The largest oil and gas companies in the world, including US oil major ExxonMobil, are revising their long-term oil price and demand outlook, and looking to streamline their portfolios to improve cash flow, cost efficiency and competitiveness.

Norway-based Rystad Energy said because of this development, billions of dollars in assets are about to change hands.

A study by the energy research and business intelligence company of the geographical spread of ExxonMobil, BP, Shell, Total, Eni, Chevron, ConocoPhillips and Equinor (Majors+) reveals that to adjust to the energy transition, the eight companies may need to divest combined resources. This could be to the tune of up to 68 billion barrels of oil equivalent, with an estimated value of $111 billion and spending commitments in 2021 totaling $20 billion.

“Our key criteria for determining whether a Major+ would benefit from staying in a country are the company’s cash flow over the next five years, the potential growth in its current portfolio, and its presence in key E&P growth countries towards 2030,” Rystad Energy said. “Based on this we see that the Majors+ may seek to exit 203 country positions and as a result reduce their number of country positions from 293 to 90.”

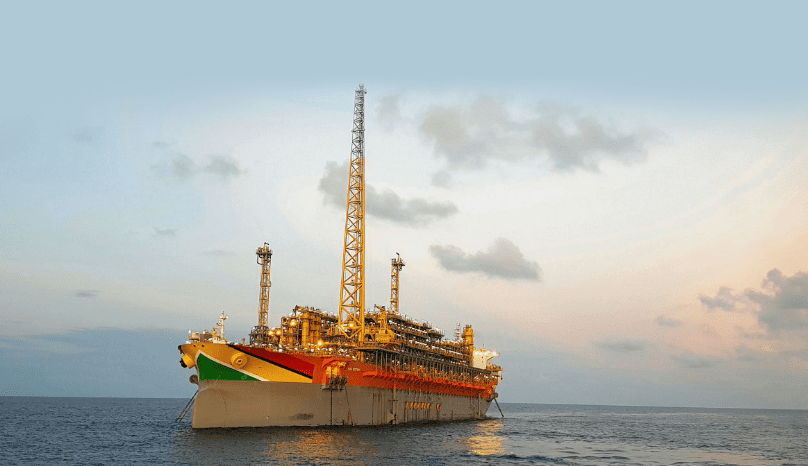

ExxonMobil’s operations in Guyana have so far resulted in 18 discoveries covering more than 8 billion barrels of oil equivalent resources with multiple targets remaining at the prolific Stabroek Block. The company has also began exploring for hydrocarbon resources at the Kaieteur Block and another well is expected to be drilled at Canje in the coming months.

“Companies will look to expand in the prioritized countries through exploration, acquisitions or asset swaps with other Major+ players,” Rystad Energy said. “However, to stay in a country that our criteria exclude, a company may instead seek to grow its local business more aggressively to make sure the portfolio will have a positive and more significant impact on overall performance.”

Rystad Energy said based on its criteria, it sees that the Majors+ altogether need to exit 203 country positions in 60 countries. The remaining countries after the screening vary from six to 16 countries per company.

The study shows that all the Majors+ companies are likely to keep a presence in the US, and most of them may also remain in Australia and Canada.

“On the other end of the scale we see quite a few countries with only one oil major present, including Argentina (BP), Ghana (Eni), Thailand (Chevron) and Guyana (ExxonMobil),’ Rystad Energy said. “In some of these countries it could be tempting for others to stay or increase their presence as the competition may be more limited.”

Rystad Energy said at the same time, these countries could also be growth targets for other companies, in addition to the Majors+.