(Reuters) – Oil prices eased on Thursday following weak U.S. payrolls data and some profit-taking, but remained underpinned by tight supply as OPEC+ producers stuck to planned moderate output increases.

Brent crude fell 61 cents, or 0.7%, to $88.86 a barrel by 0915 GMT, after rising 31 cents on Wednesday. U.S. West Texas Intermediate crude was down 69 cents, or 0.8%, at $87.57 a barrel, having gained 6 cents the previous day.

U.S. private payrolls fell for the first time in a year in January, raising the risk of a sharp decline in employment that would deal a temporary setback to the labour market.

Still, tight global supplies and geopolitical tensions in Eastern Europe and the Middle East have boosted oil prices by about 15% so far this year.

The Organization of the Petroleum Exporting Countries and allies led by Russia, known as OPEC+, agreed on Wednesday to stick to moderate rises of 400,000 barrels per day (bpd) oil output despite pressure from top consumers to raise output more quickly.

“At this juncture, even if OPEC+ were ramping up faster, this would only come at the expense of a critically lower level of spare capacity,” Goldman Sachs said in a note.

The bank, which forecasts Brent topping $100 a barrel in the third quarter, had predicted that OPEC+ may consider a faster unwinding of its production cuts.

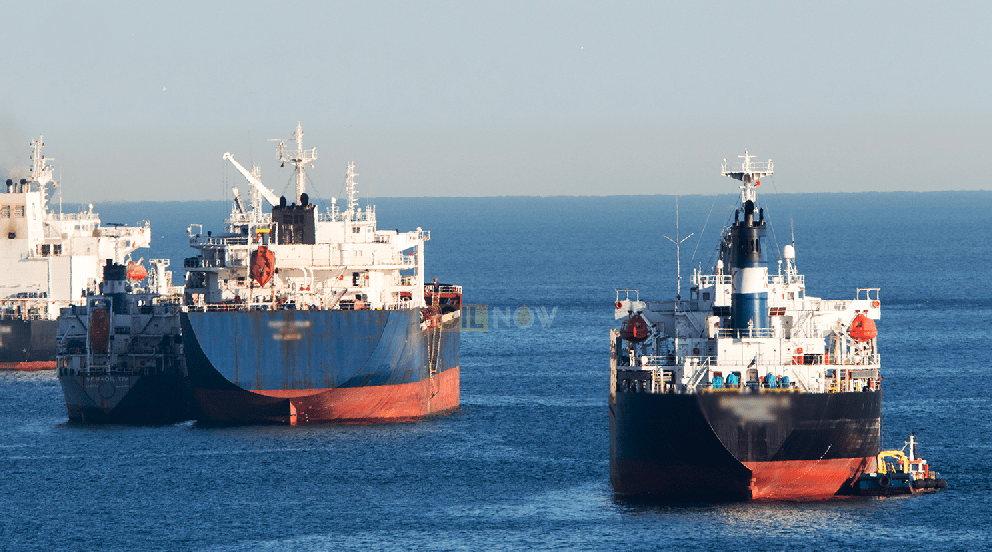

An explosion has rocked an oil production vessel owned by Nigeria’s Shebah Exploration & Production Company Ltd (SEPCOL) with a 22,000 bpd capacity, the company’s chief executive Ikemefuna Okafor said on Thursday.

Nigeria had already been struggling to meet its production quota under the OPEC+ deal due to under-investment.

Shell again boosted its dividend and share repurchases on Thursday after fourth quarter profits hit their highest in eight years, fuelled by higher oil and gas prices and strong gas trading performance.

U.S. crude stockpiles fell by 1 million barrels last week, the U.S. Energy Information Administration said on Wednesday, while distillate inventories also dropped amid strong demand both domestically and in export markets.

Cold weather forecasts for the central United States and parts of the Northeast this week also gave prices a floor.