When the proceeds received by Guyana for the first quarter of 2021 from oil produced and sold at the offshore Liza Phase 1 Development are added to the amount currently in the Natural Resources Fund, this is expected to see total revenue exceeding US$340 million, since production began in December 2019.

OilNOW understands that in the first quarter of this year, royalties amounted to almost US$14 million. Oil was trading at just over US$60/barrel when the country exported its 6th million-barrel cargo this month, paving the way for revenues of around US$60 million from that lift. This added to the previous total of US$267,668, 709 in the fund representing oil sales and royalties, would bring the new total to just over US$341 million.

The International Monetary Fund (IMF) said in an updated forecast that oil prices are expected to average just above $50/b in 2021, a more than 21% rise from 2020’s depressed level, as the rollout of vaccines and fiscal stimulus programs will help the global economy post a stronger-than-expected recovery from the pandemic.

While the IMF’s projections could see Guyana earning around US$50 million from each cargo exported by the government this year, American multinational investment bank and financial services company Goldman Sachs has a more optimistic outlook for oil prices. In a new forecast, Goldman said it expects Brent oil prices to reach $70 per barrel in the second quarter (Q2) of this year, up from the $60 it had previously predicted, and to $75 in the third quarter (Q3), up from $65. This could see Guyana earning as much as $75 million for each cargo exported.

“We believe this faster rebalancing during what was expected to be the dark days of winter will be followed by a widening deficit this spring as demand rebounds faster than supply, setting the stage for a tight physical market,” Goldman said in a note on February 21.

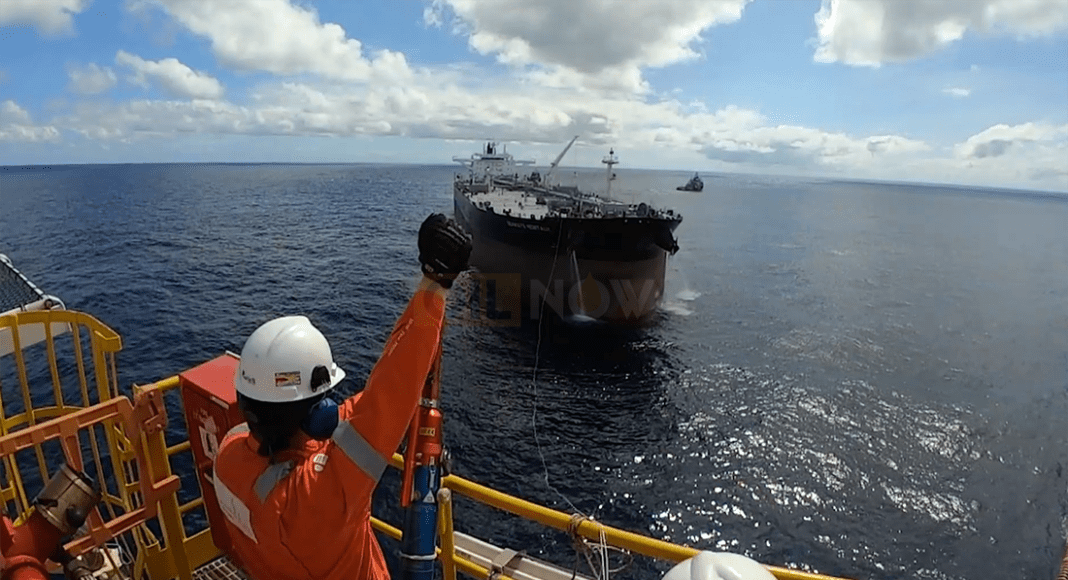

While oil prices are being closely watched by the Guyana government, production levels at the offshore Liza Phase 1 Development will also play a key role in the volume of oil exported, and revenue earned. A shortfall last year due to issues with a gas compressor on the Liza Destiny FPSO saw the government exporting 4 tanker loads of crude instead of the expected 5. Additional challenges with a discharge silencer on the vessel this month saw production dropping to around 30,000 barrels per day (bpd) from the average 120,000 bpd.

However, ExxonMobil said in an update on Wednesday that it was slowly ramping up production to between 100,000-110,000 barrels per day at a flare level of no more than 15 million cubic feet of gas per day.

The Government of Guyana (GoG), in expressing disappointment with the ongoing equipment failure on the FPSO, said it was closely examining the implications of the production shortfall.

“The GoG is currently examining the implications of the loss of output, and consequently loss of income and revenue, including measures that it may have to institute to protect national interest,” the Ministry of Natural Resources said last week.