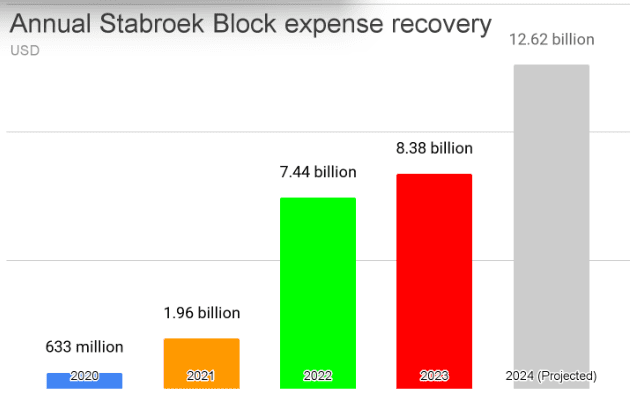

Cost recovery for investments into the Stabroek Block petroleum operations are set to accumulate to approximately US$31 billion by the end of 2024.

The Stabroek Block Production Sharing Agreement, inked by the Guyana government, ExxonMobil, Hess and CNOOC, allows the co-venturers to recover investments by taking up to 75% of annual production as ‘cost oil’ barrels.

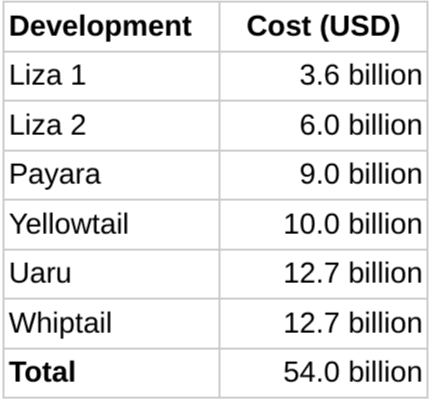

The Bank of Guyana indicated that the co-venturers recovered US$8.38 billion in 2023, taking total cost recovery, since oil production started, to approximately US$18.4 billion. This is roughly equivalent to the development costs of the first three Stabroek Block projects combined.

With US$16.8 billion expected to be generated from oil production offshore Guyana in 2024, the Stabroek Block co-venturers’ 75% cost recovery ceiling is expected to allow them to recoup more than US$12 billion in investments, enveloping the cost of the US$10 billion Yellowtail project.

With increasing production levels, as Exxon adds new projects, the Stabroek Block consortium could recover the cost of an entire offshore development (and more) annually. Other significant investments in the cost bank include exploration and appraisal in the Stabroek Block and the US$160 million ExxonMobil operational center being constructed at Ogle.

ExxonMobil Guyana President, Alistair Routledge, has said that Exxon could substantially recover its investments in a few years, leaving room for a steep increase in annual revenue to Guyana as early as 2026/2027.

While the first three developments are already in the production stage, the additional three are expected to achieve first oil in the period 2025-2027, at a rate of one project per year. Each project targets 250,000 barrels per day (b/d). Combined production from these projects is expected to exceed 1.3 million b/d at optimum performance, with significant optimization upside expected.

ExxonMobil is considering its seventh potential Stabroek Block development, which could add substantially to the cost bank.

The company has a 45% stake (Operator) in the Stabroek Block, alongside Hess (30%) and CNOOC (25%).