Guyana’s 2024 national budget, set at a new high of US$5.496 billion (GY$1.146 trillion), reflects a 47% increase compared to the 2023 budget of US$3.75 billion (GY$781.9 billion). This expansion is being partially fueled by the nation’s increasing oil windfall, projected to constitute nearly 29% of the budget.

In 2023, the Natural Resource Fund (NRF) received US$1.617 billion (GY$337 billion) from oil-related activities, including royalties and profit oil sales. The government has tabled a bill in Parliament, proposing to amend the NRF Act to spend more money than the law currently allows. A Ministry of Finance release said this is necessary to allow “greater financial resources to be available to support intensified public investment and accelerated delivery of social services.”

Guyana is building up transport infrastructure, schools, hospitals, and energy plants. The 2024 budget is proportionate in its reliance on oil revenues to the previous year when withdrawals from the oil fund accounted for about 27% of the national budget.

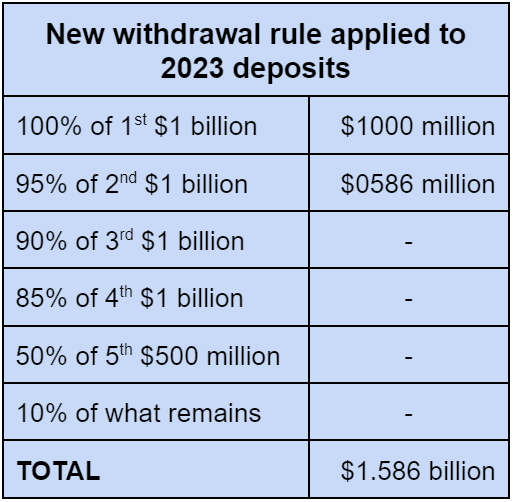

The proposed new formula suggests allowing higher withdrawal limits: 100% of the first US$1 billion (GY$208.5 billion) received in the preceding year, then decreasing percentages for subsequent billion-dollar increments.

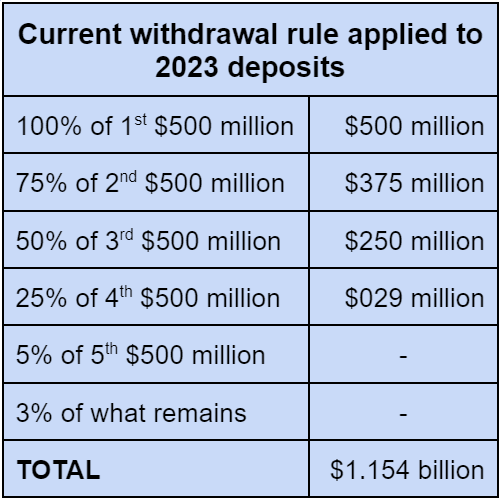

Under the existing NRF formula, the maximum permissible withdrawal for spending in 2024 stands at about US$1.154 billion (GY$240.6 billion). However, the proposed amendment elevates this ceiling to US$1.586 billion (GY$330.7 billion), enabling the government to access approximately 98% of the oil revenues received in 2023.

Oil fund withdrawal rule too conservative, says Guyana VP

The Finance Ministry said the new rule “will ensure that as production and revenue ramp up further, an increasing share of the inflows into the NRF will be saved relative to the share transferred to the Consolidated Fund [government’s main bank account] to finance these national development priorities.”

While that is so, there is a reduced emphasis on saving compared to the current rule. Saving a substantial portion of the government’s oil windfall would depend on annual deposits being higher than US$4 billion.

Guyana received nearly US$3.5 billion from oil sales and royalties for the first four years of production. Of that sum, less than US$400 million would remain as savings following the enactment of the new withdrawal rule for the 2024 budget.

While the influx of oil money allows rapid investments in development, the government is sure to draw criticisms linked to concerns about long-term saving, overspending, and economic overheating.

Vice President Bharrat Jagdeo has said when government has expended enough funds on immediate large-scale development needs, there will be a “steep fallout” in annual budgets.