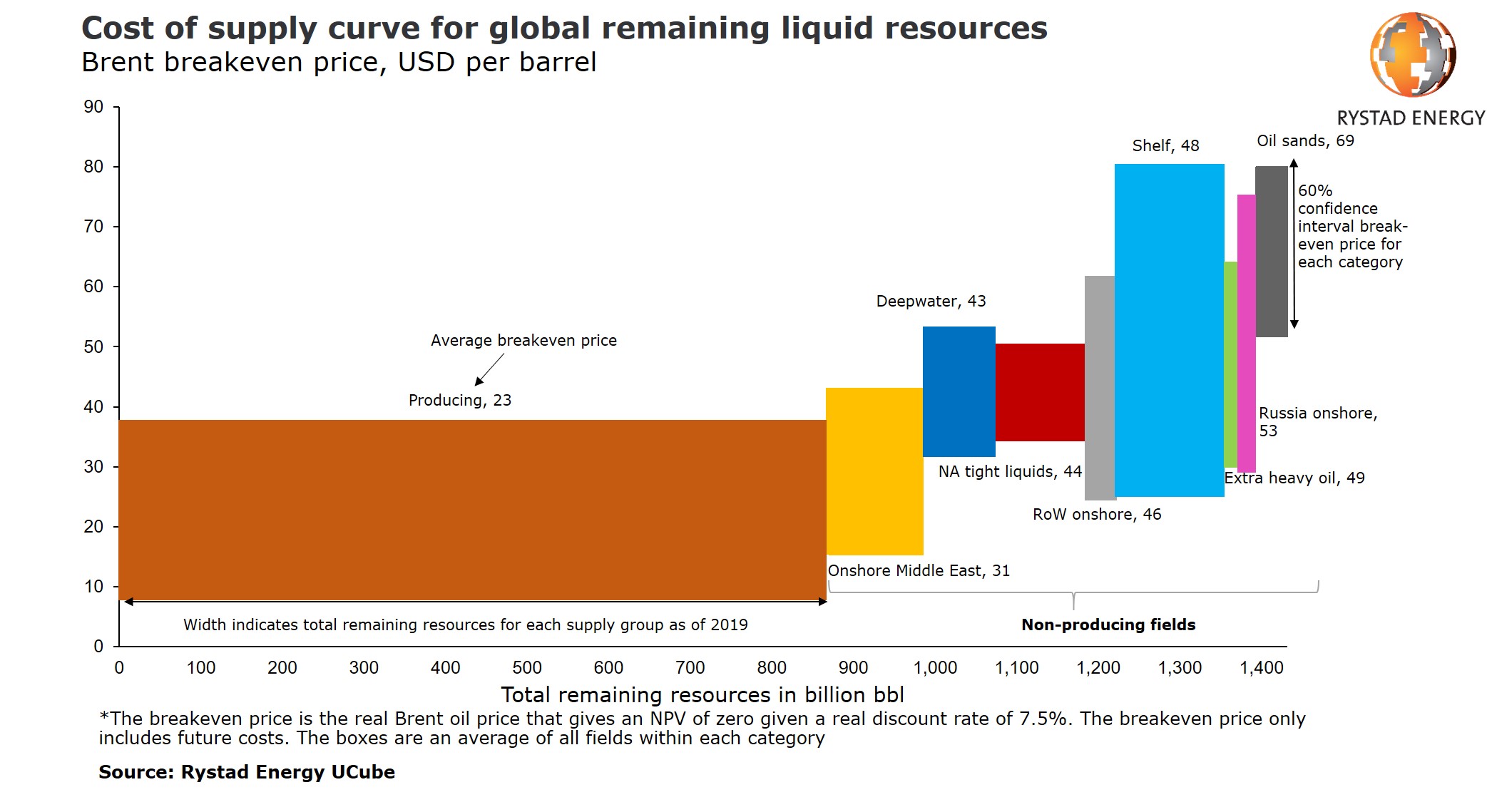

A comprehensive analysis by Norway-based Rystad Energy of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around $50 per barrel, down around 10% over the last two years, and 35% since 2014.

Rystad Energy said this means that oil is much cheaper to produce now compared to six years ago, with the clear cost savings winner being new offshore deepwater developments.

“Our cost of supply curve for liquids now reveals that the required oil price for producing 100 million barrels per day (bpd) in 2025 has been in continuous decline in recent years, with our updated projection showing that an oil price of only $50 per barrel is needed to keep oil production at this level,” Rystad Energy said.

In Guyana, where US oil major ExxonMobil has made 18 discoveries since 2015, OilNOW understands the Liza Phase 1 development has a breakeven of $45, Liza Phase 2 – $25 and Payara, the third offshore development – $32.

Rystad Energy said it had previously estimated in 2014 that the required oil price for producing 100 million barrels per day in 2025 was close to $90 per barrel globally, an estimate which it then revised in 2018 to around $55 per barrel.

The updated analysis also shows another key trend, Rystad Energy said. From 2014 to 2018, the cost of supply curve moved to the right. In 2014, the energy research and business intelligence company estimated that the total 2025 liquids potential was only 105 million bpd. In 2018, this number had increased considerably to around 115 million bpd. However, since 2018, it has revised down the potential to about 108 million bpd, moving the cost curve to the left.

“The implication of falling breakeven prices is that the upstream industry, over the last two years, has become more competitive than ever and is able to supply more volumes at a lower price. However, the average breakeven prices for most of the sources remain higher than the current oil price,” says Espen Erlingsen, Head of Upstream Research at Rystad Energy. “This is a clear indication that for upstream investments to rebound, oil prices must recover from their current values.”

When it comes to breakeven prices and potential liquids supply in 2025 for the main sources of new production, Rystad Energy data shows that from 2014 to 2018, tight oil and OPEC came out on top. Back in 2014, Rystad Energy estimated the average breakeven price for tight oil to be $82 per barrel and potential supply in 2025 at 12 million bpd.

Since then, the breakeven price has come down and the potential supply has increased for tight oil. In 2018, Rystad Energy estimated an average breakeven price of $47 per barrel and a potential supply of 22 million bpd. After 2018, the breakeven price for tight oil has continued to fall, reaching a current average of $44 per barrel. However, the potential of tight oil production has dropped from our 2018 estimate.

“Now we estimate that tight oil can potentially supply around 18 million bpd of liquids in 2025. This drop is due to the sharp reduction in tight oil production during the first half of this year. The lower activity this year, and a potentially slow recovery next year, will remove tight oil supply from the market,” Rystad Energy said.

Between 2014 and 2018, shelf and deepwater projects experienced a cost reduction of around 30%. However, the lack of new sanctioning during the same period reduced the offshore potential liquids supply for 2025. Since 2018, breakeven prices have been falling for offshore, with deepwater down 16% and shallow water down 10%, Rystad Energy pointed out.

This cost reduction puts average breakeven prices for deepwater just below those of tight oil. At the same time, the potential 2025 supply from offshore developments has not changed too much. Rystad Energy said this makes offshore a winner out of all the supply sources over the last two years when it comes to cost improvements and supply potential.