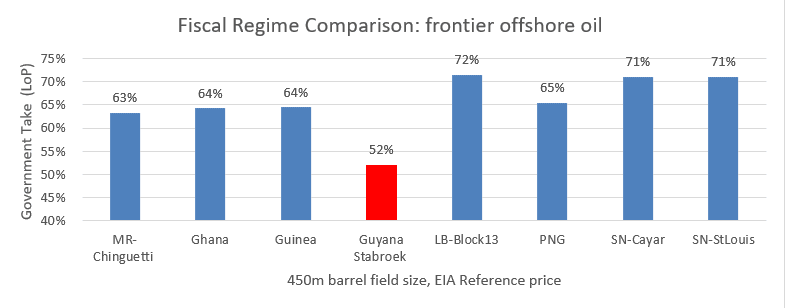

Guyana’s first and major oil deal, with ExxonMobil, produces results for the government which are outlier low, a financial model reveals. Over the life of the project the government should expect to see from 52% to 54% of profits, compared to well over 60% in a cluster of comparable projects signed in other frontier countries.

The gap could cost the small South American country billions of dollars, as successful drilling continues apace in the Stabroek Block, and recoverable reserves figures climb into the billions of barrels.

The relatively low performance of the Stabroek terms, first signed in 1999 and amended in 2016, following the first significant discovery the previous year, holds under a wide variety of market and field size conditions.

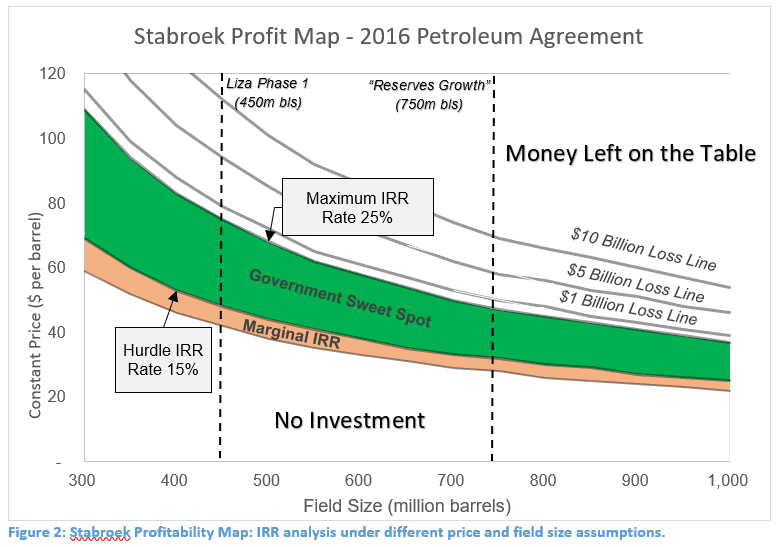

There is also a significant possibility, as reserves growth gathers pace, that ExxonMobil and its partners Hess and Nexen could achieve “super profits”, rates of return of over 25% and edging considerably higher under certain conditions, as this profit map of the project shows.

The agreement has become controversial in Guyana in the past year and the contract was published by the government at the end of 2017 to allow public scrutiny. The financial model and this accompanying narrative are based on that contract, as well as public statements and media reports giving details of reserves, development lead time and costs.

Former Chief Executive Officer of the Guyana Oil and Gas Association (GOGA), Bobby Gossai Jr., told OilNOW even under conservative assumptions, Stabroek will transform Guyana. Government revenues, he said, could hit a billion dollars a year by 2024 – more than the entire current government budget.

Mr. Gossai Jr. who holds a Master’s Degree in Economics from the University of the West Indies, is currently pursuing a Master’s Degree in the field of Petroleum, Energy Economics and Finance at the University of Aberdeen, Scotland, United Kingdom.

“The 52% Average Effective Tax Rate (also known as “the government take”) is lower than a general rule of thumb of 60% to 80% government take in oil projects, and also from a range of frontier projects in Ghana, Senegal, Papua New Guinea, Mauritania and Guinea, which were comparable at the time of signature,” he said.

What is significant in the analysis he told OilNOW, is to understand the role reserves growth scenarios could play in increasing company rates of return. “At the currently stated field size of 450 million barrels in Stabroek, for example, the company does not reach “super profits”, defined here as an Internal Rate of Return (IRR) of 25% or more, until a price point of $75 per barrel for oil,” he pointed out.

But this field size relates only to the first stage of development of the field now underway, with first oil anticipated for 2020. A second phase is now under active consideration by the companies, with a projected production plateau which could be twice as high as in the first phase. If the amount of oil produced rose only modestly, compared to Exxon’s declared reserves, to 750 million barrels, the super profit level (25% IRR) could be reached at $50 per barrel – below today’s prices. At a billion barrels, that stage could be reached with prices in the $40s per barrel.