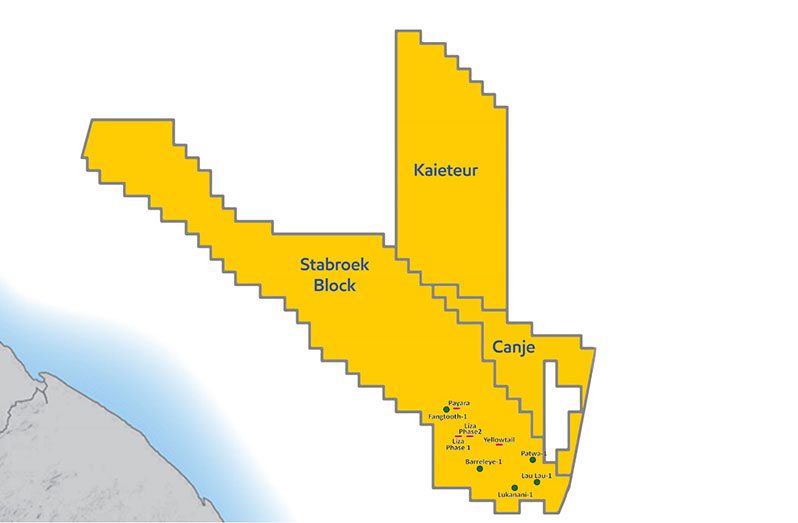

ExxonMobil’s Vice President in Guyana, Philip Rietema, said that the company’s decision to withdraw from the Kaieteur Block last year was driven by the project’s failure to meet ‘investment hurdles’ given the complex realities of oil and gas exploration.

“We exited late last year from the Kaieteur Block after doing seismic drilling wells, doing a lot of work over many years and when we stepped back, we didn’t have something that met our investment hurdle… It wasn’t meeting that requirement and we stepped away to focus our time and energy in other areas,” Rietema explained during a June 30 episode of the Guyana Energy Perspectives Podcast.

Exxon was faced with a “drill or drop” decision regarding Kaieteur block – Routledge | OilNOW

Rietema discussed the significant financial risks and strategic shifts that guided their exit from the “high-risk” venture.

“It’s indicative of the risk that is inherent in exploring for oil and gas,” Rietema explained. While reflecting on the broader context, he added, “If you go back in history, before our discovery in the Stabroek Block, there were over 40 wells drilled in the basin…they were all dry.”

As explained by Rietema, this historical backdrop highlights the substantial risks involved in the region, which outcomes in the Kaieteur and Canje blocks have further underscored.

“We have separate contracts, separate licenses, for Canje and Kaieteur with different co-venturers as well,” Rietema clarified, emphasizing the distinct operational contexts of these blocks compared to the successful Stabroek Block.

Exxon to write off Kaieteur Block expenses | OilNOW

However, despite these efforts, Rietema said that commercial quantities of hydrocarbons were not found in either of these blocks.

Another partner in the block – Hess, also walked away and both returned their participating interest to the original Kaieteur Block license holders: Ratio Guyana Limited and Cataleya Energy Limited.

Regarding the financial impact of the Kaieteur Block exit, Rietema acknowledged that the oil giant spent significant amounts of money which it’s now just a “lost investment”, but it’s nothing new given the nature of exploration.

Despite this setback, ExxonMobil remains committed to its exploration endeavors in Guyana as the company continues to evaluate prospects in the Canje Block, exploring avenues for potential future drilling despite previous unsuccessful attempts.

At Canje, Exxon has a 35% stake, with TotalEnergies (35%), JHI Associates (17.5%) and Mid-Atlantic Oil & Gas (12.5%).

Exxon’s 12-well campaign in Canje block slated to start in Q2 2024 | OilNOW

Meanwhile, Guyana’s oil sector continues to thrive, primarily driven by successful projects in the Stabroek Block like Liza Phase 1, Liza Phase 2, and Payara, which collectively produce over 600,000 barrels of oil per day.

Additionally, more projects (Yellowtail, Uaru and Whiptail) are set to start production in the next few years.

Rietema pointed out that this reaffirms ExxonMobil’s ongoing contributions to Guyana’s economy through royalties and other financial commitments which remain significant.

“It highlights the high-risk nature of the business we’re in. If you have a great discovery, like we do [with the] multiple discoveries in the Stabroek block, it can be very rewarding as well,” he said.