Noble Corporation said, in its first quarter earnings release, that new contracts since its prior-quarter update totaled US$215 million (including mobilization payments).

These include:

- Noble Venturer was awarded a three-well contract for an estimated 150 days with Trident Energy in Equatorial Guinea expected to commence in June 2024. Additionally, the Noble Venturer was awarded two wells, plus options, with Rhino Resources in Namibia at a dayrate of US$410,000, excluding additional fees for managed pressure drilling (MPD) services, mobilization, and demobilization fees. These new contracts are scheduled to follow in direct continuation of the rig’s current contract with Tullow which Noble expects will conclude early due in part to drilling efficiency outperformance.

- Noble Viking was awarded three wells (plus one well option) with Prime Energy in the Philippines at a dayrate of US$499,000, excluding additional fees for MPD services, mobilization, and demobilization fees.

- Noble Voyager was awarded a one-well option exercised by Petronas in Suriname for a minimum term of 60 days at a dayrate of US$470,000.

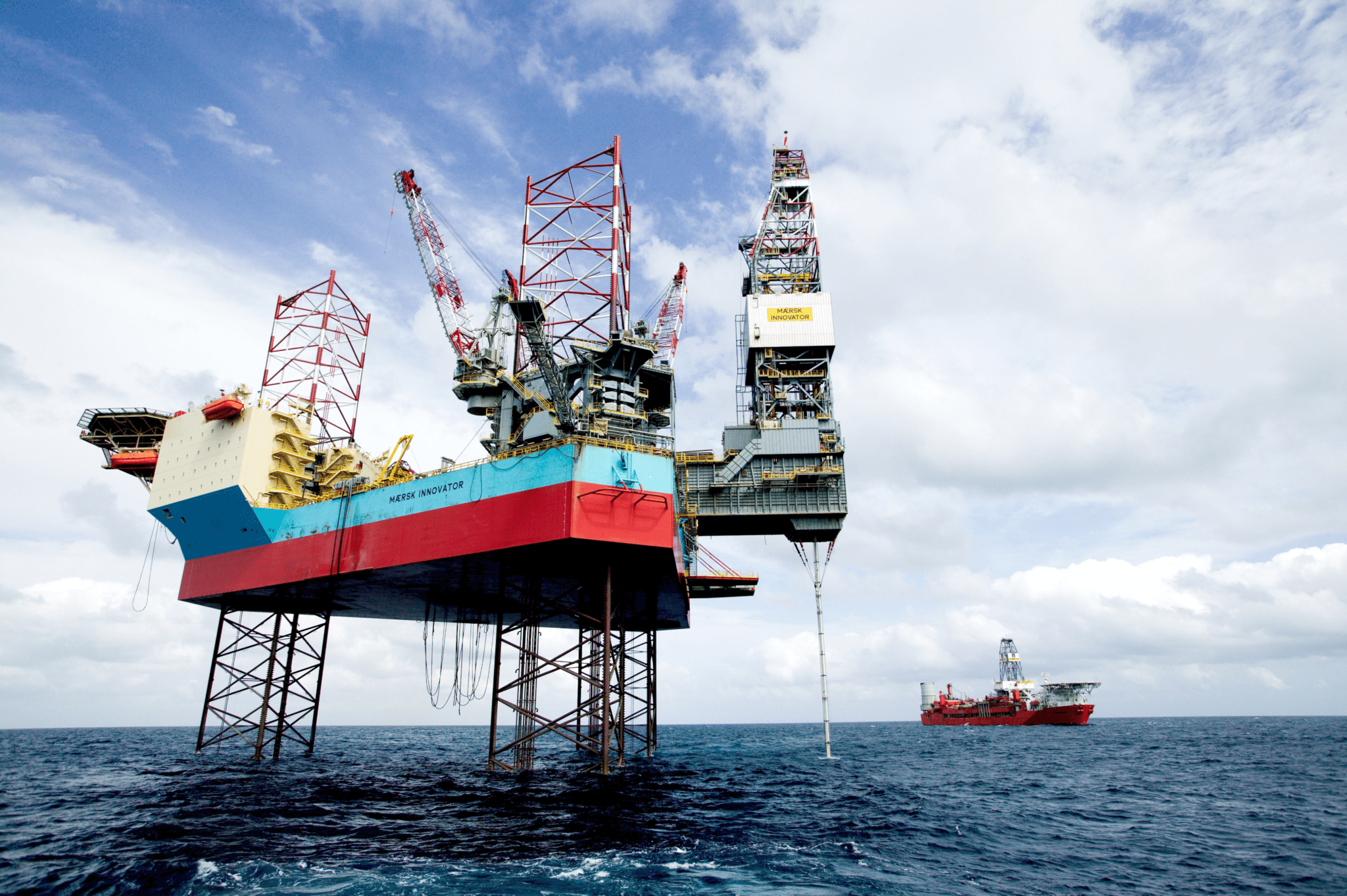

- Noble Innovator was awarded a one-well extension with BP in the UK at a dayrate of US$145,000. Two well-based options remain under the contract.

Guyana is leading contributor to Noble’s 2023 revenue surge | OilNOW

Noble’s marketed fleet of sixteen floaters was 76% contracted through the first quarter, compared with 75% in the prior quarter. It said industry utilization has stabilized over the past year, with mid-90% contracted utilization of the marketed fleet of ultra-deepwater floaters. Noble said leading edge dayrates for tier-1 drillships are now approaching or eclipsing US$500,000 per day, with discounts applicable for longer term duration fixtures as well as for lower specification sixth generation floaters. Within the latter category, Noble’s two Globetrotter drillships and the Noble Developer continue to have limited backlog presently and are being actively marketed for 2024 and 2025 opportunities.

Utilization of Noble’s thirteen marketed jackups improved to 67% in the first quarter, up from 61% utilization during the prior quarter. While the international jackup market is presently digesting a release of several rigs from the Middle East, Noble said this dynamic has not impacted the North Sea and Norway markets where its jackup fleet in primarily concentrated. Leading edge harsh environment jackup dayrates are in the mid US$200,000s per day in Norway and US$130,000 to $150,000 per day in other North Sea, the driller said.

Noble Venturer booked all year for campaigns in Africa hotspots | OilNOW

Noble reported net income of US$95 million in the first quarter of 2024, diluted earnings per share of $0.66, Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of US$183 million, and cash provided by operating activities of US$129 million.

Robert W. Eifler, President and Chief Executive Officer of Noble Corporation, stated, “Our first quarter results reflect continued strong operational performance in a rising market, resulting in a 32% improvement in Adjusted EBITDA compared to a year ago. Following the short-term slow down in deepwater contracting activity during late 2023, first quarter contracting momentum for 7G rigs has been back on trend for this up-cycle, with a significant pipeline of contracts due to come to market this year for 2025 and 2026 project commencements.”