The energy transition is challenging the raison d’etre of conventional exploration, which has always been the industry’s primary engine for growth. So says Andrew Latham, Vice President of Global Exploration at Wood Mackenzie.

In a low-carbon future, is there still room for growth? Latam says to answer that question, consider the following three factors:

- Demand is uncertain

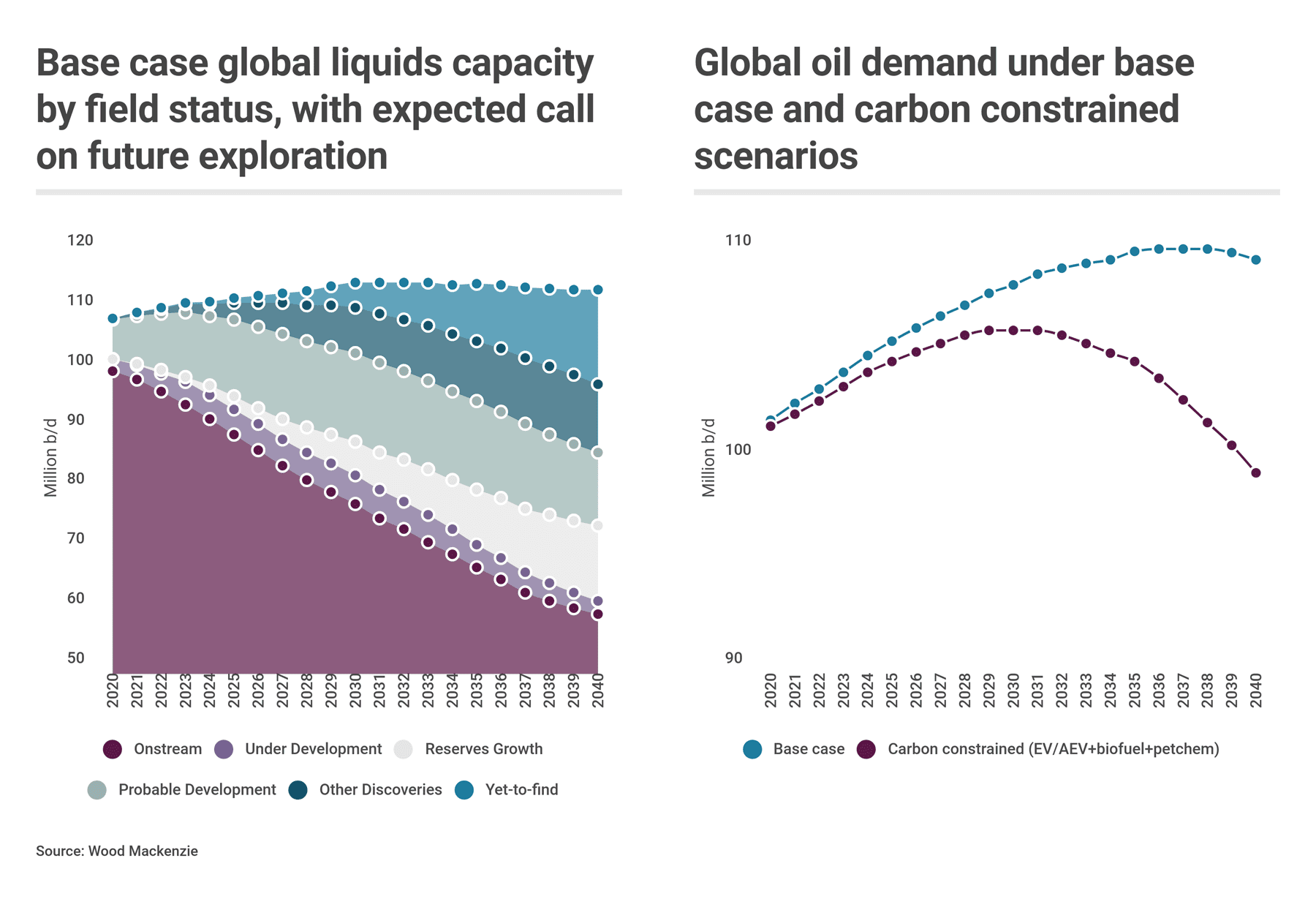

Peak oil demand is probably less than 20 years away. Our base case oil demand outlook has plenty of room for future exploration. We see a supply gap beyond known fields of 16 million barrels of oil a day by 2040. This represents an opportunity for the industry to continue its current rate of exploration spending. With healthy profits from exploration at oil prices above US$50/barrel, the economic case for exploration under this scenario is compelling.

But the pace and nature of the energy transition is highly uncertain. Any number of factors could accelerate decarbonisation, from faster adoption of electric vehicles to fewer single-use plastics. It’s entirely possible that, by 2040, all but 6 million barrels of oil a day comes from fields known today.

- Global recovery rates are rising

The clearest threat to future exploration comes from development and production technologies that boost existing fields. Just a 2% improvement in global recovery factors could add that 6 million barrels of oil a day by 2040. Given that we might be on the cusp of a new digital technology revolution – advanced seismic imaging, data analytics, machine learning and artificial intelligence, the cloud and supercomputing – such an improved recovery scenario is hardly fanciful.

- Stakeholders are turning up the heat

Exploration has already been out of favour for several years. Initially, investors fell out of love with the sector because of its perceived poor returns when prices fell. Now their misgivings more likely reflect the energy transition. Investors also have an eye on the exciting new technologies that will either increase demand destruction or meet energy supply from other sources.

Meanwhile, a new policy trend is emerging, with some governments opting to accelerate a non-carbon future by banning exploration. They see it as a highly visible and generally popular move with little near-term consequence. For explorers, the implications of waning public support could become much more serious if it triggers wider tax policy changes.

What does the energy transition mean for oil and gas explorers?

Even under these conditions, there’s a compelling economic case for exploration. The sector is back in profit and set to remain so as long as oil prices hold above US$50/barrel. Hot new plays such as Guyana create huge value, and doubtless many more await discovery. While many stakeholders are unconvinced, good explorers will continue to thrive.

But there is no room for complacency. In the longer term, the need for new discoveries will diminish. Companies need to implement strategies today that will be robust enough for a carbon-constrained future. In short, exploration needs to reinvent itself if it is to survive.

How are leading explorers changing their core strategies in response to the energy transition? Get your complimentary copy of the report to find out. Fill in the form on this page.