In its 2020 manifesto, the People’s Progressive Party/Civic administration pledged to ensure better contract management for the Stabroek Block Production Sharing Agreement (PSA) and future contracts.

In just two years, the government has embarked on a number of legislative and regulatory reforms– a good sign that it intends to stay true to its word.

The passage of the Local Content Act as well as the strengthening of the Natural Resource Fund Act in December 2021, are two of the main achievements for the government on the legislative front.

The former not only protects the interests of Guyanese workers but also increases locals’ participation in 40 categories in the First Schedule. These areas include catering, janitorial services, ground transportation, food supply, rental of office spaces, and local marketing and advertising. It is estimated that they can bring in about US$700 million per annum.

The NRF law, which was first introduced by the APNU+AFC, saw several potentially lethal flaws such as entrusting alarming powers to the Finance Minister, removed. New provisions in the NRF Act include simplified rules for withdrawals from the account. It also criminalises the nondisclosure of oil receipts by the subject minister.

With respect to the Stabroek Block Production Sharing Agreement (PSA), the government has categorically stated that given its respect for the sanctity of contracts, this PSA would not be touched. But certain actions can be seen as a means to generate greater value to Guyana in the absence of renegotiation. Meantime, the government is making certain that new contracts are subjected to better terms. In fact, PSAs will be armed with 10% royalty, the payment of a 10% corporate tax and a 65% cost recovery ceiling. Profit oil would be split 50/50. The new model PSA is still in the incubation stage but is expected to be released.

Importantly, the new PSA will be used for the ongoing licensing round for which submissions will close in April 2023. This licensing round also notably brings an end to the one-on-one negotiations approach previously utilised for the award of blocks.

On the institutional front, the Guyana government has been working to strengthen the capacities of the Guyana Revenue Authority (GRA), the Ministry of Natural Resources and the Environmental Protection Agency (EPA).

