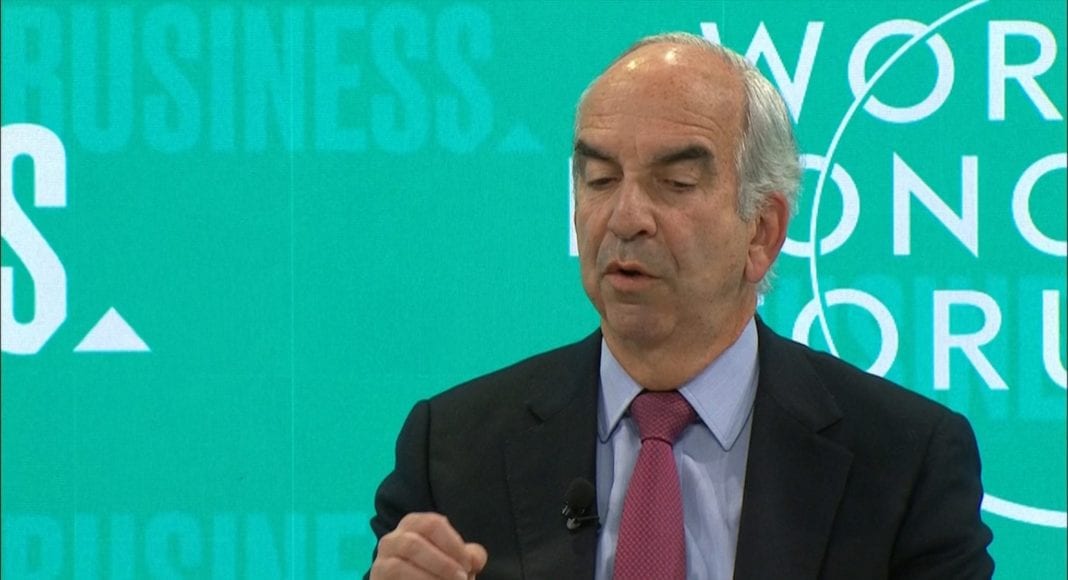

When it comes to his company’s perception of the macro-environment for oil , Hess Corporation’s Chief Executive Officer (CEO), John Hess, recently informed the market that it predicts global demand strengthening by three million barrels of oil per day (mbd) between now and the end of the year.

The official made this disclosure during his participation in a fireside chat at the JP Morgan U.S. All Stars Conference. In offering his thoughts on the macro-environment, Hess said that the company looks at this through three lenses: demand, supply and inventories. In terms of demand, he said the company is of the view that the world is in a V-shaped recovery. Expounding on this front, he noted that April demand in the world was down 21 million barrels per day and probably a little bit more than that out of a total of 100 million barrels per day. He said demand since then has recovered by seven million barrels per day.

“…But we see demand strengthening three million barrels a day between now and the end of the year as refineries go up and as the vaccine trade progresses with its work,” he stated.

For supply, the Hess boss said that the company predicts a U-shaped recovery, “meaning, supply being stickier to respond to the shocks that COVID-19 has created in the economy.”

In the USA, Hess was keen to note that the rig count has gone down to 254 rigs running as opposed to over 1000 over a year ago while adding that production has obviously declined. Further to this, he noted that the historic OPEC+ agreement between Russia and Saudi Arabia to allow for production cuts has not been successful in achieving its goal of preventing oversupply.

The CEO said, “…OPEC+ countries are suffering and not just oil producers, Saudi has lost over US$100B in revenue and their financial reserve is about US$450B and that is a 25 percent decrease in one year and this is not sustainable…they have an economy and country to run and so both Russia and Saudi are feeling the pinch…”

When the foregoing factors are considered, Hess said that it all comes back to inventories. As a result of the COVID-19 pandemic and demand shock, Hess said that global inventories stand right now at about a billion barrels of oil in surplus while adding that this has gone down by about 200 million barrels since April. The Chief Executive Officer said Hess predicts there will be another drawdown of 250 million barrels. He noted nonetheless that current forecasts indicate that there will be a rebalancing of the global market by 2021.