Updated September 2, 2021

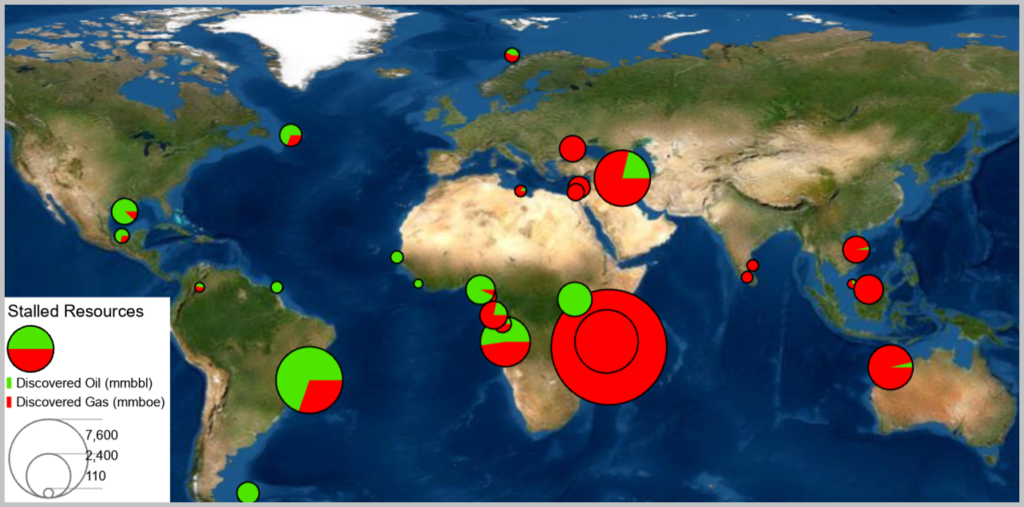

A study by Westwood Global Energy Group shows that 11 billion barrels of oil and 36 billion barrels of oil equivalent (boe) gas in 119 discoveries – >100 million boe in size – made between 2008 and 2016 is currently stalled with no progression towards development.

This oil and gas, potentially worth more than $65 billion and costing an estimated $24 billion to discover, represents 40% of the volume found in high impact discoveries in the period, Westwood said, pointing out that these fields are located all around the world, including South America.

“The largest volume of stalled gas is in the Ruvuma-Rufiji basin of Mozambique and Tanzania where 166Tcf was discovered between 2010 and 2015 yet only 38Tcf has shown any sign of progression and 128Tcf of gas remains stalled,” Westwood said. “Brazil has the largest stalled oil (and condensate) resource, estimated at 3.8 bnbbl in 19 high impact discoveries in 5 geological basins.”

Westwood said 16.5Tcf of gas remains stalled in Iraqi Kurdistan, 3bnboe of oil and gas (split 50:50) is stalled across the Kwanza and Lower Congo basins of Angola and 14Tcf of gas remains in the ground in the Browse and Carnarvon basins of Australia. “More than 500 mmboe are stalled in each of Nigeria, Malaysia, Gabon, Vietnam, USA, Romania, Uganda, Cyprus, Canada and the Falkland Islands.”

Westwood said it has identified 26 different contributing factors for >100mmboe discoveries stalling. “Above ground factors dominate, with the fiscal regime / gas terms in the host country, access to finance and portfolio prioritization being the most common. Subsurface factors include fluid composition, and reservoir quality and compartmentalisation.”

Analysts have long said the mega hydrocarbon discoveries being made offshore Guyana remains viable due to competitive fiscal terms and reservoir quality.

So far, Liza Phase 1, 2 and the Payara Development are the projects which have been sanctioned in Guyana. These projects have a Brent breakeven oil price of between $25 to $35 per barrel.

“The implication of falling breakeven prices is that the upstream industry, over the last two years, has become more competitive than ever and is able to supply more volumes at a lower price,” said Espen Erlingsen, Head of Upstream Research at Rystad Energy.

“I think you have seen that the [oil] resource stacks up well, the investment has continued…. At this point I think it is good news and a good indication that Guyana has not seen backtracking so far,” Dr. Dean Foreman, Chief Economist at the American Petroleum Institute has said. “The key for Guyana is that it has a very attractive crude oil, creating relationships with refineries in North America, Europe and Asia Pacific.”

Westwood said in Tanzania for example, 14 deep-water gas discoveries clustered in five potential developments are stalled due to a combination of above ground and subsurface issues. The above ground issues are mainly related to protracted negotiations with the Tanzanian government on gas terms. Reservoirs are more compartmentalised than in neighbouring Mozambique with lower resource densities and higher development costs.

In the Santos basin of Brazil six discoveries are stalled mainly due to subsurface issues. The Jupiter discovery has large volumes of associated CO2 and development is possibly waiting on new CO2 handling technologies that are being tested at Mero. Dolomita Sul, Bigua and Bem-Te-Vi pre-salt discoveries are smaller than the average in the play due to small trap size and low reservoir quality and so were low in the priority list for Petrobras who relinquished the discoveries

In Angola’s Kwanza basin seven pre-salt discoveries are stalled due to a combination of above ground and subsurface issues. The discovered hydrocarbons are gas rich, ~50% gas and only since 2018 have operators had the rights to the gas under production sharing agreements. The financial struggles of the operator Cobalt International and its subsequent replacement by Total didn’t help resource progression either, Westwood said.

“It is both surprising and concerning that 40% of the resource found in discoveries >100 million boe size made between 2008 and 2016 remains stalled, with no appraisal activity or indications of progression to FID since 2016,” Westwood stated.

More than 9 billion barrels of oil equivalent resources have been found offshore Guyana since 2015. ExxonMobil, operator at the Stabroek Block, has been looking to move these resources to development, with one project producing oil since December 2019 and two more already sanctioned. The company expects to be producing more than 750,000 bpd by 2026 across 5 developments and analysts have said Guyana production will surpass the 1 million bpd mark by the end of the decade.