Rystad Energy – an independent research and business intelligence company based in Norway – predicts that oil production in Guyana will exceed 600,000 barrels per day over the next decade, raking in billions of dollars in profit per year for the South American country.

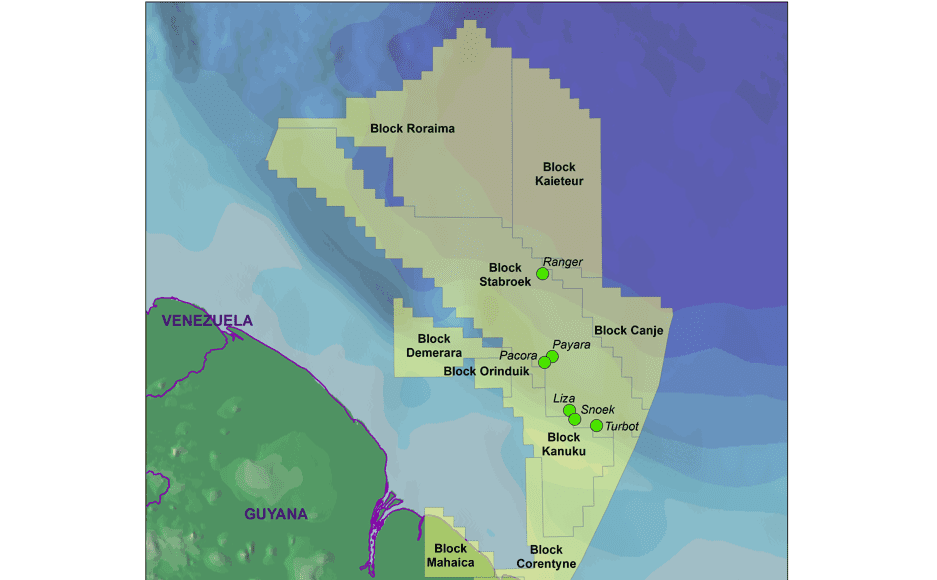

In a recent report, Head of Upstream Research at Rystad Energy, Espen Erlingsen said ExxonMobil’s discovery of the Liza field in 2015 placed the country on the global energy map.

“We predict Guyana’s total oil production to surpass 600,000 barrels per day by the end of the next decade. These volumes could generate total annual revenue of $15 billion from the oil and gas industry. After all costs are paid, around $10 billion of profit could thus be split between the companies and the government,” Erlingsen stated.

While an analysis done by Rystad Energy shows that Guyana’s fiscal regime is favorable to oil companies when compared to mature oil and gas development countries, the same study pointed out that it is in line when compared with other countries of equivalent maturity.

In the current fiscal regime, the government collects its share through a 2% royalty and a 50% profit oil levy. Rystad Energy estimates that this will give the government 60% of the profit from the various projects (government take), while the remaining 40% will go to international E&P companies.

“The average government take of 60% in Guyana is indeed favorable when compared to other large offshore producers. On average, the government take for all offshore projects is around 75%, while rates in major producing countries such as Nigeria, Norway, Mexico, Indonesia and Trinidad are all above 80%,” says Erlingsen. “However, for countries that only recently opened up for E&P activities – such as the Falkland Islands, Israel, Mozambique and Mauritania – the government take is in the range of 50% to 65%.”

In order to attract investments from international E&P companies to kick-start their offshore ambitions, frontier countries often need to sweeten the pot with favorable fiscal terms. Guyana has followed this pattern, Rystad said.

“In retrospect, one can argue that the government has succeeded in generating the activity they were hoping for,” says Erlingsen. “The question going forward will be whether the Guyanese government – emboldened by its stunning exploration success over the past three years – will elect to alter its fiscal regime when future licenses are awarded.”

In this regard, the country’s Finance Minister, Winston Jordan, said in April that recommendations made by the International Monetary Fund (IMF) relating to the modernizing of Guyana’s petroleum fiscal regime, taxation structure and Production Sharing Agreements (PSAs), will be taken onboard.