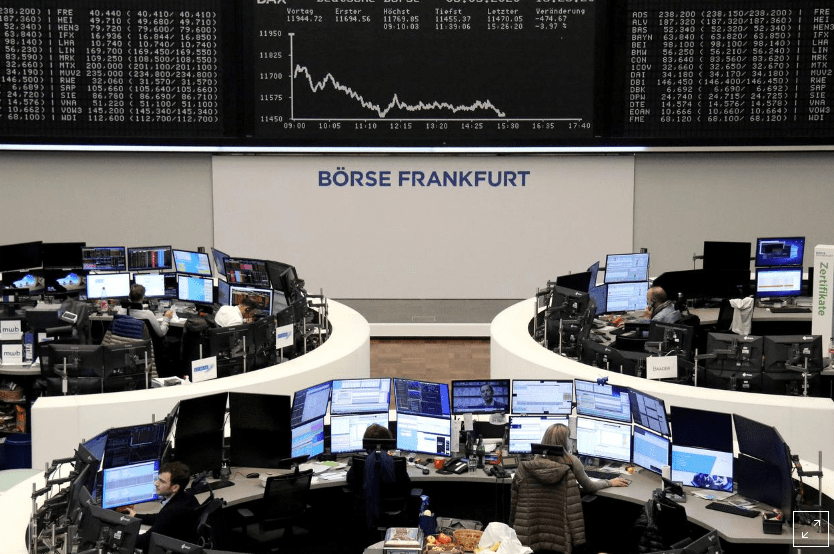

(Reuters) – European shares slumped across the board on Monday, taking the benchmark STOXX 600 into bear market territory as a lock-down of northern Italy due to the coronavirus outbreak and a 30% plunge in oil prices amplified fears of a global recession.

The pan-European STOXX 600 fell 7%, meeting the common criteria for a flip into a more negative “bear” environment – a 20% drop from all-time highs. The index is on course for its biggest percentage drop since June 2016, when Britain voted to exit the European Union.

London’s commodity-heavy FTSE 100. FTSE was down 8%, with shares of oil majors BP (BP.L) and Royal Dutch Shell (RDSa.L) both down almost 20%. The top decliner on the STOXX 600 was Tullow Oil (TLW.L), with an eye-popping 38% drop.

Europe’s oil & gas index .SXEP tumbled 13.5%, with crude prices LCOc1 CLc1 in free fall after Saudi Arabia launched a price war with Russia and U.S. shale producers by slashing its official selling price and putting in place plans for a dramatic increase in crude production next month. [O/R]

“Wild is an understatement,” said Chris Brankin, chief executive at TD Ameritrade. “I figured maybe we’d see a 5% or 10% drop in the oil market, but 25% down has literally just spooked the rest of the market.”

All sectors were deep in the red, with growth-sensitive miners. SXEP, automakers. SXAP, banks .SX7P, insurers .SXIP falling between 7% and 10%. Defensive sectors, considered safer during times of economic uncertainty, posted minimal losses.

European firms have now lost nearly $3 trillion in value since the rapid spread of the coronavirus sparked a worldwide selloff in February.

Italy has become the continent’s frontline in the crisis after the government ordered a virtual lockdown across much of its wealthy north, including the financial capital Milan, in a drastic new attempt to try to contain the outbreak.

Traders are betting the European Central Bank will cut interest rates at a meeting on Thursday, following moves by central banks in the United States, Canada and Australia last week to soften the blow of the outbreak.

In the starkest warning sign of adverse economic impact – yields on 10-year U.S. Treasuries US10YT=RR, the benchmark for global borrowing costs and the safest of safe havens for investor capital, dropped to 0.4258% – a record low.

German 10-year bond yields DE10YT=RR fell to a new record at -0.8%. [US/] [GVD/EUR]

Shares in Italy’s blue-chip index. FTMIB dropped 11%, while Spain. IBEX saw its main equity index. IBEX drop 6%.