By The Value Portfolio (Published on Seeking Alpha)

Exxon Mobil (NYSE: XOM) is one of the largest publicly traded oil companies in the world. The company has recovered admirably from its COVID-19 lows towards a market capitalization of ~$260 billion. However, it’s still ~40% below where it was below the mid-2014 oil collapse.

As we’ll see throughout this article, Exxon Mobil’s Guyana and Permian Basin assets alone are worth more than its market capitalization, highlighting the company’s value.

Exxon Mobil Guyana

Exxon Mobil has a substantial portfolio of assets in Guyana. The company’s discoveries here have grown significantly in recent years and should continue to grow.

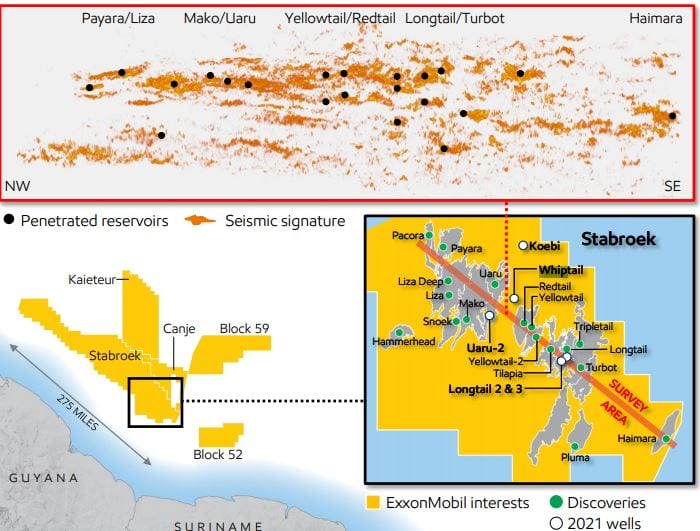

Exxon Mobil has focused on a highly capital-efficient development, with unmatched flexibility and extended production plateaus. In the company’s Stabroek seismic signature, it’s penetrated numerous reservoirs helping it to have numerous discoveries. The company has found numerous discoveries beneath previously identified resources.

Additionally, the company anticipates 10 exploration and appraisal wells in 2021. The company’s basin potential is >2x discovered resources, and the company plans to extend here.

