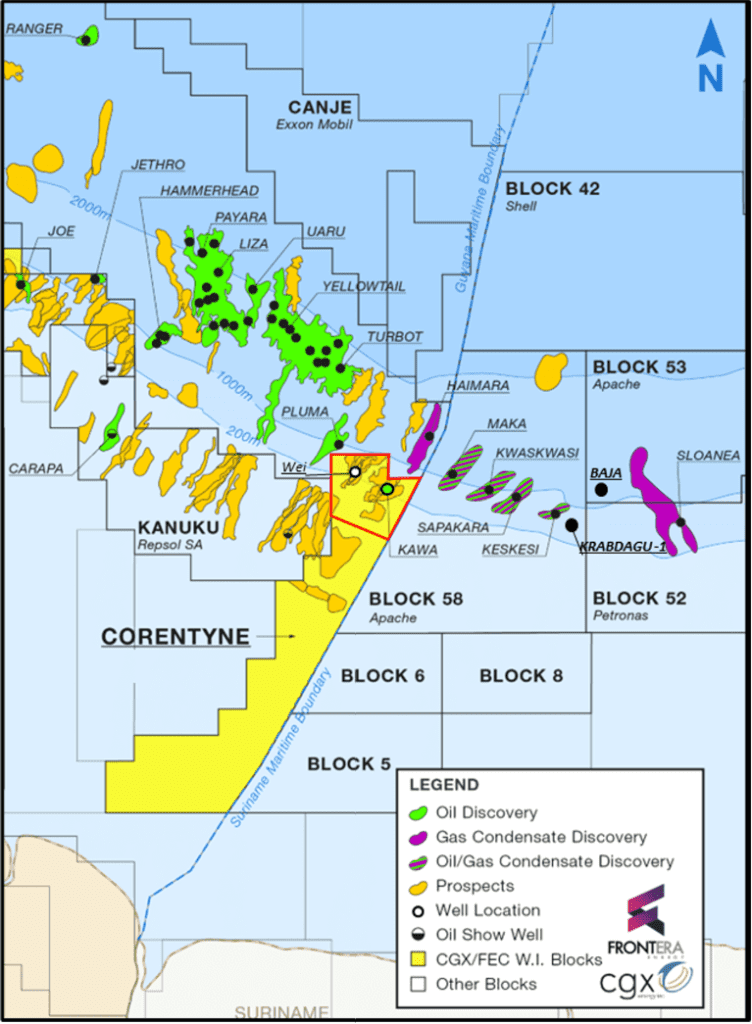

Guyana has taken control of the Corentyne Block from Frontera Energy and its partner, CGX Resources. This move follows a series of unmet contract obligations. Frontera and CGX had been working on this block for some time, with CGX acting as operator and Frontera holding 72.52% in shares.

This is not the first time the two companies have faced setbacks in Guyana. In 2022, they were involved in the forfeiture of the Demerara and Berbice Blocks due to similar issues. According to Seeking Alpha Analyst Long Player, “There is some history here of a failure to meet government expectations.”

In an Oct. 4 piece, the analyst wrote that Frontera and CGX’s failure comes at a significant cost. Two wells were drilled in the Corentyne Block, alongside other expenses, leading Long Player to estimate total costs in the US$100 million range. The analyst also pointed out that “management time spent on this endeavor could have been far better spent elsewhere.”

Government not convinced CGX can fund operations, find a capable partner – Jagdeo | OilNOW

The core issue lies in the companies’ ability to manage such a large offshore project.

“The offshore business usually involves large projects with billions of dollars to spend before there is production and cash flow,” Long Player noted. According to the analyst, neither Frontera nor CGX had the assets to meet these demands. The lack of resources became evident, and the companies could not bridge the financing gap.

Guyana’s decision to repossess the block followed an unconventional approach by Frontera and CGX to try and turn a profit, according to Long Player.

‘The devil is in the details’ – petroleum geologist says of CGX’s Guyana discovery | OilNOW

Despite being committed to transparency on their website, neither Frontera nor CGX has issued a formal statement regarding the repossession since it happened. Long Player highlighted the importance of shareholder communication, saying, “Shareholders have a right to be informed of material developments and management’s stance on those developments.” The analyst believes that both companies may face further obligations tied to the two wells drilled under the original lease agreement. What remains unclear is whether Guyana will make any claims related to those wells.

Ultimately, the situation reveals a stark lesson in risk management. “Bluffing did not work,” Long Player said. The repossession of the Corentyne block underscores the need for better planning and realistic assessments of the resources required for such high-stakes ventures.

With the loss of the Corentyne block, Frontera and CGX now face a tough road ahead. According to Long Player, their future in Guyana will depend on the government’s willingness to give them another chance—though the outlook appears dim.