For the first time, a cargo of Guyana’s crude traded through the Platts Market-on-Close (MOC) assessment process, S&P Global Commodity Insights said in a Feb. 16. piece by analyst Patrick Harrington.

This comes “exactly three years” after Platts started assessing crude from Guyana’s Stabroek block, operated by ExxonMobil.

The Platts Market-on-Close (MOC) process by S&P Global Platts sets prices for commodities like crude oil based on the idea that the most accurate prices come at the end of the trading day. In this system, MOC orders are set to activate only as the market is closing. These orders stay inactive throughout the day and spring into action near the end, to trade at the latest prices. This ensures the final prices reflect the day’s most relevant information, as transactions made at the close are considered the best indicator of a commodity’s true value. Essentially, the MOC process captures the last and most informed pricing moment of the trading session.

S&P Global said the trade occurred after Totsa – the trading arm of TotalEnergies – marked interest in a one-million-barrel cargo of Liza crude offered by Exxon “at a discount of US$1.60 per barrel to Dated Brent.”

From 0 to 400,000 barrels a day, Guyana “exploded” onto oil scene – S&P Global Analyst | OilNOW

“Both counterparties confirmed the trade and the cargo is set to load March 18-19 from the Liza Unity FPSO [floating, production storage and offloading vessel] offshore Guyana,” Harrington wrote.

“Platts assessed Liza at minus US$1.60 per barrel to the 30-60 day forward Dated Brent strip, at the traded level, a US$0.60 cents per barrel decline on the day. Payara Gold was also assessed lower by US$0.60 per barrel to minus US$1.60 per barrel, with Unity Gold assessed at minus US$1.45/b,” Harrington explained.

S&P Global trading sources said in recent days, that while offer levels for Guyana’s crude have jumped, they have remained under pressure as production ramps up and uncertainty mounts over global crude flows.

Heavier Payara crude may be pricier than Liza’s due to Europe’s preference – S&P | OilNOW

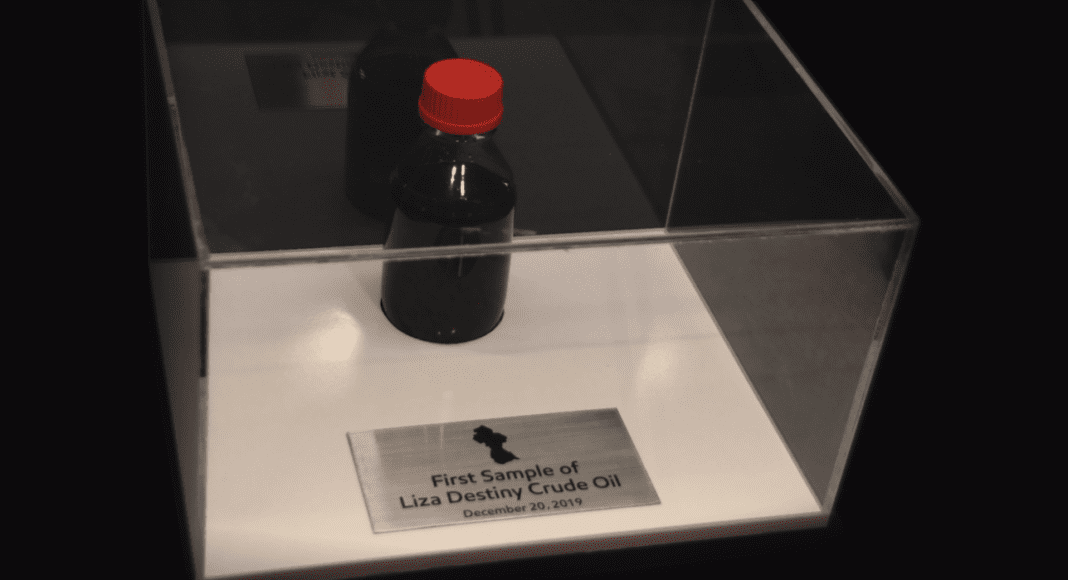

The Liza MOC trade comes after Platts announced on Nov. 3 that it would consider information from Exxon’s Sales and Supply, LLC in the Platts MOC for the Americas, specifically in the physical Latin America and Caribbean crude cargoes market. Since then, Exxon has offered all three of the Guyanese crude grades currently in production through the Platts MOC — Liza, Unity Gold, and Payara Gold. Platts first launched its Liza crude assessment on Feb. 16, 2021, after first oil in December 2019. Platts followed with assessments of Unity Gold on Aug. 1, 2023, and of Payara Gold, on Dec. 1, 2023.

With Payara producing, S&P said Guyana has already become one of Latin America’s largest producers. It reached its production target just two months after start-up in November. Currently, total production offshore Guyana, including the Liza projects, has surpassed 600,000 barrels per day.