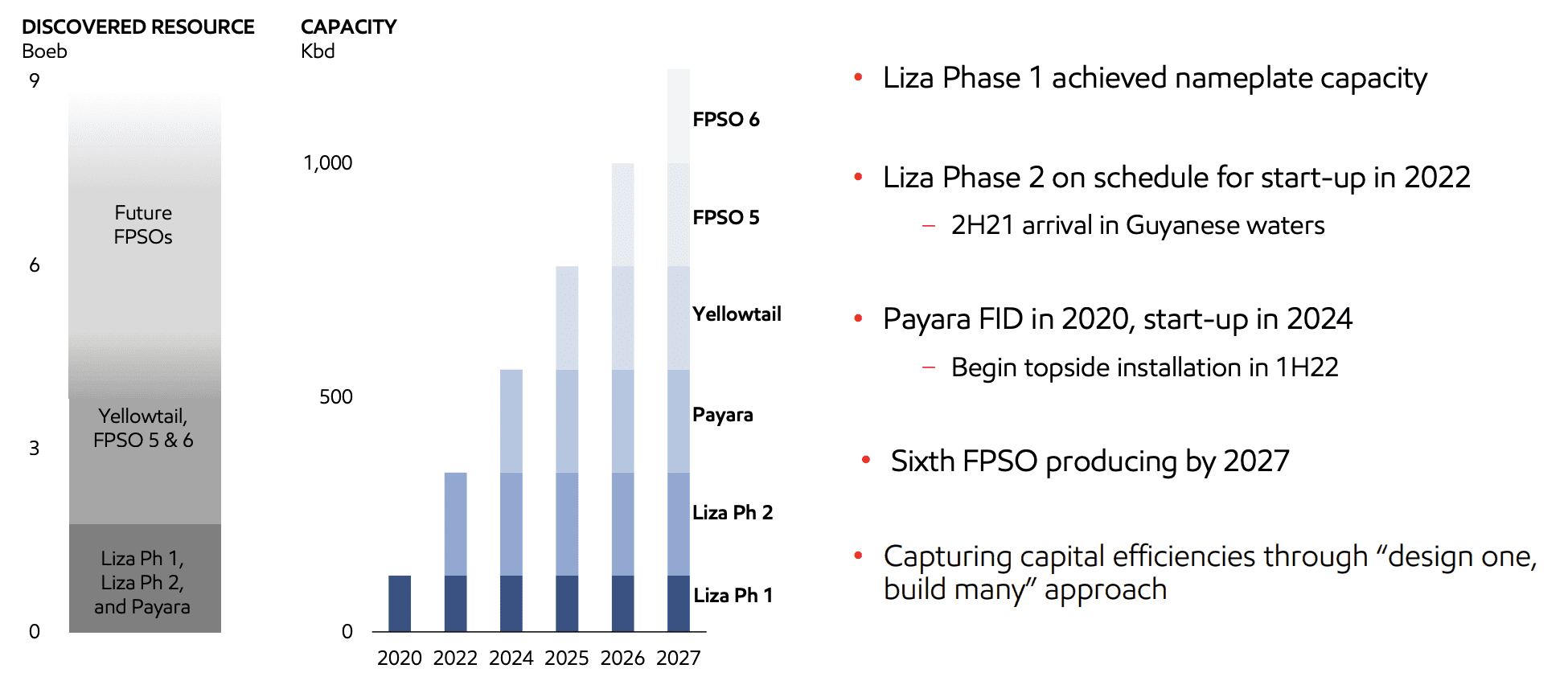

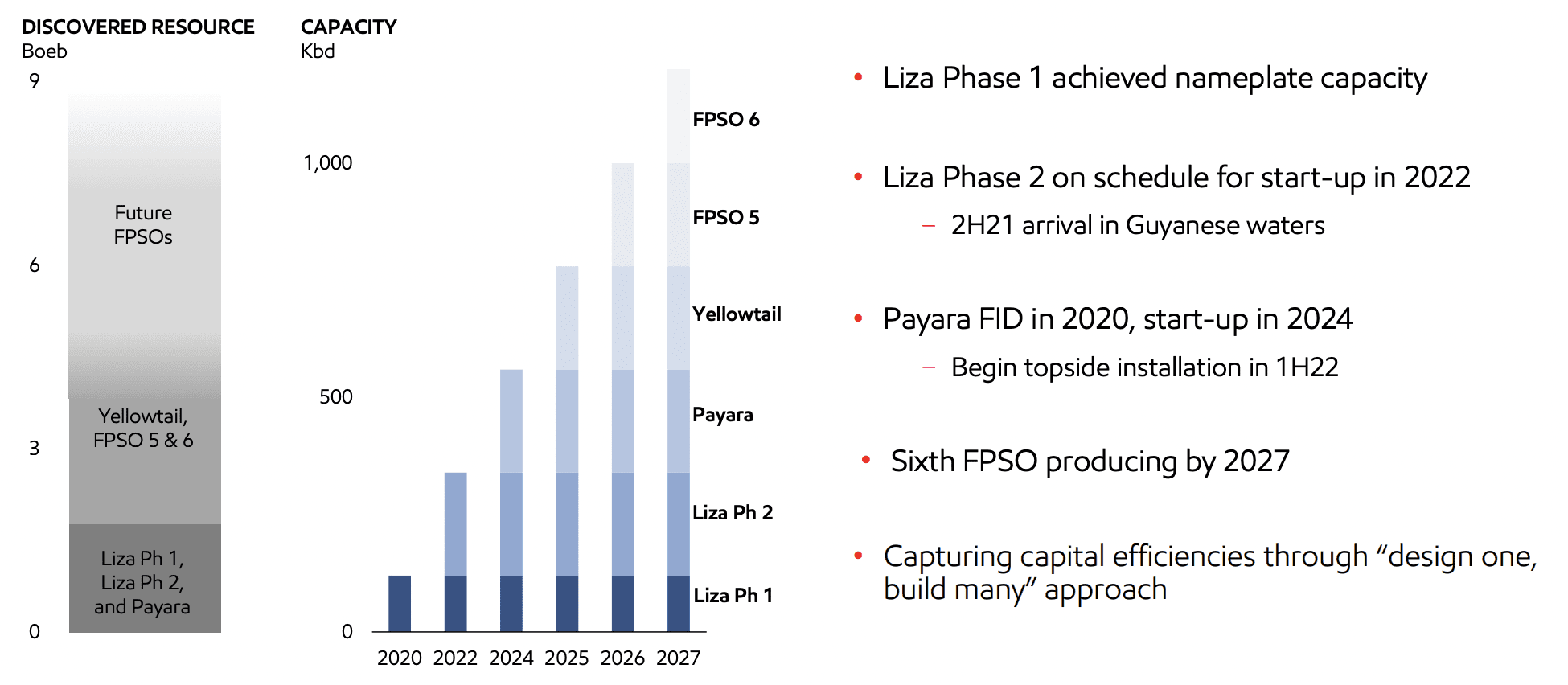

Exxon Mobil is currently producing more than 100 thousand barrels/day in production. By 2022, the company expects that to move to more than 300 thousand barrels/day. The company has a 45% stake in the Stabroek Block and forecasts production by 2027 growing to >1.2 million barrels/day. That means Exxon Mobil’s stake would be >500 thousand barrels/day.

At the same time, a key takeaway here is that from 2024 onwards the company plans to startup 1x FPSO/year. The company’s current discovered resources are ~9 billion barrels or a multi-decade reserve time period at 2027 production. That doesn’t count the potential for additional discoveries, which could push production well past this.

Exxon Mobil expects $3.5 billion of operating cash flow by 2025 from these assets at $50 Brent. Current Brent crude prices are almost $70/barrel. Given 50% production growth from 2025-2027, along with an extra $20 / barrel, that’ll turn $3.5 billion in operating cash flow towards $9 billion annualized for the company.

Most of that will be profit for the company given the incredibly low cost. The company has had an 80% success rate out of 18 wells so far, which combined with 10 more opportunities in 2021, and more opportunities past that, the company can expand its production much more. At $9 billion in operating cash flow, we’d conservatively value this at a 10x multiple ($90 billion).

That valuation includes, but in our view significantly underestimates, the asset’s future growth and cash flow potential.

Exxon Mobil Permian Basin

Exxon Mobil’s other key upstream asset is in the Permian Basin.

