Prominent attorney, politician, and former Speaker of the National Assembly, Ralph Ramkarran, wrote in a recent column about Guyana’s strong debt position, noting that the country is among the top 10% of countries with the least debt. This distinction comes amidst ongoing commentary in the local press about the government’s decision to raise the country’s debt borrowing capacity.

The government has proposed a GY$1.146 trillion (US$5.5 billion) national budget, to be constituted 40% by loans. For this to be facilitated, the government needs to increase Guyana’s legal ceilings on domestic and external debt by a collective GY$1.35 trillion (approximately US$6.47 billion).

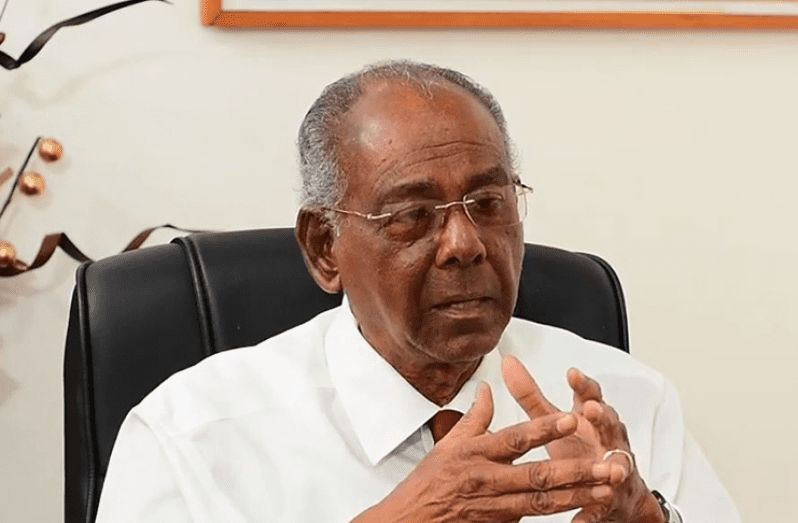

In defense of the decision, Ramkarran stated, “Of 236 countries and territories assessed by the International Monetary Fund, only 27, which included Guyana, had a debt to [gross domestic product] GDP ratio of less than 30%.”

This position, the lawyer noted, is due to Guyana’s economic growth, largely fueled by its growing oil production.

Guyana oil production peaked at 589,000 b/d in December 2023 | OilNOW

The decline in Guyana’s debt-to-GDP ratio is particularly noteworthy. Ramkarran states, “The ratio of debt to GDP had declined from 38.9% at the end of 2021 to 24.6% at the end of 2022.”

Ramkarran recalled the impact of the Economic Recovery Programme initiated by Guyana in the late 1980s when it faced challenging economic conditions—this period marked a turning point, leading to considerable debt relief and setting the stage for sustained economic improvement. The recent decline in the debt-to-GDP ratio continues this positive trend, thanks to oil.

Vice President Bharrat Jagdeo and Senior Minister within the Office of the President with responsibility for Finance and the Public Service Dr. Ashni Singh have reassured the public, in recent weeks, of the nation’s strong debt sustainability. Jagdeo explained that the increases in the domestic and external debt ceilings are to facilitate infrastructure projects, including the Gas-to-Energy project.

Guyana has almost no debt, generating Asian levels investment – AMI | OilNOW

Ramkarran’s view aligns with the government’s, as he argued that Guyana’s current low debt level relative to its GDP provides a solid foundation for responsible borrowing.

“Emerging from a past with a colonial economy that had been further devastated in the immediate post-independence period, no one, except the uninformed, should have an issue with the investment of all of our [Natural Resource Fund] and borrow as much as 40% of GDP to resolve Guyana’s problems and build a strong, thriving, economy,” Ramkarran said.

Jagdeo has assured that, “Even with us raising the debt ceiling, it doesn’t mean that we are going to actually borrow that sum to the level of the ceiling.”

The Vice President has also explained that the government’s increased spending will only be sustained for a time and that there will be a decrease in spending after major capital investments are made. He also argued that with increases in oil production, Guyana’s oil windfall will grow, providing the government with greater capacity to service its debts.