By Steven Jasmin – OilNOW

Over the past 4 years Guyana has worked hard to iterate and develop a local content strategy and policy that strikes the balance of helping and protecting the Guyanese population, while simultaneously encouraging growth.

As it is currently envisaged Guyana’s local content policy (LCP) is almost entirely focused on everything related to the Oil and Gas infrastructure from Upstream to Downstream production and the services needed to successfully explore and develop the country’s world class oil finds.

Some of the major concerns I repeatedly hear center around the human capital and capacity building that needs to occur to support such policies and ensure that they are successful.

Long term, I am of the view that Guyana needs to not only focus on the Oil and Gas industry but look to the Oil and Gas industry to help create an entire eco system of highly trained Guyanese who can help develop and lead not just the nation over the next 100 years, but rather the entire hemisphere. One only has to look at the U.A.E. and how it quickly diversified its economy to become the de-facto center of business for the entire GCC region. With a mix of progressive legislation and a focus on the development of non-petrol-based business sectors it successfully diversified itself and quickly became a global leader.

The reality is that the Guyana everyone is fighting over today will still be here long after we are all gone, and the only thing will remain are the impacts of the decisions that were made in its formative years. Fortunately, along with Guyana’s world class oil find, the country does not have mountains of existing debt and legacy infrastructure that it has to maintain. This means, that the country should be able to take a longer-term focus and realize that they are uniquely positioned to become the de-facto leader of Central America, South America, and the Caribbean.

With Guyana having the only positive Real GDP Growth in the hemisphere during 2020 despite Covid-19 and a disputed election, the fact that it has more oil wealth per-capita than any other nation on earth, and the fact that a major growth and leadership vacuum currently exists in the region, I believe Guyana will not only be facing internal challenges, but we will see unprecedented levels of immigration over the next 20 years as everyone seeks to leave their struggling countries and declining economies to participate in the opportunities that will come as a result of Guyana’s oil growth.

How will population growth impact Guyana’s LCP?

With a border spanning 3 countries and 1800 miles, I believe the Government of Guyana will struggle to enforce immigration rules and laws and thus needs to be proactive in assuming that it is going to happen regardless of the wishes of the Guyanese Government and people.

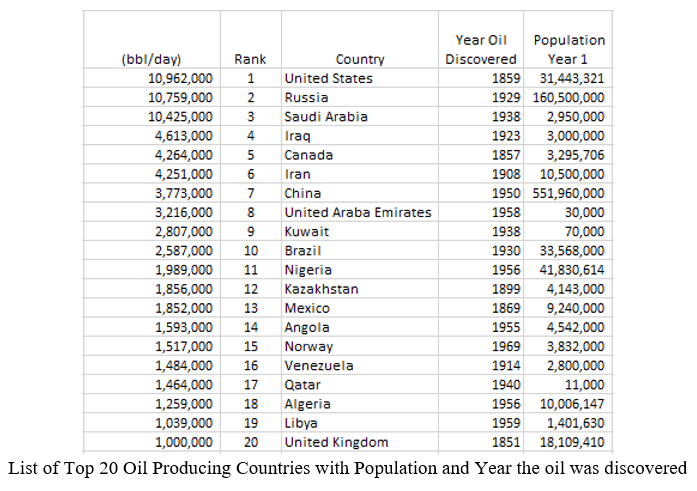

One of the areas that I feel is not being properly addressed and considered is the role immigration will play in the local content equation. To help illustrate this point, the team at Sc3 performed some simple analysis. First, we identified the top 20 countries that are actively producing oil today and what their population was the year that they found oil:

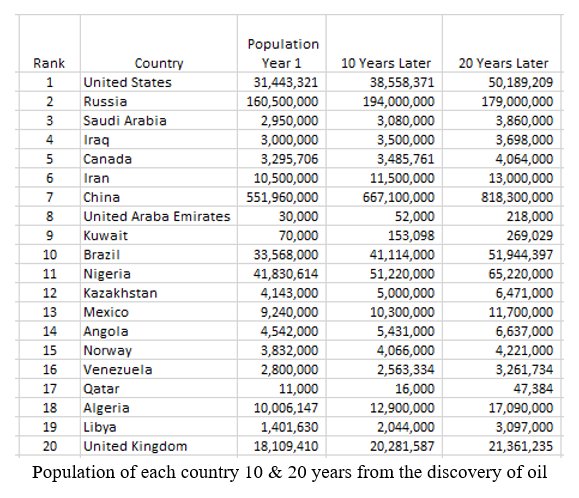

We then went through and identified their estimated populations 10 years from the year they first found oil and then 20 years from the year that they found oil.

We then went through and identified their estimated populations 10 years from the year they first found oil and then 20 years from the year that they found oil.

