The global offshore industry is firing on all cylinders with the floating, production, storage and offloading (FPSO) vessel market set for close to 50 awards this decade, according to Norway’s Rystad Energy.

Brazil and South America’s rising oil star, Guyana, account for a chunk of the awards.

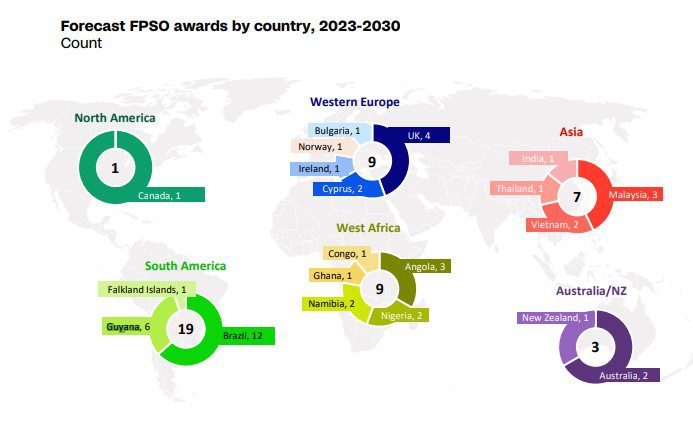

“From 2023 to 2030, Rystad Energy forecasts 48 FPSOs will be awarded for new greenfield developments. The majority of these – 19 units – will be destined for Brazil and Guyana with 12 and six units respectively,” a new March report outlined.

Brazil’s state-owned Petrobras had announced plans to add 18 FPSOs in five years. Three have already been delivered. Guyana will be adding the Prosperity FPSO by April and in 2024, the ONE GUYANA FPSO will also be online.

Rystad Energy said increased spending on oil and gas projects “will provide a solid springboard for offshore activity and supplier opportunities”, which could lead to a higher number of FPSO awards until 2030.

Europe will also see a large number of units – nine in total, with new countries added to the list such as Cyprus and Ireland. In Africa, Angola, and Nigeria will see three and two units respectively. In Namibia, Rystad Energy expects recent exploration success will lead to two new FPSOs in the emerging Orange basin.

Rystad Energy also expects dozens of lifetime extension projects and redeployments to materialise in the brownfield market as energy prices stay high.

Offshore spending is also on the rise, with total greenfield CAPEX of US$214 billion representing offshore fields sanctioned this year and 2024. Rystad Energy said it is the first back-to-back years in which over US$100 million in offshore CAPEX will be sanctioned since 2012-2013.

“We anticipate that the offshore investments cycle will last for several years as oil demand grows until the end of this decade,” it stated.

Additionally, offshore projects sanctioned between 2023 and 2024 will amount to 68% or 24 billion barrels of committed conventional resources – up from 40% for projects sanctioned between 2015 and 2018.