With nearly five years of oil production so far, Guyana has received more than US$5 billion in revenue from oil sales and royalties. With this new injection of revenue, the government has already withdrawn nearly half of this amount and is due to exceed US$3 billion in spending by the end of the year.

The total government receipts up to September 30, 2024, are US$5.44 billion. Sales from the Liza 1 project total US$2.04 billion, with US$2.06 billion from Liza 2 and US$646 million from Payara. Royalties paid by the ExxonMobil-led consortium total approximately US$701.7 million.

In terms of spending, the amount withdrawn over multiple years was US$2.46 billion at the end of September. This total is expected to double by the end of 2025 as the government expands spending to meet urgent development needs. The administration is expected to have more than US$2.5 billion in oil revenue to contribute to its 2025 budget, based on the withdrawal rule in the Natural Resource Fund (NRF). The growing spending is thanks to ExxonMobil’s expanding crude oil production offshore Guyana, which closed out August at 663,000 barrels per day (b/d).

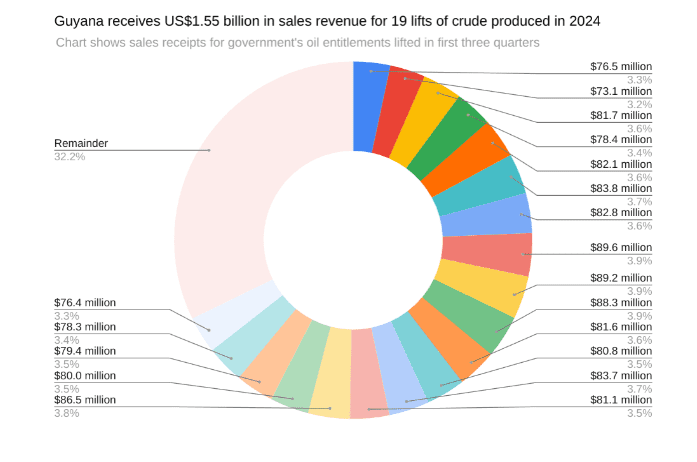

In the first three quarters of 2024, the Fund received revenue for 19 million-barrel lifts of crude produced and sold this year, amounting to approximately US$1.55 billion. More than US$730 million is expected in the last quarter, as payments for eight lights of crude

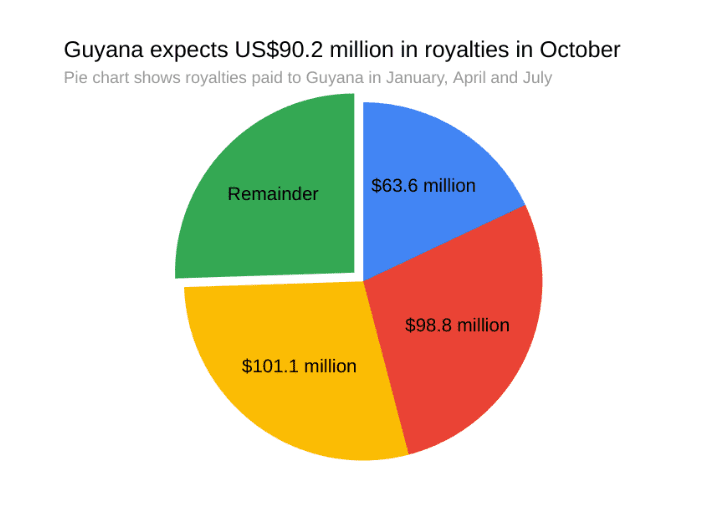

The Fund is expected to receive the final quarterly payment of royalties in October. Royalties for the final quarter of 2024 will be paid in January 2025. Higher output due to production optimization at the Liza 2 project could boost this payment.

All revenue from oil sales and royalties are derived from crude oil production at the Stabroek Block. ExxonMobil, the operator, has a 45% stake, alongside Hess (30%) and CNOOC (25%).

Guyana’s Oil Ledger offers analyses of the latest oil production data and government oil fund receipts, published typically on a fortnightly basis. The column is authored by Kemol King, a journalist specializing in Guyana’s oil and gas sector.