Hess Corporation, a 30% co-venturer on Guyana’s Stabroek Block, announced on Wednesday that it suffered a net loss of US$97 million, or $0.32 per common share, in the fourth quarter of 2020, compared with a net loss of US$222 million, or $0.73 per common share, in the fourth quarter of 2019.

With regards to its exploration and production net loss, Hess said this stood at US$39 million in the fourth quarter of 2020, compared with a net loss of US$64 million in the fourth quarter of 2019. On an adjusted basis, its fourth quarter 2020 net loss was US$118 million.

As for the corporation’s average realized crude oil selling price, excluding the effect of hedging, Hess reported that this was US$39.45 per barrel in the fourth quarter of 2020, compared with US$55.05 per barrel in the prior-year quarter, primarily reflecting a decrease in benchmark oil prices.

At the Stabroek Block, the Corporation’s net production from the Liza Field which commenced operation in December 2019, averaged 26,000 bopd in the fourth quarter of 2020. Hess said this was due to the fact that the operator, ExxonMobil, completed the commissioning of the natural gas injection system allowing the Liza Destiny floating production, storage and offloading vessel (FPSO) to reach its nameplate capacity of 120,000 gross bopd in December last.

As for Phase 2 of the Liza Field development, which will utilize the Liza Unity FPSO with an expected capacity of 220,000 gross bopd, Hess said that this remains on target to achieve first oil by early 2022. It was further noted that the Payara development which was sanctioned in September 2020 and will utilize the Prosperity FPSO with an expected capacity of 220,000 gross bopd, is still on target first oil in 2024.

At the Kaieteur Block where Hess holds a 15% stake, the corporation noted that the operator, ExxonMobil, completed drilling of the Tanager-1 exploration well, which did not encounter commercial quantities of hydrocarbons on a stand-alone basis. The company noted that fourth quarter results include a charge of US$14 million in exploration expense for well costs incurred.

After drilling the Tanager-1 well, Hess was keen to note that the Stena Carron drillship completed appraisal work at the Redtail-1 well before moving to the Canje Block, offshore Guyana. It disclosed as well that the Noble Don Taylor, the Noble Bob Douglas and the Noble Tom Madden drillships are currently drilling and completing Liza Phase 2 development wells.

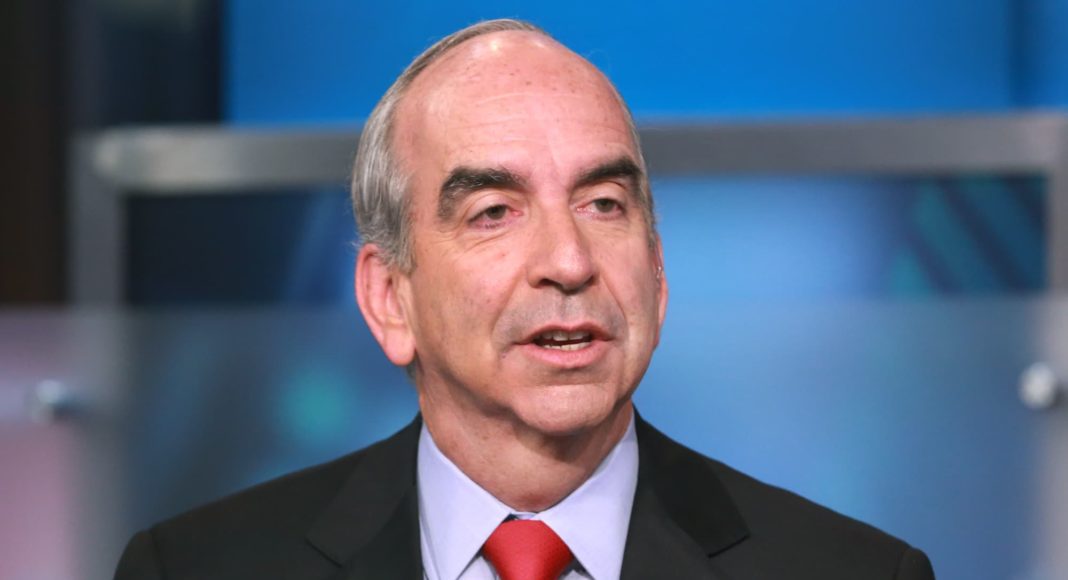

For 2021, Chief Executive Officer (CEO), John Hess noted that the corporation’s priorities remain to preserve cash, capability, and the long-term value of its assets, with more than 80% of its capital expenditures allocated to its high return investments in Guyana and the Bakken.