As offshore exploration activities ramp up across the Guyana-Suriname basin, oil majors are also turning their attention to the opposite side of the Atlantic in a rush to tap into vast reserves.

Bloomberg reports that the world’s biggest companies from Exxon Mobil Corp. to Royal Dutch Shell Plc and BP Plc are setting up camp across Africa. Armed with stronger balance sheets and higher crude prices the industry is on track to double drilling in African waters this year. Rising natural gas demand is adding to the attraction.

“The majors starting to move into these areas for exploration again is probably the first sign of things picking up,” Bloomberg quotes Adam Pollard, an analyst at consultant Wood MacKenzie Ltd., as saying.

He said Africa “may be one of the first to get hit when the price goes against explorers, but equally it’s perceived to be one of the places where people are keen to get involved when the price is supportive.”

There are plenty of signs of a recovery. Rigs working in waters off Africa have increased to the highest in two years, according to Baker Hughes data. Consultant Rystad Energy AS expects 30 offshore exploration wells to be drilled this year compared with 17 last year.

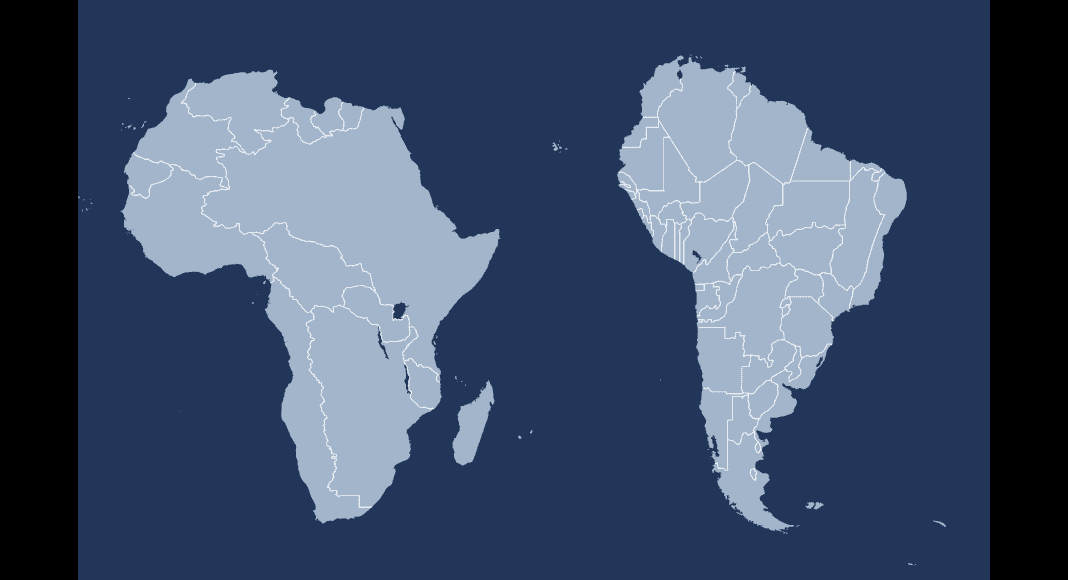

Acquisitions along the west coast, seen as a geological mirror of the other side of the Atlantic where huge discoveries have been made from Guyana to Brazil, have also accelerated. Shell secured its first exploration acreage offshore Mauritania in July and Exxon bought stakes in Namibian fields in August.

Companies drilled almost 100 exploration wells in African waters each year on average from 2011 to 2014, as Brent prices stayed above $100 a barrel, according to Rystad’s data. Then came crude’s slump to nearly $27 in 2016, and spending suffered because the best prospects are in deep waters, making them expensive to drill. The slowdown contributed to declining production.

Oil has since recovered, trading above $77 on Wednesday, making exploration attractive again, according to Tracey Henderson, who has lived through three boom and bust cycles in the continent.

“The more you see the less you tend to get too fussed about” the troughs and crests, Henderson, senior vice president of exploration at Dallas-based Kosmos Energy Ltd., which gets almost all its revenue from Africa, said in an interview, the Bloomberg report stated.

For companies willing to take the risk, the prize could be significant. There’s a high probability that there’s at least 41 billion barrels of oil and 319 trillion cubic feet of gas yet to be discovered in sub-Saharan Africa, according to a U.S. Geological Survey report of 2016. That’s equivalent to more than five years of the U.S.’s oil consumption and 12 years of gas.