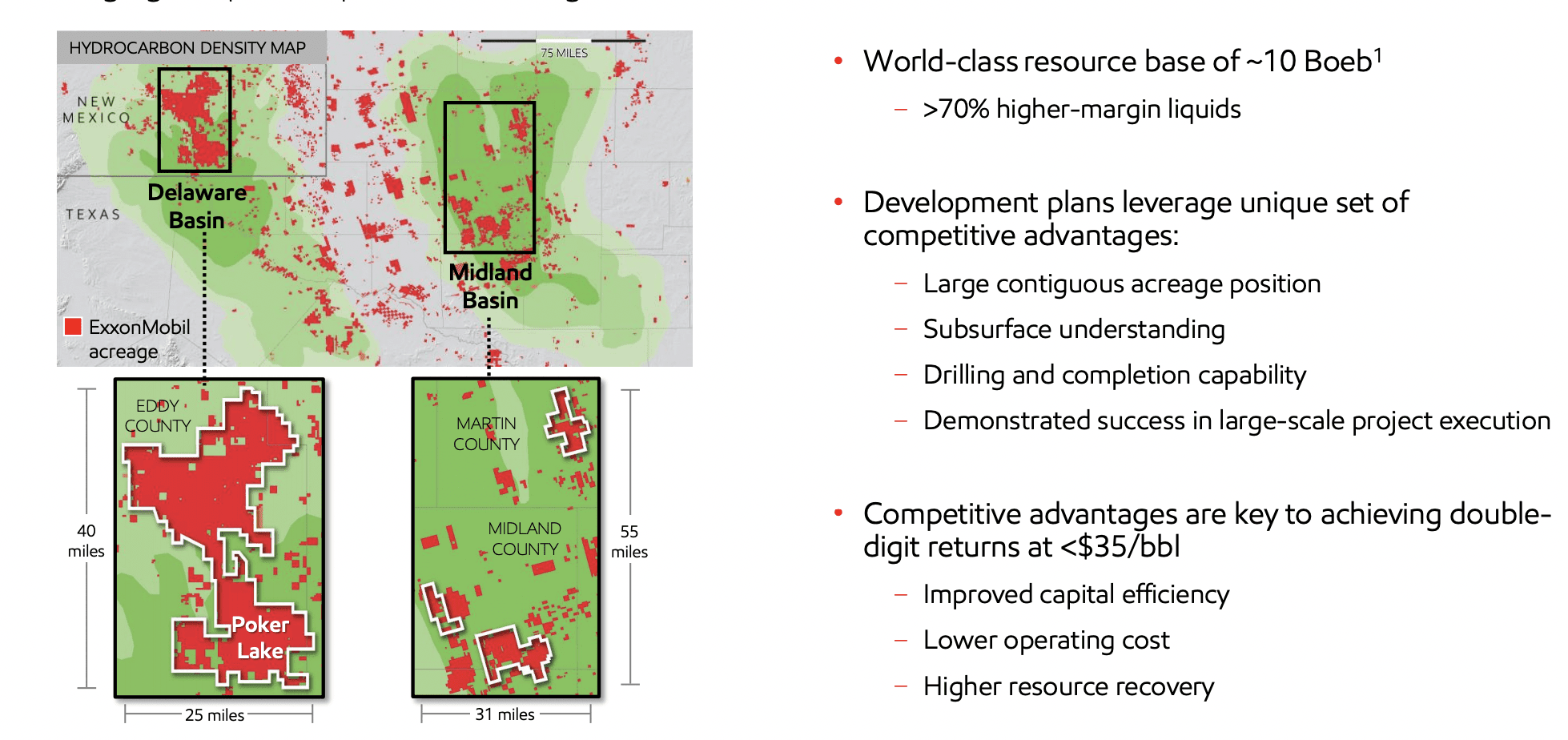

Exxon Mobil has a world-class resource here of ~10 billion barrels. This is primarily in higher-margin liquids. The company’s development plans leverage its unique competitive advantages and the company’s advantages are key to enabling it to hit its targets of double-digit returns at <$35/barrel. This highlights the company’s strength.

One example of this is the company’s cube development strategy at Poker Lake to develop >2.5 billion barrels across ~65 thousand acres. The asset will help generate incredibly strong returns at much lower costs.

At $50 / barrel Brent, the company expects 2025 operating cash flow of >$4 billion at ~500 thousand barrels/day production. The company is maintaining slower growth, it was originally forecasting ~1 million barrels/day in 2025 production at lower prices. The asset has double-digit returns at <$35/barrel highlighting its strength.

Going into 2025, the company, at current prices, could have almost 800 thousand barrels/day of production. That’s 60% higher than the original 2025 forecast, which combined with Brent prices almost $20 / barrel higher, which can push operating cash flow of ~$12.5 billion. At current prices, we can see the company expand production even further.

Given the lower margins and more growth potential of the asset, we give the asset a 15x operating cash flow multiple or a valuation of ~$190 billion. Combined with the Guyana assets this gives the assets a valuation, in our view, of more than Exxon Mobil’s market capitalization, without including their true potential.

Exxon Mobil Cash Flow Potential

Exxon Mobil’s cash flow potential is incredibly significant.

