The reopening of the Suez Canal is now likely to take several days, market watchers told S&P Global Platts on March 25, as almost 40 oil and LNG tankers have piled up to transit one of the world’s most critical commodity chokepoints.

The container ship Ever Given remains stuck in the key waterway, more than 48 hours after it first ran aground. Efforts to refloat the container ship are persisting with many tugboats and dredgers assisting the vessel, shipping and industry sources said.

By 1300 GMT, there were at least 21 crude tankers (carrying around 18 million barrels) and 12 product tankers (holding around 500,000 mt) waiting to navigate through the canal, according to data from cFlow, Platts’ trade flow software.

These oil tankers are carrying crudes such as Saudi Arabia’s Arab Light and Arab Extra Light, Libya’s Es Sider, US’ Mars, Mexico’s Maya, Iraq’s Basrah Light and UAE’s Murban, and also refined products like naphtha, jet fuel, gasoil and fuel oil, according to Platts cFlow.

Royal Boskalis Westminster, a Dutch dredging and heavy lift company, has been entrusted in rescuing the giant container to the shore bank.

The chief executive of Boskalis Peter Berdowski said the salvage operation “could take days to weeks” comparing the giant ship to a “heavy whale”.

“The more [grounded] the ship is, the longer an operation will take. It can take days to weeks,” Berdowski said on a Dutch television program called Nieuwsuur. “Consider bringing in all the equipment we need, that’s not around the corner.”

Bernhard Schulte Shipmanagement, or BSM, which is the technical manager of the Ever Given, said in a statement on March 25 that it “intensified its efforts” to refloat the vessel but progress had been slow.

“A further attempt to refloat the vessel… this morning was not successful, and another attempt will be made later today,” it said.

Loading/discharge delays

Trade for crude oil, refined products, LNG, steel has already been hit, with some discharge and loading delays already caused and these could worsen if the blockage persists longer.

Some sources said that if the Suez Canal reopens early next week, it could take somewhere between 7 and 14 days to clear the backlog.

Platts Analytics does not expect the blockage to last more than a few days but admitted that a longer protracted closure could “lead to a spike in freight rates, impair refining margins and inject further volatility” into oil and gas prices.

“Any prolonged blockage could be detrimental to shippers facing higher fuel costs, and to the extent that these prices are passed on the refiners and other importers there is downside risk across the oil value chain,” it said in a recent note.

Oil traders are looking to move the loading date of some crude cargoes, especially those loading in the Mediterranean and Black Sea, sources said.

Crude from Libya, Azerbaijan, Kazakhstan, and Algeria are most likely to be affected the most, as a sizable chunk of this oil heads east on Suezmaxes and Aframaxes, which can pass through the Suez Canal.

“There will most likely be some cargoes that will need to be withdrawn and resold to other parties not looking to go East,” said a crude oil charterer active in the Mediterranean crude market.

North Sea crude travels east, but it mainly flows on a VLCC, and a fully laden VLCC cannot pass through the Suez Canal.

“Some laycans [loading dates] can be moved depending on loading,” especially for crudes loading out of Ceyhan in Turley, ports in Libya and from Novorossiysk which loads Russian and Kazakh, the charterer added.

Freight rates

The incident has already had some impact on freight rates on tankers.

Spot freight rates for a Suezmax shipping crude from the Persian Gulf to the Mediterranean were assessed at Worldscale 23 on March 25, the highest level since Feb. 2, according to Platts data. Freight rates in the Mediterranean and Black Sea were also strengthening, with ships stuck in the long traffic jam tightening tonnage, shipping sources said.

Owners were now refraining from offering into cargoes, hoping to see rates further strengthen. On the Hound Point-to-East VLCC run, owners were reported offering around the $5 million mark, up $825,000 from last done. Modern tonnage availability on VLCCs was limited, with ships having to ballast from East and go around the Cape of Good Hope.

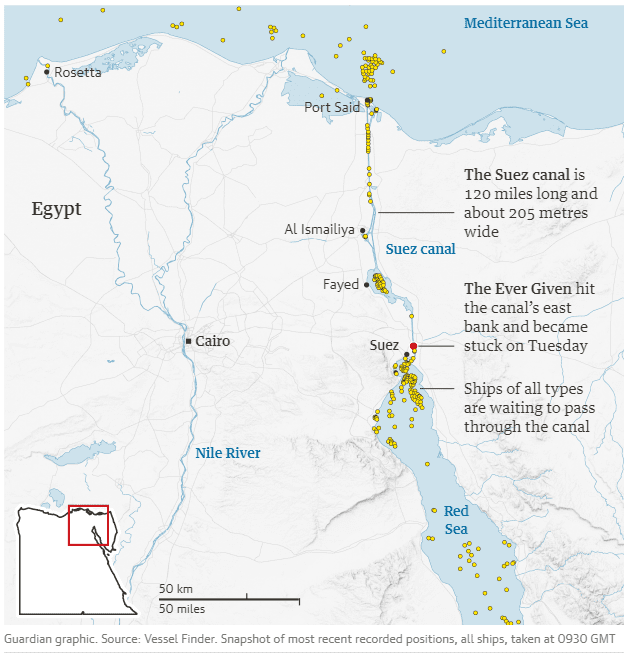

A strategic route for crude oil, petroleum products, and LNG shipments, the 120-mile-long canal connects the Red Sea with the Mediterranean and sees more than 18,000 ships transit each year, according to the Suez Canal Authority. Almost 10% of total seaborne oil trade and 8% of global LNG trade passes through the Suez Canal, according to the US Energy Information Administration.

Some 5 million b/d of crude and oil products transited the Suez Canal, or the SUMED pipeline in 2018, according to the EIA, in addition to about 3.5 Bcf/day of natural gas in the form of LNG.

Earlier on March 25, Japan’s Shoei Kisen Kaisha, owner of the Ever Given, said it is currently using a power shovel or an industrial dredger to try to move the vessel. The Ever Given has a capacity of 20,000 twenty-foot equivalent units and is sailing under a Panama flag. The vessel loaded from the Chinese port of Yantian on March 8 and was on its way to Rotterdam in the Netherlands before the incident on March 23.

The Ever Given grounded on March 23 “due to strong winds as the vessel, with two canal pilots onboard, was transiting northbound through the canal,” according to BSM.

Source: S&P Global Platts