Exxon Mobil Corporation announced on Friday an estimated first quarter 2020 loss of $610 million, or $0.14 per share assuming dilution, compared with earnings of $2.4 billion a year earlier. Results included a $2.9 billion charge from identified items, or $0.67 per share assuming dilution, reflecting noncash inventory valuation impacts from lower commodity prices and asset impairments. Cash flow from operating activities was $6.3 billion. Capital and exploration expenditures were $7.1 billion.

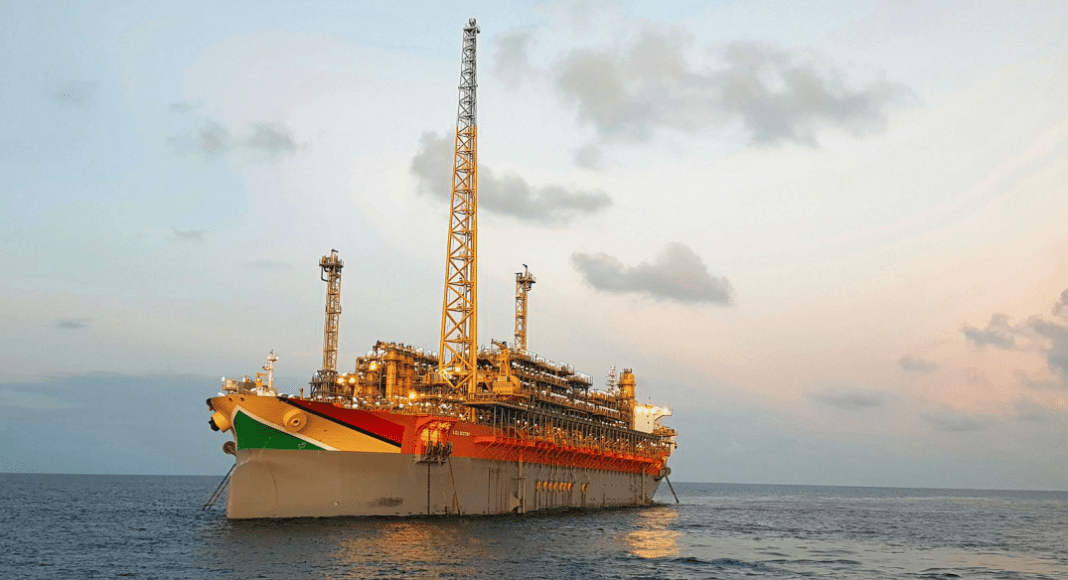

The company said oil-equivalent production was 4 million barrels per day, up 2 percent from the first quarter of 2019, with a 7 percent increase in liquids partly offset by a 5 percent decrease in gas. Excluding entitlement effects and divestments, oil-equivalent production was up 5 percent from the prior year, with Upstream liquids production up 9 percent on growth in the Permian and Guyana.

In response to market conditions, ExxonMobil announced that it is reducing 2020 capital spending by 30 percent and cash operating expenses by 15 percent. Capex is now expected to be approximately $23 billion for the year, down from the previously announced guidance of $33 billion.

“COVID-19 has significantly impacted near-term demand, resulting in oversupplied markets and unprecedented pressure on commodity prices and margins,” said Darren W. Woods, chairman and chief executive officer. “While we manage through these challenging times, we are not losing sight of the long-term fundamentals that drive our business. Economic activity will return, and populations and standards of living will increase, which will in turn drive demand for our products and a recovery of the industry.”

ExxonMobil’s capital allocation priorities remain unchanged. The company’s objective is to continue investing in industry-advantaged projects to create value, preserve cash for the dividend, and make appropriate use of its balance sheet.

“Our company remains strong and we will manage through the current market downturn as we have for decades,” said Woods. “Today’s circumstances are certainly unique, but our people have the experience, our business has the scale, and we have the financial strength to see us through and emerge stronger than ever.”

To minimize risks presented by COVID-19 and maintain operations, ExxonMobil has implemented enhanced cleaning procedures and modified work practices at sites around the world.

The company is maximizing production of products critical to the global response, including isopropyl alcohol, which is used to manufacture hand sanitizer, and polypropylene, which is used to make protective masks, gowns and wipes. Manufacturing operations in Louisiana have been reconfigured to produce medical-grade hand sanitizer for donation to COVID-19 response efforts in Louisiana, New Jersey, New Mexico, New York, Pennsylvania and Texas. ExxonMobil is assisting in community-level relief efforts around the world with donations to support food banks and provide fuel, meals, and masks for health care workers and first responders. In addition, ExxonMobil is supporting efforts to redesign and accelerate production of reusable face masks and shields to help alleviate the shortage for medical workers and first responders.

Exxon said total production volumes were essentially unchanged from the fourth quarter. Excluding entitlement effects and divestments, both liquids and gas volumes increased 5 percent on growth and lower scheduled maintenance.

The company said production in Guyana at the Liza Phase 1 development continues to ramp up, while the first oil shipment was successfully processed at the company’s refinery in Baytown, Texas. Permian production grew 20 percent from the fourth quarter and was up 56 percent from the first quarter of 2019.