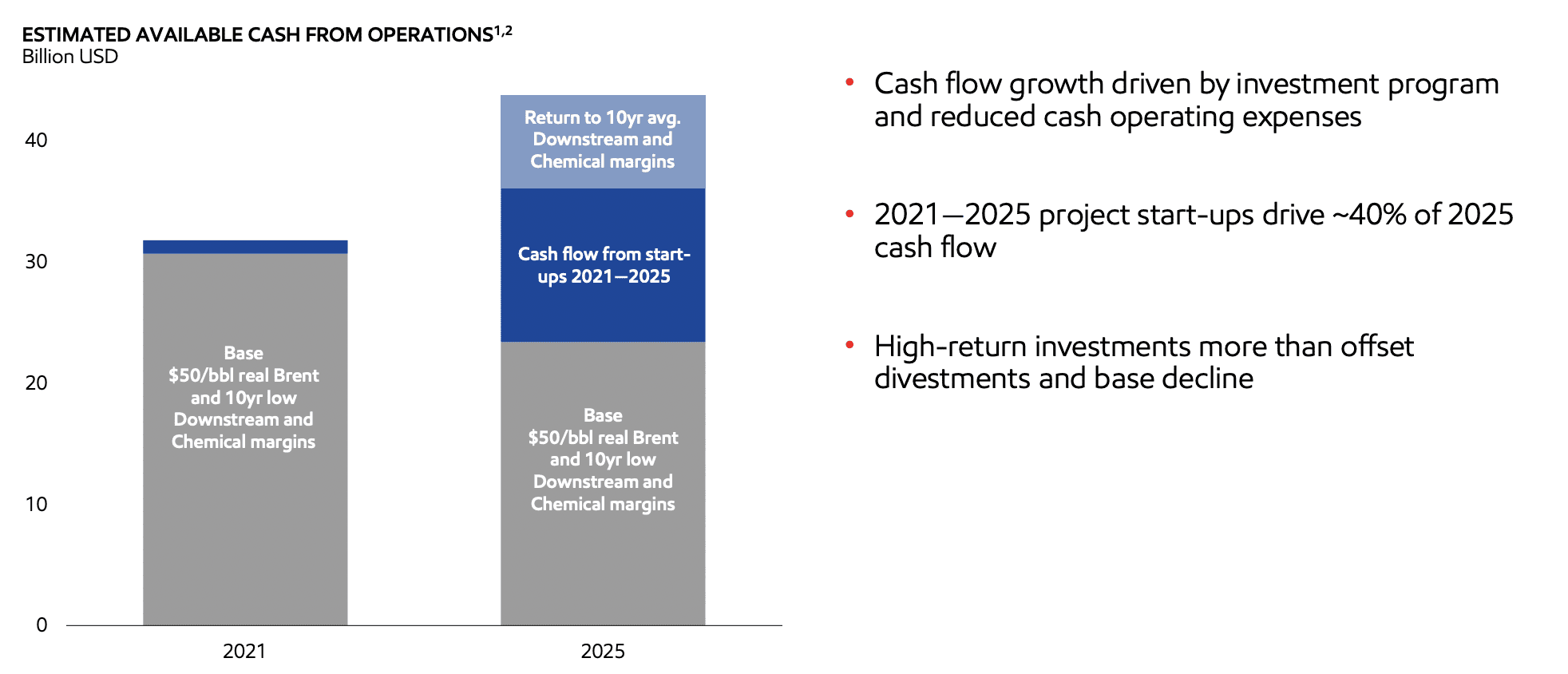

Exxon Mobil expects cash from operations to grow dramatically. By 2025, at $50/barrel Brent, well below current prices, the company expects to have ~$45 billion in cash from operations. Subtracting its capital spending, that means ~$20-25 billion in annual FCF. That gives the company an FCF multiple of ~8-9%.

However, the company’s profits are much higher given prices, and the company has the ability to continue growing and driving strong shareholder returns. This cash flow potential will enable Exxon Mobil to drive substantial shareholder returns.

Exxon Mobil Risk

Exxon Mobil’s risk of course is oil prices. The company is incredibly profitable at current oil prices. As we discussed above, the company’s Guyana and Permian Basin assets alone together justify the company’s valuation. Past these existing assets, the company has significant growth potential, that’ll help drive significant shareholder returns.

However, if prices were to drop significantly, the company would have a tough time driving stronger shareholder returns and justifying its valuation.

Conclusion

Exxon Mobil has an impressive portfolio of assets that we expect to utilize to drive incredibly strong shareholder returns. The company has numerous upstream growth assets although two of the largest are in the Permian Basin and Guyana. These two upstream assets alone are worth more than the entire company.

Going forward, at $50/barrel Brent, the company has the ability to drive 8-9% annualized shareholder returns, which we believe highlights its strength. However, at $70/barrel Brent, the company has the ability to continue investing in its businesses and drive much stronger shareholder returns. Putting all of this together makes the company a top-tier investment.

The Value Portfolio focuses on deep analysis of a variety of companies with a primary focus on the energy sector. Occasional articles also focus on building a retirement portfolio or on other sectors (such as healthcare or technology).