A dark cloud of capacity constraints is casting a shadow over the oilfield service industry heading into 2020, mirroring the sharp growth in the number of new projects being brought forward by oil and gas operators. About 250 new oil and gas projects are likely to be sanctioned for development in 2020, up from 160 in 2016, and bottlenecks among suppliers appear inevitable.

According to Rystad Energy’s latest market report on the global service market, floating production contractors, subsea installation players and fabricators of liquefied natural gas facilities will all likely struggle to keep up with the surge in demand for their services, thus causing projects schedules to slip. Exploration and production companies will thus find themselves in a fierce competition to secure capacity.

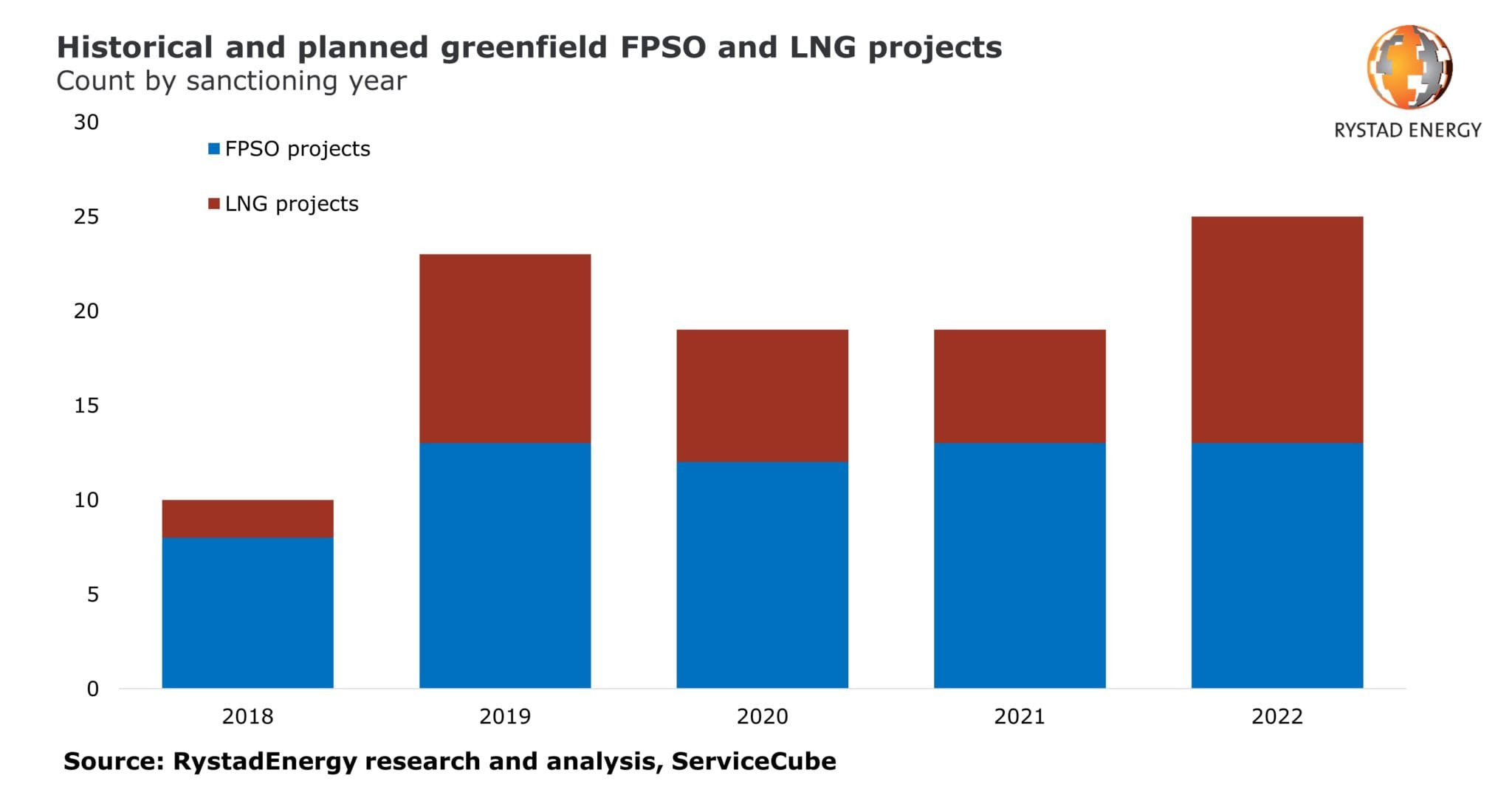

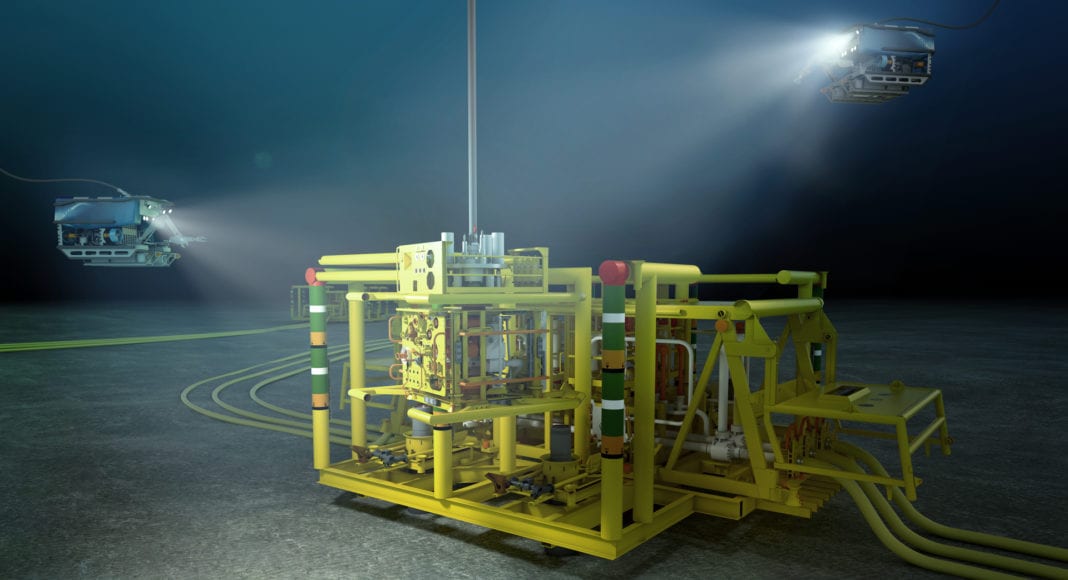

Contractors, having secured 13 new orders for floating production, storage and offloading vessels (FPSOs) in 2019, have thus raised the total number of units currently under construction or on order to 28. This means FPSO players will not be able to handle all 12 of the additional units that operators aim to move forward with in 2020. Likewise, in the installation market for subsea umbilicals, risers and flowlines (SURF), orderbooks are swelling and players are racing to keep pace given the vast number of Christmas trees – nearly 600 in all – that were ordered in 2018 and 2019. Furthermore, marine contractors are already scheduled to install about 4000 kilometers of subsea oil and gas flowlines and umbilicals in 2020.

“Deepwater projects are now in a challenging situation as they are heavily dependent on SURF and FPSO contractors,” says Audun Martinsen, Head of Oilfield Services at Rystad Energy. “Deepwater fields have been among the most sought-after supply sources in recent years, next to the shale bonanza, and the increase in massive contract awards to players in the deepwater industry now could put constraints on further field sanctioning activity.”

