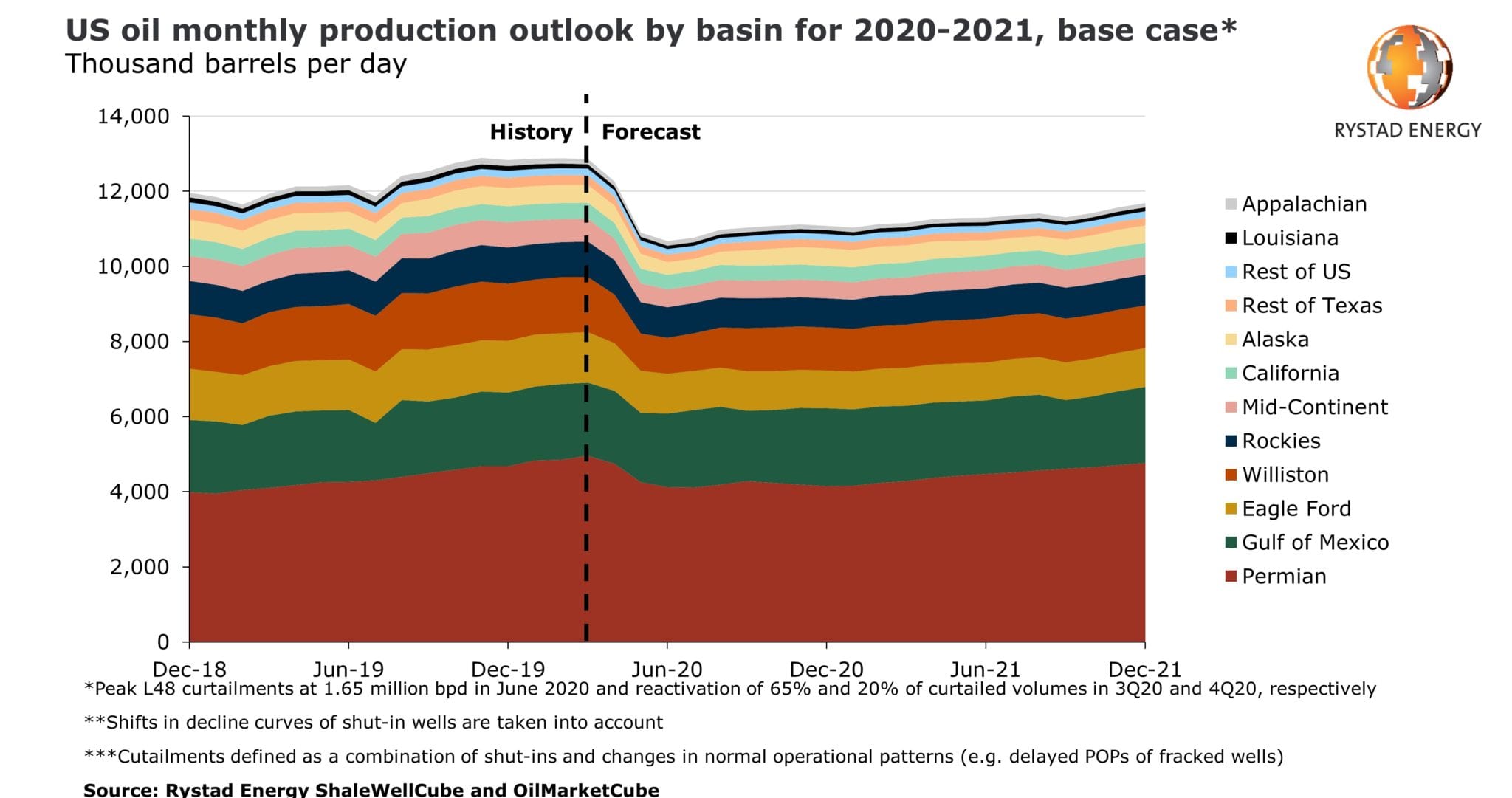

US oil production, which has steeply declined as low prices forced shut-ins, will reach a bottom of around 10.7 million barrels per day (bpd) in June, a two-year low, Rystad Energy estimates, before it starts to slowly recover. Still, US monthly output is not likely to exceed 11.7 million bpd before 2022, a staggering difference from the nearly 12.9 million bpd achieved in March 2020.

It was just months ago that US oil production was at an all-time high and seemed unstoppable. In November 2019, production reached 12.884 million bpd, only marginally higher than 12.855 million bpd in March.

After June 2020, oil production will recover a bit in autumn, ending at around 11.1 million bpd in December. Next year will not be the year of salvation: despite a gradual output increase, monthly production is expected to only touch 11.7 million bpd at the end 2021, according to Rystad Energy’s base-case price scenario, which assumes a $30 WTI oil price for 2020 and a rise to $39 for 2021.

“A major portion of the decline throughout 2Q20 stems from production curtailments and not from natural decline due to the collapse in frac activity,” says Rystad Energy’s Head of Shale Research Artem Abramov.

Production curtailments are now defined as a combination of complete and partial shut-ins of producing wells along with changes in standard operational patterns (i.e. delayed production on already fracked wells). With such a general definition, Rystad Energy said it estimates that total production curtailments (including all private operators) will peak at 1.65 million bpd in June 2020.

Natural decline assuming no curtailments exhibits a significant lag relative to the number of started frac operations which started declining already in March 2020. Natural decline accounts for only about 520,000 bpd of US oil decline throughout 2Q20.

In terms of the outlook, a material upward shift in the WTI price strip provides an economic rationale for the faster reactivation of significant curtailed volumes. “Our most recent discussions with E&P clients suggest that the actual degree of flexibility allows operators to bring back most of the curtailed volumes within weeks if such decisions are made,” Rystad Energy said.

The actual cash cost level for the majority of light oil wells is much lower than the current prices, but many E&Ps prefer to wait until 3Q20 to build confidence in improved market fundamentals. Rystad Energy now estimates that 65% of curtailed volumes will be reactivated throughout 3Q20 and another 20% will be put on production in 4Q20.

Thousands of stripper wells in the country will be left inactive before WTI crosses into the low 40s, but the contribution of these wells to the total production is marginal.

The reactivation of curtailed volumes will be sufficient to offset natural production decline in 2H20 and which is why we expect US oil production to bottom out in June 2020.

“The recovery will not be distributed evenly across major US oil basins and in fact, we expect the Permian and Gulf of Mexico (along with Alaska) to gain market share throughout 2020-2021. Yet even in the Permian Basin, we might need to wait until 2022 or a better oil price, before the basin can again achieve its 1Q20 production record of close to 5 million bpd,” Abramov concludes.