The Guyana Oil and Gas Energy Chamber (GOGEC) said on Thursday that the call by former head of the Environmental Protection Agency, Dr. Vincent Adams, for ExxonMobil’s operations to be shut down in the South American country is extreme and unwarranted.

“GOGEC wishes to point out that this call by the former EPA [head] is an unwarranted and unnecessarily extreme in the circumstance,” the oil and gas body said. “While any excessive flaring is unacceptable, GOGEC is cognizant that with regards to the specific matter, the Government of Guyana and ExxonMobil and its partners are currently addressing the matter.”

On Wednesday, Dr. Adams heavily criticized the company for its operations at the Liza Phase 1 Development where issues with a gas compressor on the FPSO has resulted in above pilot level flaring. The company had also encountered similar challenges last year.

“The permit is explicit in the law that the EPA has the authority to terminate operations at any time and that is what I would’ve done because we have been bending over for Exxon,” the former EPA head stated.

GOGEC said as a new oil producing country, it is imperative that there is an understanding and appreciation of the high risk involved in oil and gas investments, pointing out that it is heavily capital intensive.

“Not only is the nature of the oil industry business one that is highly risky, but this is compounded by high regulatory costs in other countries whose industry is heavily regulated and of course – risks of oil spill which is also very costly to oil companies. ExxonMobil, unfortunately, has not been spared of the manifestations of such risks over the years in other parts of the world and has borne the costs that comes with it,” GOGEC said. “These are factors that are beyond the control of ExxonMobil coupled with the demand and supply dynamics that impact oil price volatility as well.”

GOGEC said moreover, Guyana must be reminded that ExxonMobil commenced oil exploration activities following the 1999 contract which it secured with the Government at that time. More than a decade later in 2015 it struck oil in commercial quantities. “Hence, if it wasn’t for ExxonMobil’s persistence and its risk appetite, Guyana would not have been an oil producing country today.”

The energy chamber said owing to the now burgeoning oil and gas sector, Guyana’s average Foreign Direct Investment (FDI) annually pre–oil was US$260 million. Post oil production in 2019, FDIs amounted to US$1.7 billion, it said, which is an increase of US$1.4 billion or 536% from what Guyana’s normal average level of FDIs was before becoming an oil producing country.

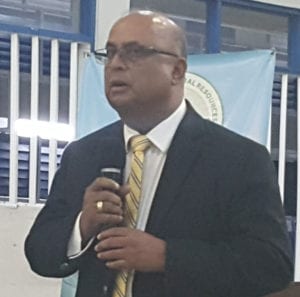

According to the statement, the President of GOGEC Mr. Manniram Prashad said he wishes to reiterate the fact that ExxonMobil is an important partner in Guyana’s long-term development. “As such, it is unacceptable to allow any unnecessary calls for extreme consequences towards the company. GOGEC, therefore, wishes to urge all stakeholders to seek to obtain win-win situations in these matters rather than a strong-arm approach. This may not be healthy for the country’s and ExxonMobil’s mutual interest.”

The energy chamber cautioned that such calls for extreme actions can also stave off foreign investors and dampen investors’ confidence altogether – at a time when investors’ confidence in Guyana is at an all-time high.

“We, therefore, strongly reject such calls by the former EPA Head,” GOGEC stated.