Americas Market Intelligence (AMI) has ranked Guyana #1 in its Latin America 2023 Outlook: The Good, The Bad and The Ugly. Guyana’s neighbours Venezuela and Trinidad and Tobago scored so low that they were categorised among The Ugly.

Among the region’s 20 largest economies, Guyana is not only first place, but its score is nearly three times that of the second ranked country, Chile. The Good, Bad, Ugly Score incorporates quantitative assessments of growth opportunities, debt challenges and investor risks found in each market, giving investors a useful benchmark for their planning.

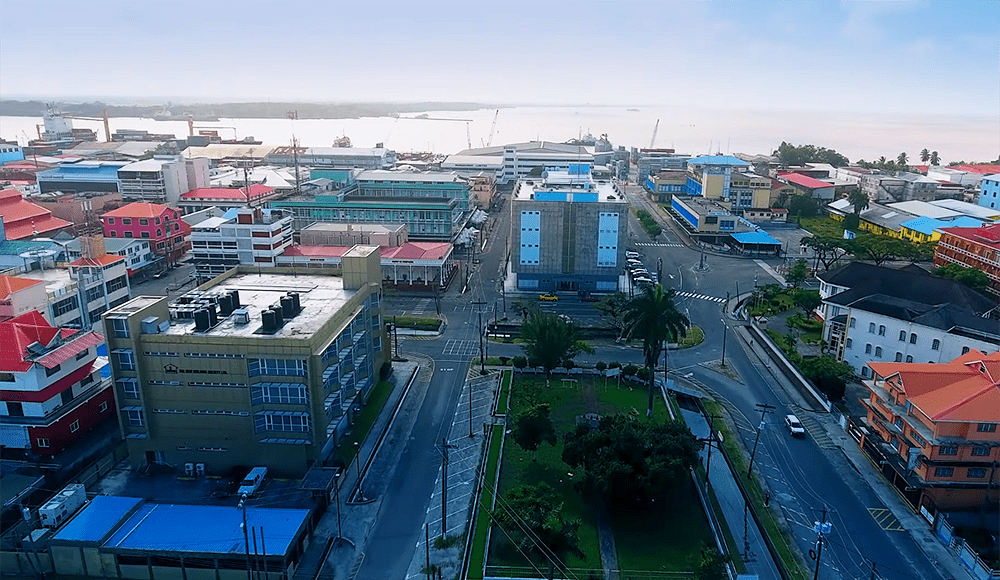

“Guyana stands head and shoulders above its peers,” AMI Managing Director, John Price said. “The little country that struck oil is the fastest-growing economy in the world and will expand close to 50% over the next two years.”

Price referred to Guyana’s low debt levels and described its levels of investment as ‘Asian.’ Guyana’s debt-to-GDP ratio has fallen significantly, since the growth of its economy, thanks to oil. Investors have also flocked to the country because of the opportunities in the oil and gas sector, but there is a lot of investment in other sectors too.

However, the analyst said Guyana is dominated by a tiny cabal of business and political leaders where the rules of engagement can be opaque. In this regard, Guyana’s ‘Transparency International’ score was the only Bad rating it got from AMI. Guyana ranked #85 out of 180 countries in the Transparency International Corruption Perceptions Index 2022 report, released in January. Its ranking was based on a score of 40 up from 39 in the previous report. On the scale, a score of 100 his very clean, and zero is highly corrupt.

Price noted that successful foreign ventures in Guyana require the right local partner and robust government relations with both dominant political parties.

With Guyana’s local content drive, a new law requires foreign investors to cede 51% of a joint venture company to Guyanese owner(s) to benefit from preference in procurement awards in the oil and gas sector. The government encourages joint ventures outside of the oil sector too.

The countries scoring high enough to be categorised as The Good ones are Chile, Costa Rica, Dominican Republic, Guatemala, Panama and Jamaica. Those named The Bad are Peru, Colombia, Mexico and Brazil.

Guyana retained its #1 ranking from AMI’s 2022 report, but the analyst used different metrics mostly linked to the energy sector, due to the circumstances of the time.