By the time oil production in Guyana hits 340,000 barrels per day at the end of 2022, the Organization of the Petroleum Exporting Countries (OPEC) will be reassessing member states’ output after a new accord to cut production by several million barrels per day takes effect next year.

The 23-country OPEC+ alliance is in the midst of a 7.7 million b/d production cut agreement that is scheduled to shrink to 5.8 million b/d from January 2021 through April 2022, in anticipation of improving demand as the world recovers from the coronavirus pandemic, S&P Global said in a report Tuesday.

“That is the agreement we signed. It is very clear,” UAE Energy Minister Suhail al-Mazrouei said at the Energy Intelligence Forum. “There have been no changes to the agreement that I am aware of.”

But with oil prices hovering in the low $40s/b in recent weeks and Libya, which is exempt from the cuts, rapidly restoring production after a ceasefire between warring factions, the market has been speculating whether OPEC+ will extend its current quotas -– or even tighten them, S&P Global said in the report.

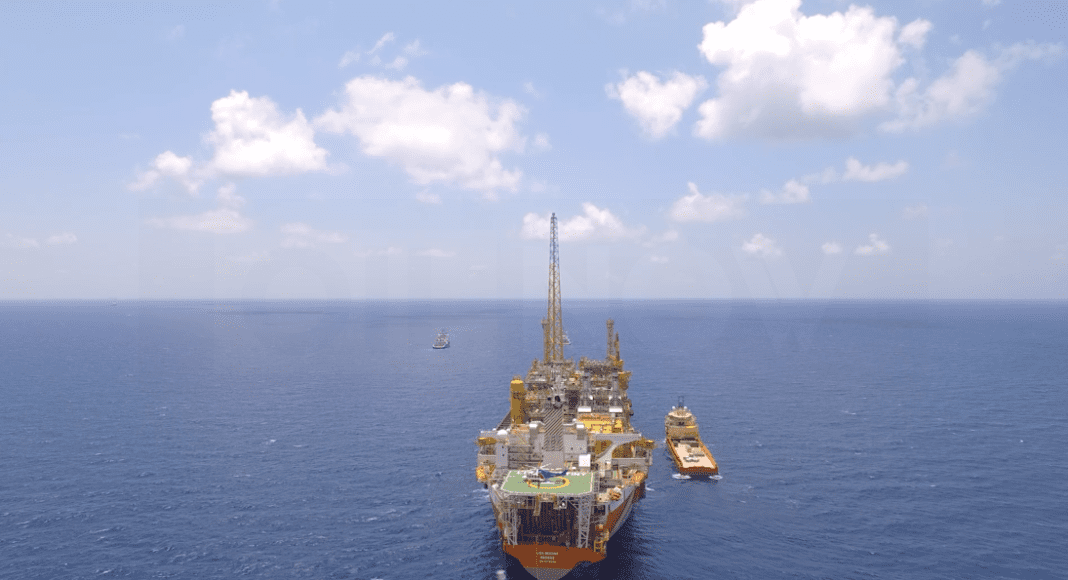

Meanwhile in Guyana, oil production from Liza Phase 1 is pegged at 120,000 b/d at peak and 220,000 b/d from Liza Phase 2, which is set to come on stream by mid-2022. Production will significantly ramp up by 2024 when a third development at Payara comes on stream at another 220,000 b/d. All told, by the end of the decade production in Guyana is expected to surpass the 1 million b/d mark making the country one of the top producers in Latin America and the Caribbean.

Lisa Viscidi, Director – Energy, Climate Change and Extractive Industries at Inter-American Dialogue said in a couple of years Guyana could be one of the largest sources of non-OPEC supply growth in the world.

“…there is the potential for more reserves to be discovered… In terms of the comparison countries, Guyana’s breakeven costs are quite competitive compared to some other areas such as US Shale,” she said. “Some of those higher cost producers could potentially lose market share to Guyana.”

OPEC said following an expected sharp decline of 3.3 mb/d in 2020, its first annual drop since 2016, non-OPEC liquids supply will grow modestly in 2021 and pick up momentum in the following years, thus increasing from 65 mb/d in 2019 to 70.7 mb/d in 2025.

“Medium-term recovery is driven mainly by Brazil, which grows by 1.7 mb/d, the US (+1.4 mb/d), Norway (+0.8 mb/d), Guyana (+0.7 mb/d) and Kazakhstan (+0.5 mb/d),” OPEC stated.

US oil major ExxonMobil has found more than 8 billion barrels of oil equivalent resources in Guyana since 2015 and continues to search for more crude offshore. Analysts have said they expect more oil to be found in the basin since multiple drill targets remain at Stabroek as well as several other blocks.