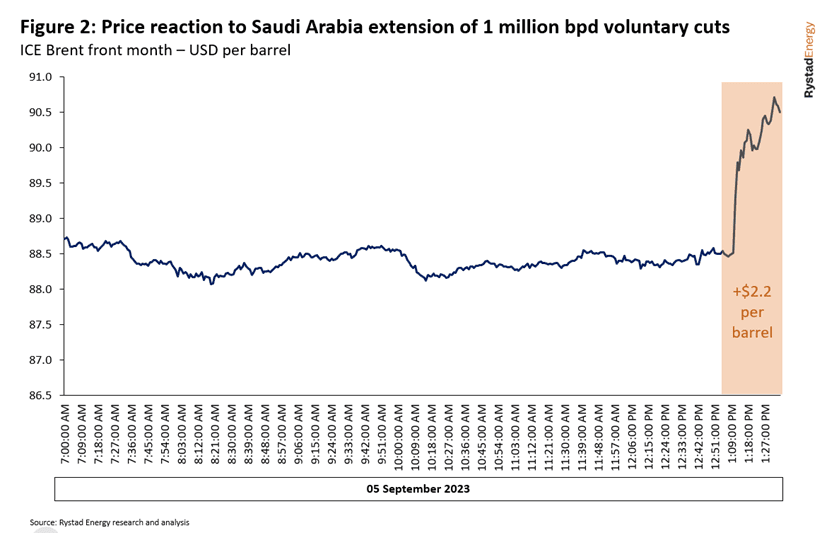

The oil market was quick to react to OPEC’s founding member Saudi Arabia extending its one million barrel per day (bpd) production cut to December 2023. Oil prices shot up to US$90.50 – the highest it’s been since November 2022.

That move, according to Rystad Energy’s Senior Vice President, Jorge Leon, indicates one thing; “that oil prices trump volumes for the Kingdom.”

Saudia Arabia’s cut, along with Russia’s extension of voluntary export cuts of 300,000 bpd till 2023’s end were deemed “bullish” by Leon and can only result in one thing: higher oil prices worldwide.

Before, Brent prices stood at US$88.50 a barrel.

Will OPEC’s biggest production cut since 2020 fuel a global recession? | OilNOW

Rystad Energy is now predicting that global liquids demand will shoot past supply by around 2.7 million bpd in this quarter.

“The big question is: Are the Saudis worried about global demand in the final quarter of 2023, particularly in China so that they need to take pre-empted measures,” asked Leon in his latest analysis.

Rystad Energy found no deceleration in China’s macroeconomics that “could justify” such a move by Saudi Arabia.

“The impact these cuts will have on inflation and economic policy in the West is hard to predict, but higher oil prices will only increase the likelihood of more fiscal tightening, especially in the US [United States], to curtail inflation. Western leaders, wary of an oil price spike, could explore import adjustments or open diplomatic discussions to help mitigate the impact and tame inflation,” Leon outlined.

The US Department of Energy already had notices out to purchase approximately 12 million barrels of oil to prop up its Strategic Petroleum Reserve (SPR).

Just in April, the International Energy Agency (IEA) traded words with OPEC, because of its production cuts. Executive Director Fatih Birol in a Bloomberg interview said OPEC should be “very careful” with its production policy, warning that its short-term and medium-term interests seem to be clashing. Birol said that higher crude prices and upward inflationary pressures can lead to a weaker global economy, with low-income nations in the direct line of fire.