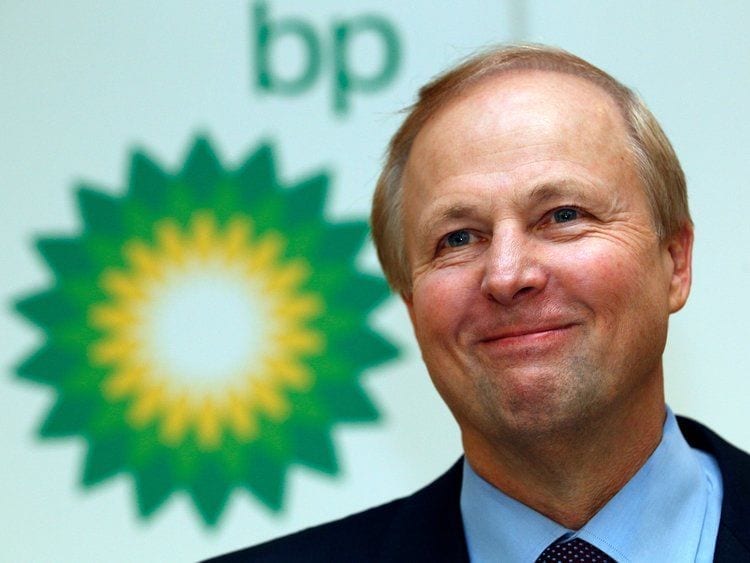

(CNBC) BP is expecting solid growth in oil demand this year despite growing concerns about a global economic slowdown, CEO Bob Dudley said Tuesday.

The British energy giant forecasts the world’s appetite for oil will grow by another 1.4 million barrels per day in 2019. That compares with demand growth of 1.3 million bpd last year, according to the International Energy Agency, a policy advisor to developed nations.

The 2019 projection puts BP’s view in line with the latest forecast from the Paris-based IEA, but ahead of OPEC, which sees demand growing at a more tepid 1.29 million bpd.

“We’re not actually seeing this worrying thought that it’s all going to start falling,” Dudley told CNBC in an interview at the World Economic Forum in Davos, Switzerland.

Asked whether that view holds despite the IMF cutting its outlook for global economic growth on Tuesday, Dudley said, “We certainly don’t see it yet in the numbers.”

Oil prices slumped on Tuesday following the IMF revision and data showing China’s economy expanded last year at the slowest pace since 1990. China is the world’s second largest oil consumer.

BP’s in-house forecast sees the world economy expanding at 3 percent or more and U.S. gross domestic product growing “a little bit under 3” percent, Dudley said.

Last month, the Federal Reserve cut its outlook for U.S. GDP growth for 2019 to 2.3 percent, down from a previous forecast of 2.5 percent.

To be sure, forecasters including the IEA and OPEC expect global oil production to grow at a brisker pace than demand this year, led by rising output from the U.S. OPEC and 10 other oil producers, including Russia, are holding back 1.2 million bpd through June in order to drain an oversupply of crude oil.

Dudley believes the oil market is tightening up, but says a big question is whether Washington continues granting waivers allowing several countries to continue buying Iranian crude, which is under U.S. sanctions.

Dudley thinks oil prices are “heading back into a reasonable balance” following two “big” overcorrections, one that saw oil prices spike to nearly four-year highs in October and another that dragged prices to roughly 18-month lows in December.

“The world probably needs a fairway for oil prices, and somewhere between $50 and $65 seems to be a fairway for producers and consuming countries,” Dudley said.