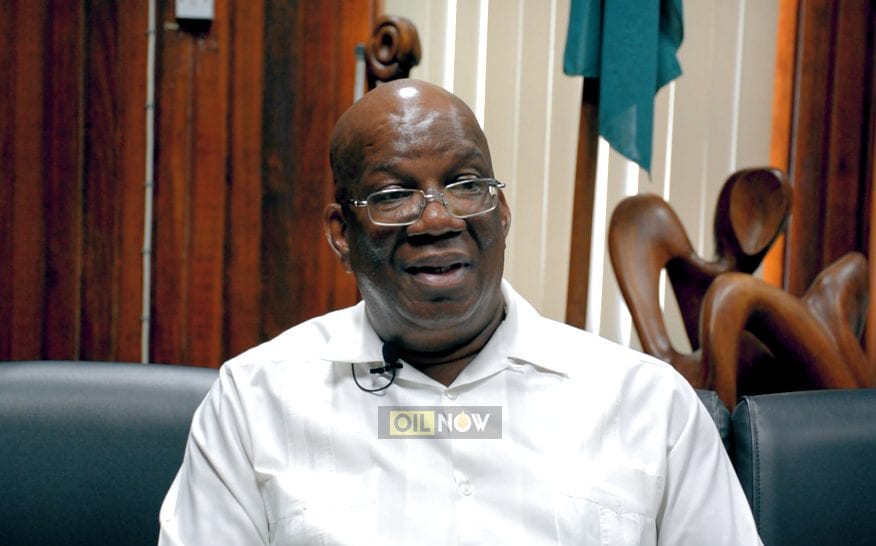

Guyana’s Minister of Finance, Winston Jordan, believes a structured approach must be adopted to ensure Guyanese can benefit meaningfully from oil revenue. Mr. Jordan favours assistance for vulnerable groups but is not in support of random cash payouts to citizens across the board, which he said would be tantamount to ‘giving people the fish rather than teaching them how to fish’.

“Cash payouts is not anything new in Guyana, we have been doing cash payouts, but always it comes with some caveat or there is something you have to do in order to get it…So it is not that I am against cash payouts, but it must be conditional. Conditional cash transfers. So, people can use the money to do specific things, such as post-secondary education,” Mr. Jordan told OilNOW on Monday during an interview at his Main Street, Georgetown, office.

He went further to explain that he supports a structured approach to disbursing funds to persons for skills training programs, small business grants, and other forms of economic empowerment. But the finance minister understands that some persons may not be able to qualify for such funds due to age or ability. However, they would not be neglected.

“Old aged pensioners, people with disabilities, and children will have a special program… the support program they have right now at the Ministry of Social Protection is little to nothing. So maybe we can ramp it up,” suggested Mr. Jordan.

In lieu of cash payouts, some financial experts have called for a slashing of taxes. In fact, Investment Fund manager of Pollards Et Filles Ltd., Dr. David Pollard, recently advocated for the complete elimination of income taxes as he believes that cash payouts will have a detrimental effect on the workforce. During a recent public lecture on the economic impact of oil Dr. Pollard explained;

“I prefer you run into zero taxes than just handouts because handouts can have a damaging long-term effect on the ability of the local workforce to deal with the problems that may come,” Dr. Pollard said.

While Mr. Jordan does not share the view of zero taxes, he did make it clear that Guyanese should receive benefits in the form of lower taxes.

“I believe in low taxes. I wouldn’t have sold it how [Dr. David Pollard] sold it. But I see it this way, such incomes, whenever they assume a certain amount can benefit from a lowering of income taxes, a lowering of corporate taxes, getting rid of certain taxes, consolidating other taxes, and keeping them to a limited amount, to ensure that people have more money in their hand… But if you put money into people’s hands than it must have real purchasing power and that power will only come through production in the society,” he said.

Nonetheless, the finance minister emphasized that the lowering of taxes and improved pensions for more vulnerable citizens are only two of several proposals his Ministry is considering.