Mid-Atlantic Oil & Gas Inc., which has a 12.5% stake in the Canje deepwater block, has signaled its interest in Guyana’s ongoing licensing round.

Its co-founder and director, Edris Kamal Dookie, is quoted in the April 21 edition of Latin America Energy Advisor as saying that the extension of the bid round deadline to July 15 will give the prospective bidder more time to evaluate the prospectivity of the three deepwater blocks.

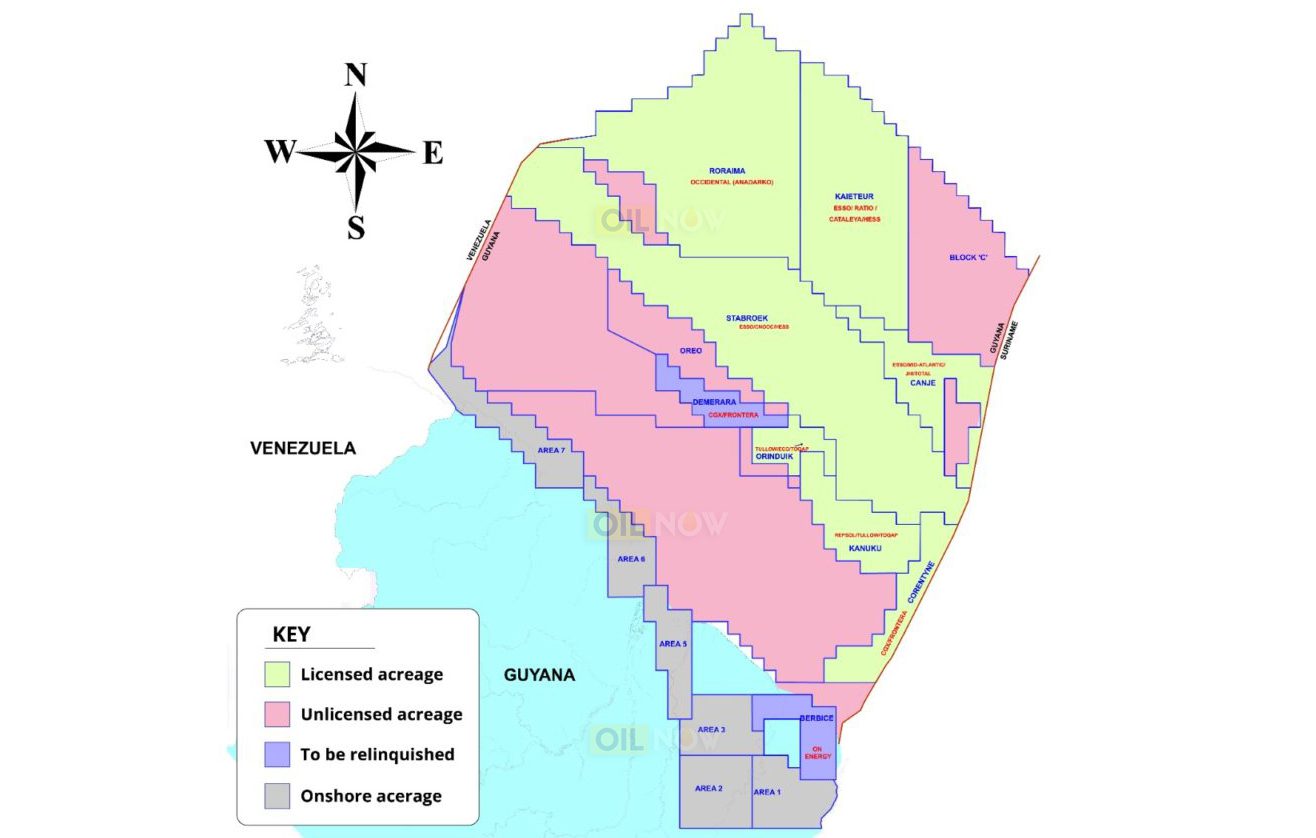

Situated on the northeast section of the basin, deepwater blocks D1, D2 and D3 are sandwiched between three ExxonMobil-operated blocks – Canje and Kaieteur on the Guyana side, and Block 59 offshore Suriname. The blocks on offer were found to demonstrate similar trends to the prolific “Golden Lane” of discoveries by Exxon in the Stabroek Block, said Petroleum Geo-Services in a recent release.

Mid-Atlantic is also reviewing the model petroleum agreement Guyana recently introduced, and is looking forward to the implications of updated petroleum legislation expected prior to the end of the round.

Mid-Atlantic was the sole awardee of the Canje block in 2015, after which there were several farm-outs. The operatorship was transferred to ExxonMobil, which has a 35% stake. TotalEnergies owns 35% and JHI Associates owns 17.5%. Exxon drilled three exploration wells which failed to encounter commercial crude and has applied for authorisation to drill 12 more.