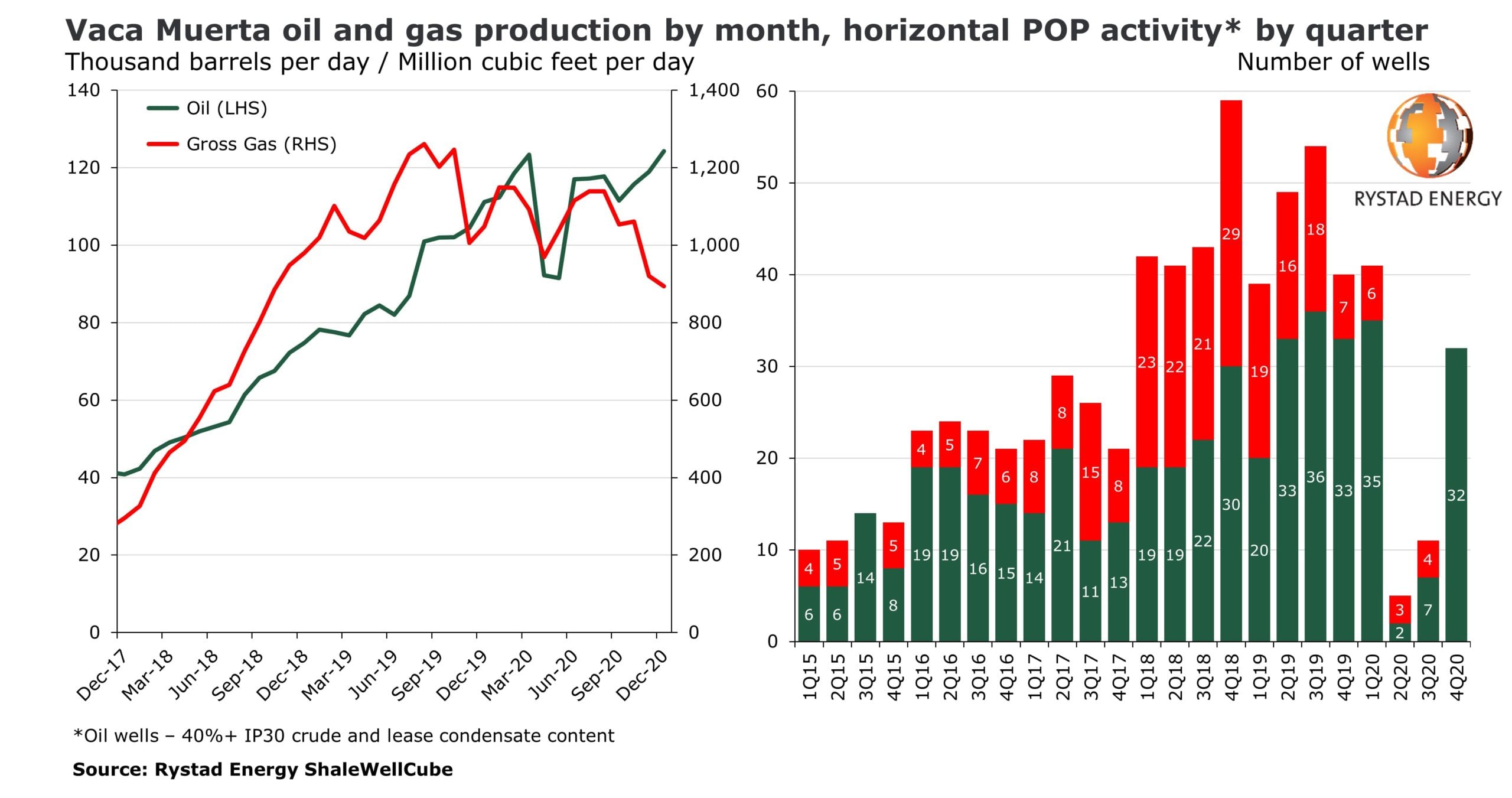

The oil production decline that the coronavirus pandemic brought to Argentina’s Vaca Muerta formation now seems like a distant memory, Norway based Rystad Energy said on Wednesday. The reserve’s oil output has not only rebounded to pre-pandemic levels but also reached a record high of 124,000 barrels per day (bpd) in December 2020.

