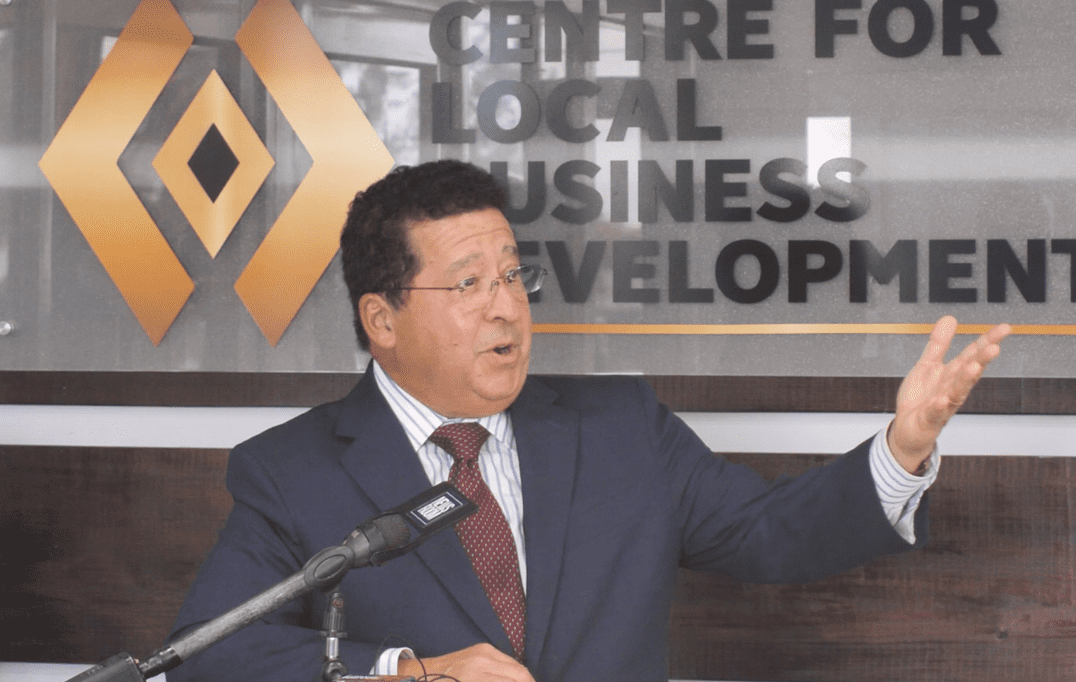

David Goldwyn, an energy expert with experience in the U.S. State Department and specialized work in extractive industry transparency, recently expressed high regard for the strategies Guyana has in place to manage its emerging oil wealth.

Speaking at a press meeting facilitated by the Centre for Local Business Development (CLBD), Goldwyn stated, “The top line strategies of the government are really all first rate. Create a natural resource fund, save for future generations, sequester some of those revenues. Second, diversify the economy, look at other areas that can create jobs… Regulatory reform, cutting red tape… all of those are really textbook cases of how you do resource management right.”

The country has established a natural resource fund (NRF) since 2019, which was later revamped at the end of 2021. Designed with a straightforward formula, the fund calculates the maximum allowable withdrawals each fiscal year, using as a basis the revenues that were received in the preceding year. The formula promotes annual savings, which are expected to increase as oil revenues rise. These revenues are derived from a financial arrangement in the Stabroek block production sharing agreement between Guyana and an ExxonMobil-led group. The agreement allows Guyana entitlement to approximately 14.5% of the value of oil production in the form of profit oil and royalties, in the early days. This is expected to increase after the investors expenses’ have been substantially recouped. The government has been spending some of its funds primarily on infrastructure development and enhancing social services.

Goldwyn also underscored the importance of a low carbon development strategy. “Just because you produce oil and gas, doesn’t mean you want to consume oil and gas,” he remarked. The Guyana government is in the developing stages, alongside oil companies, of a Gas-to-Energy project expected to be operational between 2024 and 2025. Natural gas is intended to be a transitional fuel that will allow the country’s economy to grow while simultaneously reducing its greenhouse gas emissions. This is expected to create a conducive business environment for the introduction of cleaner energy options, including solar, hydro, and wind power.

“Regulatory reform, cutting red tape, that’s really important because the cost of doing business is the main thing an investor looks at,” Goldwyn pointed out. In line with this, the Guyana government has an agenda to reform regulations aimed at making the nation’s business environment increasingly welcoming to investment. The Gas-to-Energy project is expected to help this cause, by slashing electricity rates. Beyond this, the government is keen on diversifying the economy to mitigate the risks associated with being overly dependent on oil revenues.

While Guyana has shown remarkable economic growth, challenges persist in raising the living standards of its populace. There are concerns about the rising cost of living, partly fueled by the expanding oil sector. Questions are also raised about the equitable distribution of the newfound wealth. The government acknowledges these challenges and has said it is implementing measures to temper the rising consumer costs.

Goldwyn acknowledged that “implementation is really hard,” stressing the need for the government to invest in capacity building and effective regulation as it navigates the complexities of resource wealth. Nonetheless, based on its management strategies, Goldwyn believes Guyana has “tremendous reasons for hope.”