarded in 2022 vest on November 30, 2023. The Company anticipates that the shares underlying the vested RSUs will be issued to grantees on or after December 7, 2023. At such time, the number of issued shares in the Company will increase by 14,381 shares to a total number of issued shares of 53,702,843, with each share having a nominal value of USD 1.00.

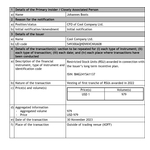

As part of the LTIP, RSUs for the following primary insiders of the Company (the “Primary Insiders”) will vest on November 30, 2023, resulting in the following share issuances:

- Richard Tyrrell: 1,898 shares

- Johannes Boots: 979 shares

Full details of the LTIP are available in the Press Release issued on November 25, 2022, or in the Company’s 2022 Annual Report on Form 20-F as filed with the SEC.

LTIP – 2023

Additionally, the Company’s board of directors (the “Board”) has resolved, in accordance with the LTIP, to authorize options (“Options”) and RSUs for 2023, as further detailed below.

Pursuant to the LTIP, the Board has resolved to grant a total number of 74,246 Options and 102,107 RSUs to employees, management and board members of the Company (equivalent to approximately 0.14% and 0.19% of the Company’s share capital, respectively).

Each Option, when exercised, carries the right to acquire one share in CoolCo, giving the right to acquire up to an aggregate 74,246 shares. The exercise price for the Options is USD 12.47 per share. The Options will vest over a period of 3 years, in equal annual installments, on each of November 29, 2024, November 30, 2025, and November 30, 2026, and will lapse 3 years from the date of their grant if not exercised.

Pursuant to the LTIP, RSUs vest into shares of the Company. The RSUs will vest equally in four installments on each of November 29, 2024, November 30, 2025, November 30, 2026 and November 30, 2027.

Share Purchase

Richard Tyrrell, CEO and Director of the Company, has on December 1, 2023 acquired 2,030 shares in the Company at a price of USD 12.49 per share.

Primary Insiders

The following Primary Insiders have been granted Options and RSUs, and purchased shares as per the below:

- Sami Iskander (Director) has been granted 37,123 Options. Following the grant, Sami Iskander holds 37,123 Options in CoolCo.

- Joanna Huipei Zhou (Director) has been granted 37,123 Options. Following the grant, Joanna Huipei Zhou holds 510 shares and 37,123 Options in CoolCo.

- Richard Tyrrell (CEO and Director) has been granted 6,062 RSUs. Following the vesting of abovementioned RSUs on November 30, 2023, the new RSU grant and the share purchase, Richard Tyrrell holds 6,313 shares, 11,755 RSUs, and 371,227 Options in CoolCo.

- Johannes Boots (CFO) has been granted 3,278 RSUs. Following the vesting of abovementioned RSUs on November 30, 2023 and the new RSU grant, Johannes Boots holds 589 shares, 6,215 RSUs, and 123,742 Options in CoolCo.

Please see the enclosed forms for further details about the transactions.

ABOUT COOLCO

CoolCo is an LNG Carrier pure play with a balanced portfolio of short and longer-term charters, the cash flows from which form the basis of the Company’s quarterly dividend for common shareholders. In addition to the built-in and funded growth from two newbuilds scheduled to deliver in the second half of 2024, CoolCo’s strategy includes ongoing assessment of opportunities for vessel acquisitions and potential consolidation in a fragmented market segment. Through its in-house vessel management platform, CoolCo manages and operates its LNG transportation and infrastructure assets for a range of the world’s leading companies in addition to providing such services to third parties. CoolCo benefits from the scale and stature of Eastern Pacific Shipping and its affiliates, encompassing CoolCo’s largest shareholder and the owner of one of the world’s largest independent shipping fleets, which strengthen the Company’s strategic position with regard to shipyards, financial institutions, and access to dealflow. CoolCo supports the world’s decarbonization and energy security needs and has stated its intention to reduce its emissions by 10-15% through its LNGe upgrade program, as part of a fleet-wide improvement target of 35% between 2019 and 2030.

Additional information about CoolCo can be found at www.coolcoltd.com.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements with respect to delivery dates of newbuilds, our strategy, our intention to reduce carbon emissions and any expected performance of our LNGe upgrade program, emissions reduction and improvement targets, statements with respect to RSUs and options, including vesting dates and other non-historical statements. Forward-looking statements are typically identified by words or phrases, such as “about”, “believe,” “expect,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could.” These statements are based on current expectations, estimates, assumptions and projections and you should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. There are important factors that could cause our actual results, level of activity, performance, liquidity or achievements to differ materially from the ones expressed or implied by these forward-looking statements. These risks and uncertainties include risks relating to future industry conditions and other risks indicated in the risk factors included in CoolCo’s Annual Report on Form 20-F for the year ended December 31, 2022 and other filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

This information is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act.

Contacts

For further information, please contact:

c/o Cool Company Ltd – +44 207 659 1111 / [email protected]

Richard Tyrrell – Chief Executive Officer

John Boots – Chief Financial Officer