Hess Corporation said on Thursday that its Board of Directors has authorized the purchase of $1.0 billion of Hess common stock by the end of 2018. The newly authorized program is in addition to the $500 million share repurchase program Hess announced in late 2017.

Under the new authorization, the Company will purchase $500 million of common stock through an accelerated stock repurchase (“ASR”) program and $500 million of common stock in the open market by the end of 2018. The amount and timing of the open market repurchases are subject to a number of factors, including Hess’ stock price, trading volume, oil prices and general market conditions. The company intends to fund the repurchases from existing cash and proceeds from announced asset sales.

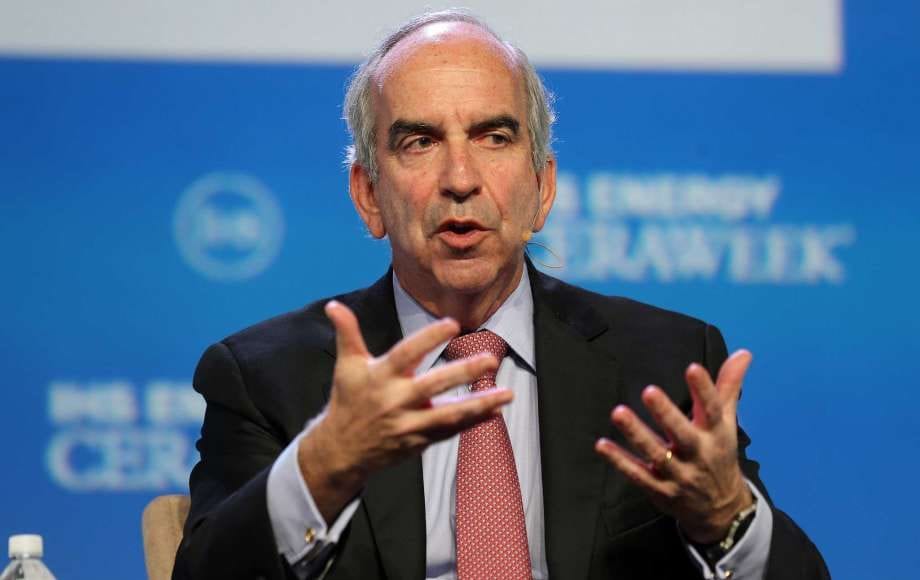

“We are pleased to be in a position to increase cash returns to shareholders, which remains one of our top priorities and is reviewed regularly by the management team and Board,” CEO John Hess said. “With a continued positive outlook for oil prices, a successful asset sale program, and increased visibility on production growth, cash flows and capital requirements for future phases of development on our Guyana asset, we can expand the buyback authorization without compromising our ability to fund this world-class investment. We believe that repurchasing our shares represents a highly compelling return opportunity for our shareholders.”

Hess recently announced a seventh oil discovery offshore Guyana, at the Pacora-1 exploration well, following previous discoveries on the Stabroek block at Liza, Payara, Liza Deep, Snoek, Turbot and Ranger. “The giant Payara field, which is planned as the third development offshore Guyana, will now include Pacora resources – increasing the size of the FPSO and bringing expected gross production from the first three phases of development to more than 500,000 barrels of oil per day,” said Hess.

Hess added, “We plan to hold an investor day later this year to update shareholders on our strategy and progress in Guyana, which keeps getting bigger and better, and the Bakken – our largest operated growth asset, where we are going from four rigs to six and conducting a review of enhanced completion techniques and further cost efficiencies to optimize value.”