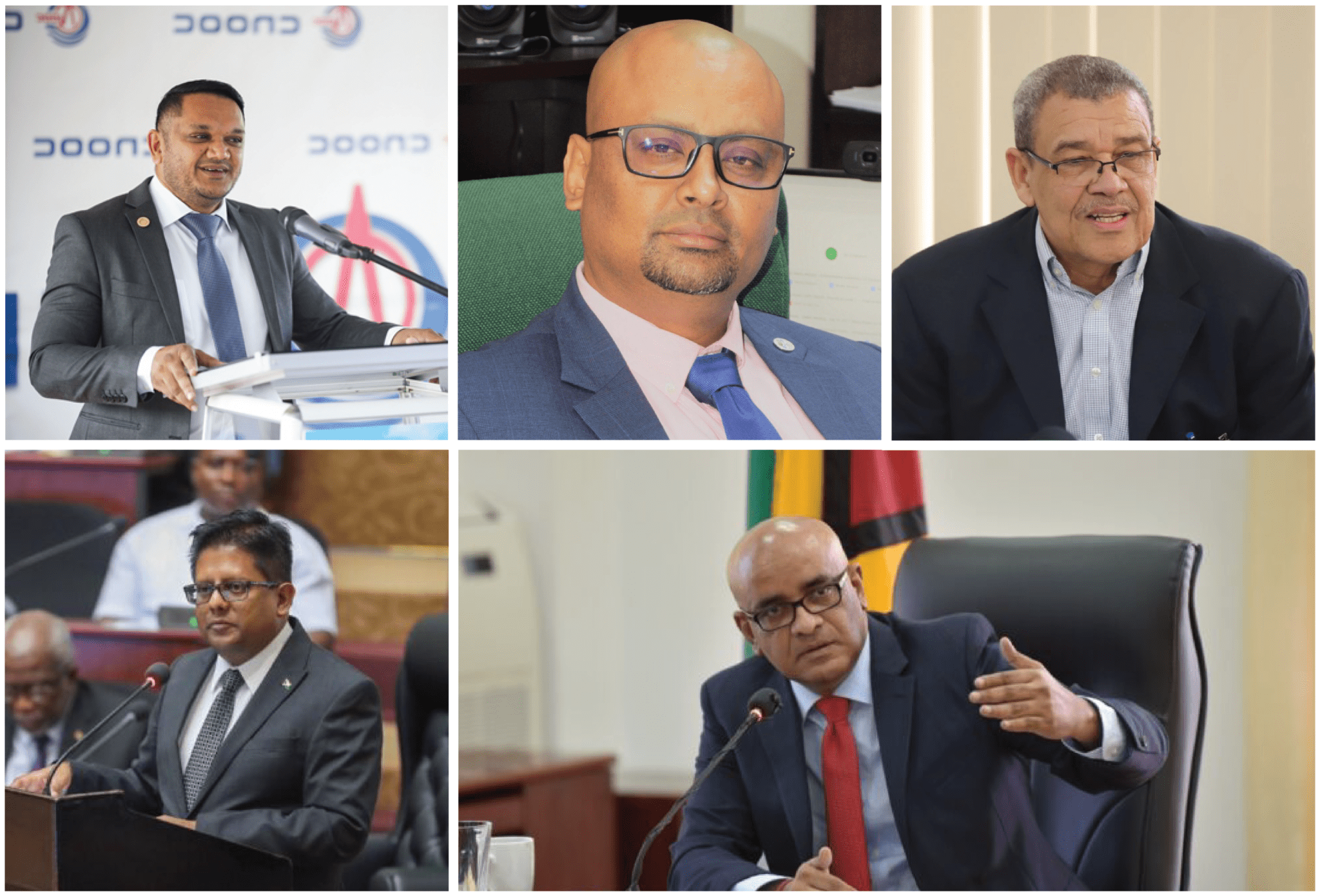

At his most recent engagement with local media, Vice President, Dr. Bharrat Jagdeo explained that the administration intends to improve the operational efficiencies and competencies of these key regulators. He said work is ongoing to beef up the Guyana Revenue Authority since it is the main functionary in charge of auditing for tax purposes.

Dr. Jagdeo said, “We are trying to recruit people to audit for tax purposes… We had some setbacks with losing qualified locals, but we believe we can get back on track.”

He also noted that the government is working simultaneously to build local capacity to conduct cost recovery audits. A local consortium was hired earlier this year, consisting of Ramdihal and Haynes Chartered Accounting and Professional Services Firm, Vitality Accounting and Consultancy Inc., and Eclisar Financial & Professional Services. They partnered with the Oklahoma-based Martindale Consultants Inc. and the Swiss technical company, SGS to audit ExxonMobil’s 2018 to 2020 cost recovery bills.

For the Ministry of Natural Resources, he said it is the government’s intention to strengthen its ability to manage the sector through modernized laws. VP Jagdeo, in this regard, said “the law, which was birthed in 1986 cannot defend our interest enough and it is not fit for the modern-day management needed. It needs to change. Hopefully, by March, that can be before Parliament.” He said a contract for the review of the archaic laws, has already been awarded.

With respect to the Environmental Protection Agency, he noted that several initiatives were funded to strengthen the capability of the agency to manage, track and respond to a range of environmental issues. One of the major accomplishments, he said, is the fact that the EPA has strengthened the permits for the oil sector. These permits now demand financial assurance from parent companies, an array of studies on the technologies to be used for emissions reduction, as well as payments by the companies for onboard audits.

He said too that the EPA now requires a higher standard be adhered to for treatment of wastewater and cradle-to-grave management. He was also proud of the fact that the country, through the EPA, now implements a tax on flaring.

Looking ahead, VP Jagdeo said the government intends to increase the operational independence of the EPA, where it will have satellite technology to track instrumentation and measure the amount of oil the country receives. He said this approach will also be extended to the full legislative and regulatory armory for the sector.

CONCLUSION

The foregoing are just a few examples of the seemingly hardcore reforms being implemented by the government to ensure Guyana is able to manage the incoming oil wealth effectively.

In just two years, Guyana has opened a tender for the establishment of a modular refinery for national security purposes, launched its first bid round, advanced efforts for its flagship gas-to-energy project, and commenced work on a new model PSA.

It is also planning to have its own specialized Crude Marketing Unit, which will be led by Middle Eastern-trained Guyanese.

The administration has also been running at a hundred miles an hour to lay the foundation for sustained, diversified growth despite the challenges of the COVID-19 pandemic and the Russia-Ukraine war.

These actions clearly show that the will stop at nothing to input the building blocks of a modern architecture for managing the oil and gas industry. Should it stay the course, Guyana’s oil bonanza is sure to translate into transformative growth for all.

About Energy Insights

From the people who bring you day-to-day coverage through OilNOW – the Caribbean’s premier oil, gas and energy information service – the Energy Insights column offers perspectives and analyses on the evolving energy sector in the South American/Caribbean region, and further afield.