Rystad Energy said the ascent can continue towards the 145,000–150,000 bpd range by the end of 2021 if current activity levels continue.

Vaca Muerta, meaning dead cow in Spanish, is holding shale gas and tight oil economically recoverable resources of global significance. The previous oil production record before December was set in March 2020, when output reached 123,000 bpd.

Contrary to oil production, Vaca Muerta’s gas output kept declining through the fourth quarter due to lower seasonal consumption. Gross gas production fell below 900 million cubic feet per day (MMcfd) in December for the first time since October 2018.

“While well activity in the gas zone of Vaca Muerta remained depressed in the final three months of last year, with literally zero gas wells put on production, oil POPs rebounded sharply in November and December, pushing the new oil well count to an average of about 11 wells per month,” says Artem Abramov, Head of Shale Research at Rystad Energy.

YPF accounted for about 95% of Vaca Muerta shale’s oil production four years ago, with most volumes coming from Loma Campana, its joint venture area with Chevron. In the past four years, other producers such as Shell, Pan American, Vista, ExxonMobil and PlusPetrol have stepped up their activities in the oil window of the play to gradually account for a larger share of the play’s volumes.

As of December 2020, YPF is yet to return to its pre-pandemic Vaca Muerta oil production record, and the play’s recovery was therefore mainly driven by producers with aggressive capital programs planned for 2020. Specifically, Vista produced 15,000 bpd of oil and Shell followed at 13,000 bpd in December, which should be viewed as new all-time highs from the basin for both operators.

Rystad Energy said both TecPetrol and YPF – the two largest gas producers in Vaca Muerta – had to implement considerable production curtailments in the fourth quarter, a practice that has become common for the play to cope with seasonal consumption lows. In addition to infrastructure challenges, uncertainty surrounding the future of subsidies for unconventional gas production from the play has also weighed on operations.

“While the gas window of Vaca Muerta offers ample potential for proven low-cost development, we remain conservative about the chances of the gas portion of the play to grow substantially in the medium term,” Rystad Energy said.

Frac sand intensity keeps increasing, while frac fluid intensity in the play is flattening out. This happens when operators adapt increased sand density completions after they are done with transitioning to slickwater and was also seen in US unconventional basins several years ago.

Operators in Vaca Muerta are making a massive push to implement the best completion practices of US unconventional plays. The average completion speed, measured in either lateral footage per day or frac sand pumped per day, has more than doubled since 2016. In the second and third quarters of 2020, Vaca Muerta operators averaged around 900 feet and about 2.3 million pounds per day, thanks to the gradual adaption of more efficient fracking operations as opposed to the legacy single-frac approach in the acreage delineation phase.

Well productivity has improved further. Contrary to major US unconventional basins, where operators have largely reached an inflection point, Vaca Muerta’s oil development is only now entering a manufacturing mode, though the downturn has induced a certain degree of high grading too.

“We have seen a 6–7% improvement in most well productivity metrics for Vaca Muerta oil wells between 2019 and 2020,” Rystad Energy said.

While some cost efficiencies are yet to be realized, Vaca Muerta already competes with the best US tight oil basins in Texas and New Mexico from a well productivity perspective. The two-stream estimated ultimate recovery (EUR) range for recent Vaca Muerta completions is comparable to what we are seeing in the US Midland and Eagle Ford plays, while extremely low gas-to-oil ratios – even lower than the Bakken – help Vaca Muerta achieve superior oil stream EURs on a per lateral foot basis.

This emphasizes the fact that Vaca Muerta’s oil window producers have almost no exposure to gas and natural gas liquids (NGL) economics, whereas producers in the US face a particularly high impact on their overall economics during downturns in the gas and NGL markets.

“As a result, we argue that the PV10 wellhead breakeven oil prices in Vaca Muerta’s oil window are already at the same level as the best US tight oil plays,” Rystad Energy stated.