In the first three quarters of 2023, Guyana received US$1.038 billion in oil revenues, representing a 32% increase compared to the US$786 million received during the same period in 2022. Disaggregated, the government’s natural resource fund (NRF) received US$872.83 million in profit oil revenues and US$165.29 million in royalties.

The 32% uptick is attributed to the introduction of the Liza 2 project in February 2022, which reached full production by July 2022. Production in the final quarter of 2023 is anticipated to increase with the start-up of the Payara project in October/November.

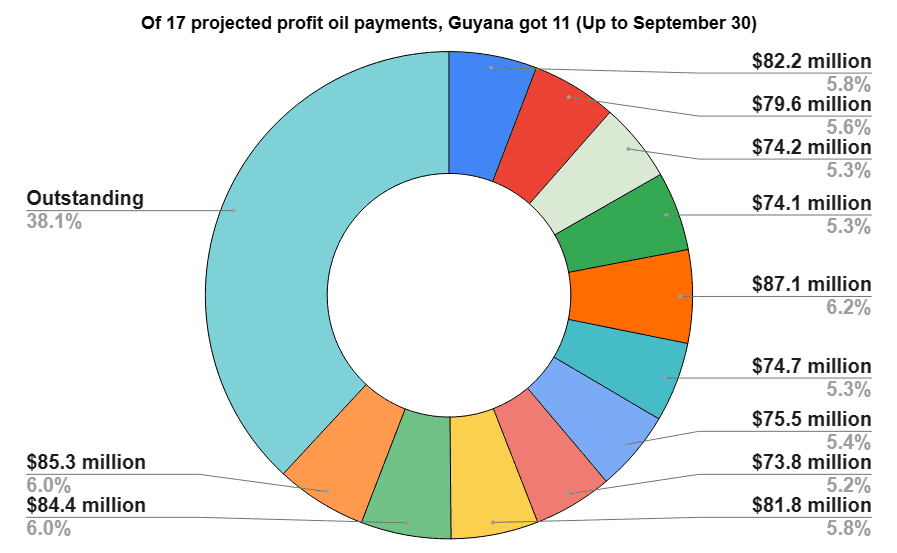

The US$1.038 billion received accounts for 64% of Guyana’s projected oil revenues for 2023. At the beginning of the year, the Guyana government had projected the country would receive US$1.63 billion in oil revenues. The expectation was that US$1.41 billion would come from profit oil revenues, specifically from 17 profit oil payments, and US$225.15 million from royalties.

However, the Ministry of Finance released a mid-year report indicating a marginal downgrade in the forecast. “With the price of crude oil declining amid demand-side concerns and financial market disruptions that threaten a global slowdown in economic activity, the forecast for NRF deposits has been marginally downgraded,” stated the Ministry of Finance. Petroleum deposits are now projected to be US$1.629 billion, with the government expected to earn US$1.410 billion from profit from oil sales and US$219.3 million in royalties.

The outstanding profit oil revenues to be generated in the final quarter of 2023 are approximately US$537.19 million, while the outstanding royalties, expected in October, are approximately US$53.99 million.

In the first three quarters, 11 lifts have already been sold, resulting in the receipt of 11 profit oil payments. Six more lifts are expected to be sold in the final quarter. These lifts are estimated to amount to approximately six million barrels. 25 companies are vying for the new crude marketing contract expected to be signed by the end of October. The contenders include energy giants such as Saudi Aramco, Equinor, Eni, and ADNOC. Previously, BP Oil International Limited had a one-year contract for marketing Guyana’s crude, having won the bid against 13 competitors.

With a revised projected sum of US$1.629 billion from oil sales and royalties in 2023, the government is expected to withdraw US$1.16 billion for spending in 2024, in support of the 2024 national budget.

Revenues are being generated from the ExxonMobil-operated Stabroek Block production, where approximately 380,000 barrels per day (bpd) are being produced and is on schedule to increase to 600,000 bpd in early 2024.