(S&P Global Platts) The global economy bounced back from the worst of pandemic lockdowns faster than expected in the second quarter, but a second wave of COVID-19 infections could still derail the strong recovery so far, the International Energy Agency said July 10.

In its latest monthly oil market report, the Paris-based agency raised its estimate for global oil demand by 400,000 b/d this year, estimating the demand collapse during the peak of lockdowns in Q2 was less severe than expected at 16.4 million b/d. Last month, the IEA had estimated a Q2 demand hit of almost 18 million b/d.

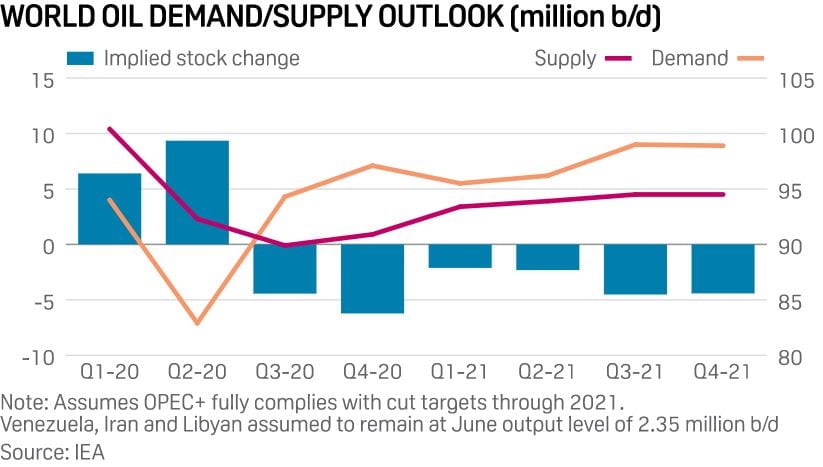

Global oil demand in 2020 is now forecast to average 92.1 million b/d, down 7.9 million b/d over 2019, the IEA said.

With lockdowns lifting, demand rebounded strongly in China and India in May, increasing by 700,000 b/d and 1.1 million b/d on the month, respectively, the IEA said. Indian oil deliveries also surprised to the upside in June, the IEA said citing provisional data. Next year, demand is now forecast to grow by 5.3 million b/d to 97.4 million b/d, unchanged from the IEA’s previous report.

But the energy market watchdog cautioned that the outlook is overshadowed by the potential for a return to lockdowns due to second wave COVID-19 infections globally.

“While the oil market has undoubtedly made progress since ‘Black April,’ the large, and in some countries, accelerating number of COVID-19 cases is a disturbing reminder that the pandemic is not under control and the risk to our market outlook is almost certainly to the downside,” the IEA said.

In the US, the IEA noted that — after plateauing around 20,000 in the first half of June — the number of new COVID-19 cases accelerated “spectacularly” to more than 50,000 in early July. As a result, the data is showing mobility and gasoline demand is slipping back in the worst-hit states of Texas, Arizona, California, and Florida.

Largely reflecting the threat to US demand, the IEA lowered its third-quarter demand forecast by 630,000 b/d to 94.3 million b/d, which is 6.5 million b/d below the year-ago levels. IEA also revised down the Q3 demand forecasts for Brazil, Russia and Saudi Arabia, among other countries.

S&P Global Platts Analytics currently estimates that global oil demand will shrink by 8.3 million b/d this year to average 94.2 million b/d before recovering to 101.2 million b/d in 2021.