Whatever the pace of the energy transition, the world will still rely on oil and gas for much of its energy needs until well beyond 2040, according to research conducted by consultancy group Wood Mackenzie. “Exploration will be critical in meeting this future demand. Yet exploration is widely perceived as discretionary, even unwarranted,” WoodMac analysts Andrew Latham and Adam Wilson said.

Doubters, they pointed out, see a world of risk, declining demand, enormous existing resources and a supply pecking order that ranks exploration squarely in last place. There’s even a public image problem in the false narrative that each new discovery somehow extends the fossil fuels era.

“Our analysis leads us to a different view. We think companies that are showing signs of fatigue with exploration are questioning their long-term commitment to upstream petroleum,” the analysts said. “Only about half the supply needed to 2040 is guaranteed from fields already onstream. The rest requires new capital investment and is up for grabs.”

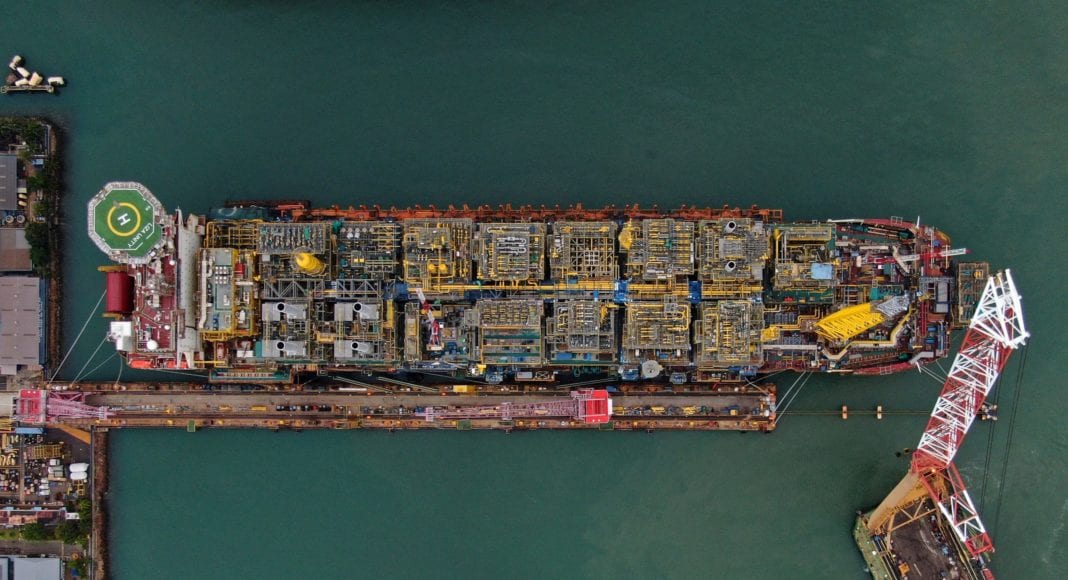

In Guyana, U.S. oil major ExxonMobil has made 18 discoveries since 2015, amounting to more than 9 billion barrels of oil equivalent (boe) resources. Most of those discoveries have been made in just a small portion of a massive 6.6 million acres block called Stabroek, which is equivalent to more than 1000 blocks in the Gulf of Mexico. Enormous potential for the discovery of more resources therefore remains.

Of the 18 discoveries, developments are moving forward mainly at the Liza field (Liza Phase 1 and 2) where the first and largest discovery (800 million to 1.4 billion boe) was made, and at the Payara field, where, following a discovery at the Payara-2 prospect in 2017, results were pegged at approximately 500 million boe for that area.

“Payara-2 confirms the second giant field discovered in Guyana,” Steve Greenlee, then President of ExxonMobil Exploration Company, said at the time.

Latham and Wilson estimate that over 100 billion boe – split roughly 50:50 between oil and gas – will come from exploration in the coming years. “This means the industry needs to maintain its success rate of the past five years until at least 2030.”

ExxonMobil has had an unprecedented success rate of around 80 percent at the Stabroek block, hitting pay at 18 out of 23 wells drilled.

The International Energy Agency (IEA) said in a new report just last week that Guyana and Brazil are set to dominate non-OPEC+ oil supply growth through 2026.

“Companies struggling to decarbonise disadvantaged older assets might even find it cheaper to start afresh with new discoveries,” the WoodMac analysts said.

The discoveries in Guyana therefore remain truly relevant and prospects have never been more favourable. Getting the oil to market in the window that remains, is therefore key.