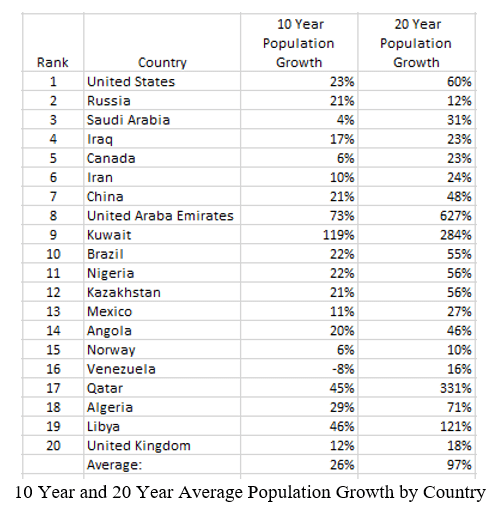

We then went through and identified the population growth as a percentage of its year 1 population after 10 years and 20 years:

We then went through and identified the population growth as a percentage of its year 1 population after 10 years and 20 years:

The interesting thing to realize is that on average after 10 years, each of the top 20 oil producing nations had an average population increase of 26% and over 20 years the average increased by almost 100%. One has to assume Guyana will invariably follow a similar path.

The interesting thing to realize is that on average after 10 years, each of the top 20 oil producing nations had an average population increase of 26% and over 20 years the average increased by almost 100%. One has to assume Guyana will invariably follow a similar path.

When looking at the data, two questions emerged – One, how can you compare a country’s growth 200 years ago to a country today? Two, what was the change in population for countries similar in total population to Guyana?

To look at both questions we decided to study a subset of the data set relative to the two questions that we identified. We believed by reducing the cohort from 20 to 5 we would be able to make predictions that may be more relevant to the trajectory that Guyana’s population growth will take.

The five Countries with the most recent oil finds are: Nigeria (1956), Algeria (1956), U.A.E. (1958), Libya (1959), and Norway (1969). When studying this cohort, the 10-year average shifted upward and became 35% and the 20 Year average is 177%. Why would there be such an upward shift? We would expect it has to do with the advance of technology and the ease of movement and trade as over the past 70 years commercial air travel has made it much easier to migrate. We also believe that as technology has evolved, the windows for countries to reach first oil and ramp up productions have shifted closer to the date of first oil allowing economic progress to rapidly alter the growth trajectory of the country’s population.

To address the second question, the five countries whose populations were closest to Guyana are: Qatar (11,000), U.A.E. (30,000), Kuwait (70,000), Libya (1,401,630), and Guyana’s neighbor, Venezuela (2,800,000). When analyzing this cohort, the 10-year average became 55% and the 20-year average became 276%. With smaller populations, obviously growth rates will be much higher as a percentage of growth. With that said, this mean that the 10-year population growth average is over twice the average of the 20 largest oil producing nations and over a 20-year period it is nearly triple.

What does this mean for Guyana?

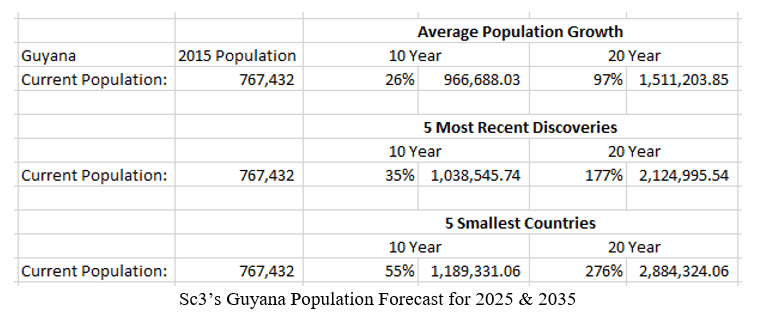

Assuming Guyana’s population in 2015 was 767,432 we extrapolated the following forecasts:

It is important to note that the growth we studied was the aggregate growth of the country and we were not able to differentiate between organic growth, immigration, and re-immigration by the diaspora. The breakdown of which will have an impact on any Local Content Policy.

We will also be the first to admit that Guyana’s growth will be determined by a number of internal and external factors including Covid-19 which may play a critical role in determining the future population growth rate of the country. With that said, how this growth will impact Guyana’s Local Content Policy, needs to be taken into consideration and added to the various models that are being used and incorporated into the discussions that are ongoing.

About the Author

Steven Jasmin is Global Chairman and Managing Director of Smart City Clearing Company Ltd(Sc3).

Steven Jasmin is Global Chairman and Managing Director of Smart City Clearing Company Ltd(Sc3).

Sc3 was founded in 2015 and opened up its Guyana office in June of 2017. It operates as an internationally based Frontier Market Merchant Bank and Asset Management firm working with institutional investors, family offices, the Global 2000 and High Net Worth individuals looking to invest and participate in the world’s fastest growing economy – Guyana, South America.

Sc3 has developed and is actively managing a portfolio of companies, joint ventures, and investment grade opportunities across all sectors of the Alternative Investment asset class. The firm is focused on helping accelerate the development of Guyana while simultaneously providing superior investment returns for both the firm and its partners.

Sc3 also provides a full suite of capital markets advisory services for organizations seeking to work in Guyana South America. Sc3 is your trusted, internationally experienced, boots on the ground asset manager. For more information please contact: [email protected].