The COVID-19 pandemic and decline in oil prices are causing major economic disruptions to crude producers around the world forcing them to adjust their projected revenue inflows downward as lockdown measures continue to curtail demand.

Americas Market Intelligence (AMI) experts Dr Remi Piet and Arthur Deakin stated in an Op-Ed published in Caribbean News Global that no oil producer has been immune from the economic disruptions and new producer Guyana is no exception.

Initially, the government’s share of oil revenues was projected to reach US$10 billion a year by 2030, a colossal sum for a nation of merely 750,000 inhabitants. Now, the country’s forecasted 750,000 barrels per day (BPD) by 2025 is being pushed back to 2026. While Guyana will likely fare better than many other nations, most of its original projections have largely been thrown out the window, the AMI officials said.

Although estimates vary, global demand for oil is expected to have declined 29 percent in April and is projected to fall nine percent for the year they stated, pointed out that the price drop induced by COVID-19, but worsened by OPEC supply disagreements, have slashed Guyana’s oil revenue projections for 2020 by nearly half.

“The expected US$300 million in government revenues for 2020, now all the more vital for a nation battling COVID-19 with insufficient health care capacity, will likely fall to a range between US$160 and US$190 million if not further. Guyana’s oil projections were based on US$65 per barrel for Brent crude, a price that now stands at US$30.07,” Piet and Deakin pointed out.

If Brent crude prices remain low Guyana will receive much less revenue than anticipated from its remaining four million barrels of profit oil this year.

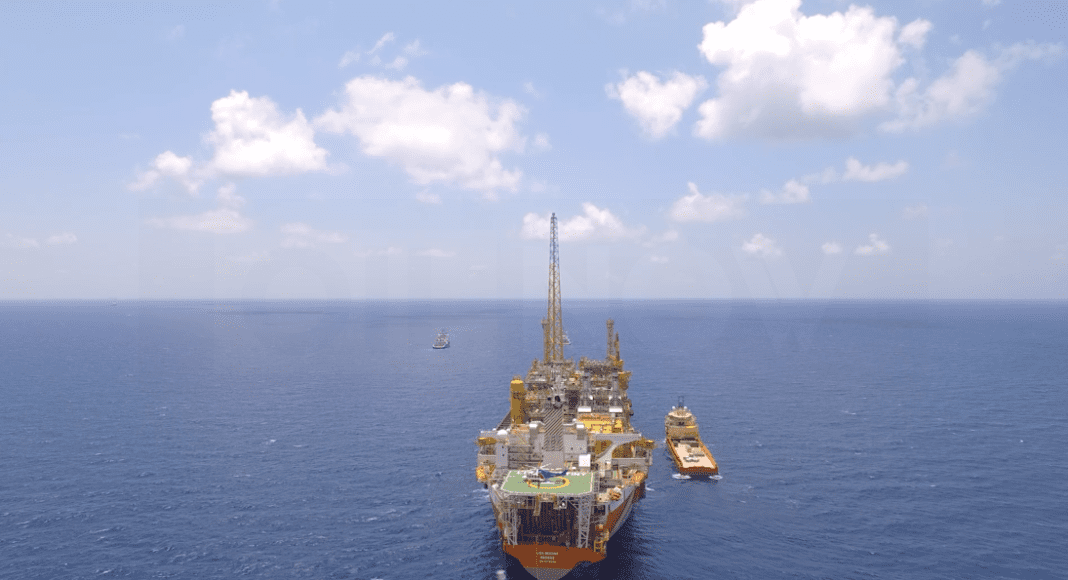

Nevertheless, the AMI officials said despite the downfall in prices, Guyana’s relatively low breakeven price and cheap production costs will ensure that the Stabroek consortium keeps pumping oil. “The current break-even price is US$35 per barrel, and the second phase of development, the Liza Unity, is projected to be even lower at US$25. When compared to the US shale breakeven price at US$48-52 a barrel, or Brazil’s Mero offshore field at US$50-60 a barrel, the continued exploration and production of oil will continue to make economic sense in Guyana.”

Piet and Deakin said the cost-benefit of Guyana’s operations is reflected by the $50 billion investment expected by major oil companies by 2030.

“Guyana will also benefit from the support and commitment of an experienced company such as ExxonMobil leading activities in its Stabroek Block. They have enough financial resources and trained personnel to weather the storm even as other industry players are battered by low prices and a slow recovery,” they said.

In May, the company announced that it will move ahead with its deep-water probes in the Kaieteur Block, 155 miles offshore. As many companies recoil their operations as cash flow is restricted, Exxon has pushed forward.

The AMI officials said the next administration in the South American country will have to cope with a smaller budget than originally expected and as such, there are several items it would have to consider as it prepares for an oil-based economy. Piet and Deakin list these as follows:

- First, Guyana needs to ensure that the local business community continues to be incorporated into the day-to-day oil economy. ExxonMobil has paid US$220 million to local contractors since 2015 and employed nearly 2,000 Guyanese citizens, a trend that should continue in order to promote Guyanese development and ensure local harmony with the new sector.

- Second, with the projected fall in revenues, the government must spend cautiously and focus on essential services such as hospitals, roads and education. The post-pandemic period will be an opportune moment to improve medical services for the general population.

- Third, Guyana should move forward with the diversification of its economy in sectors such as industrial regulated mining and agriculture, sparing the country from the infamous ‘resource curse’ present in several other countries.

Turning their attention to Guyana’s political crisis, the AMI officials said it is imperative that the country moves past this as soon as possible. “Moving past the current political impasse is critical—this means that the election recount should be conducted thoroughly and verified by accredited third parties. The US Department of State has warned that individuals that commit electoral fraud will ‘be subject to a variety of serious consequences’—a clear warning sign that nothing but honest results will be tolerated.”

Piet and Deakin said while the nation awaits the results, the government should move forward with the approval of previously vetted field development plans. “Doing so will shield Guyana from further reductions and delays to much-needed revenues. The government can do its part by keeping projects moving forward.”

However, at the heart of it all, is that a transparent and conclusive transition to the next administration is fundamental to ensure that Guyana’s offshore industry is managed responsibly in these turbulent times, the AMI officials said.

Dr Remi Piet is a Senior Director at Americas Market Intelligence (AMI) and leader of the firm’s Natural Resources and Infrastructure Practice.

Dr Remi Piet is a Senior Director at Americas Market Intelligence (AMI) and leader of the firm’s Natural Resources and Infrastructure Practice.

Arthur Deakin is an Analyst at Americas Market Intelligence where he conducts political, economic and other risk analysis activities for the mining, energy and infrastructure sectors in both Latin America and Africa.

Arthur Deakin is an Analyst at Americas Market Intelligence where he conducts political, economic and other risk analysis activities for the mining, energy and infrastructure sectors in both Latin America and Africa.