The forthcoming three-round licensing bonanza of Brazil’s pre-salt acreage includes four massive discovered resource opportunities (DROs) sandwiched between two high-profile exploration rounds. Timing for this round is set for November 6, 2019, industry analyst Wood Mackenzie said in a report on Tuesday.

“We previewed Concession Round 16 in part one of our Brazil 2019 exploration bid rounds series. The premier acreage in Brazil’s pre-salt Santos and Campos basins yield low-cost exploitation at the steep cost of record high signing bonuses. The basins’ reservoirs have ‘Goldilocks’ depth, and prolific single wells in the basin are capable of producing up to 50 kbd,” Wood Mac said.

The three upcoming bid rounds have one major limiting factor in common: incredibly high cost of entry. And with the tentative schedule placing the three bid rounds within weeks, it gives players little time to adjust bidding strategy throughout the process to reflect previous rounds’ outcomes. This means that participating companies must plan ahead for all possible scenarios within the three rounds in advance or focus on one specific round. The rounds are very different in nature – Round 16 includes concession and explorations, while Round 6 offers PSC and exploration.

The DRO will offer 10 billion boe, which corresponds to the volume discovered in excess of Petrobras’ 5 billion boe Transfer of Rights (TOR) contract. The DRO will be tendered under a production-sharing contract, which includes a $26 billion signature bonus.

Brazil pre-salt DROs: besieged with complexity

Wood Mac said look no further than Brazil’s TOR surplus for one of the most bewildering contract structures known to the oil industry.

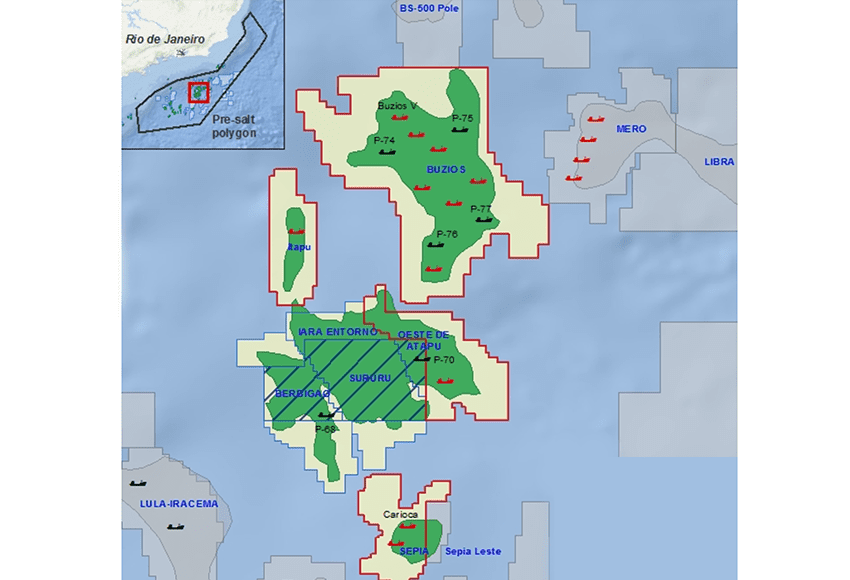

“Encompassing six high-quality pre-salt fields found between 2010-2013, the TOR areas hold 15 billion boe, 5 billion boe of which were assigned to Petrobras for a price of $42.5 billion. This year’s 10 billion boe TOR bid round comprises the resources in excess of Petrobras’ volumes in four of the six areas. The lone field on stream now is Buzios, which started commercial production in 2018, is also the largest by a long stretch,” the analyst stated.

Petrobras exercises right of preference

In May, Petrobras declared its interest in operating the Buzios and Itapu fields. The fields are two of four areas offered in the surplus of the TOR. Petrobras will spend at least 30% of the US$18 billion signature bonus.

“We expect a single bid for Buzios, given the high bonus and co-participation upfront payment. Itapu was unexpected, as it has the lowest signature bonus and minimum profit share of the round. An FPSO is planned for this area in 2023,” Wood Mac said.

Brazil pre-salt premier acreage with massive reserves

What’s being auctioned? The right to all resources in each field that’s a surplus of the Petrobras’ original assigned volume in the 2010 TOR contract.

Reserves will be auctioned under a production-sharing contract for the surplus volume between 6 billion and 15 billion boe. Wood Mac’s estimate is a midpoint of 10.6 billion boe, which equals one-third of the country’s commercial remaining reserves.

The assets are prime pre-salt acreage with some of the highest-output wells in the world, peaking at 50 kbd in the best Buzios wells.