Another complicating factor is the massive push by certain offshore energy companies to move ahead with offshore wind projects. Rystad Energy observes that 25 gigawatts (GW) of offshore wind capacity is now operational, and this is poised to double to more than 50 GW by 2022. This implies a massive increase in demand for installation of offshore wind power cables, climbing from 1800 km in 2019 to an unprecedented 4300 km in 2022 – thereby surpassing the amount of subsea cable installation work from the oil and gas industry.

“Major SURF players like Subsea7 and Saipem are in a great position to capitalize on this trend, having managed already to diversify from being pure oil and gas players to become substantial drivers within the energy transition. This segment will increasingly occupy vessel capacity from the installation fleet, likely causing a significant jump in service prices and exacerbating the contractual challenges faced by operators,” Martinsen explains. “Offshore gas and LNG projects will also add to the rising demand for services, as we forecast that these projects will require the installation of about 1000 km per year of export pipelines linking offshore fields to onshore facilities over the next few years.”

Rystad Energy forecasts capacity constraints among key vendors in the LNG market, as well, implying new projects could risk significant delays. With 10 LNG projects sanctioned this year, and with seven more on the drawing board for 2020, the few established engineering, procurement and construction (EPC) contractors that are qualified to tackle the mega-projects planned in such a specialized sector are already close to being fully booked and short of manpower.

“We expect to see pricing power strengthen further among service providers in 2020, particularly within certain segments. This will drive up prices but also delay projects and production targets for E&P companies,” Martinsen predicts. “We have seen that ambitious operators with a long-term focus have been able to secure vital capacity within the supply chain, but many other players will face difficult bottlenecks in 2020. If those companies want to deploy capital next year without any service capacity issues, they should consider drilling offshore infill wells or channeling investment into the shale sector in North America. Both of those markets still have substantial overcapacity within offshore rigs, pressure pumpers and sand providers.”