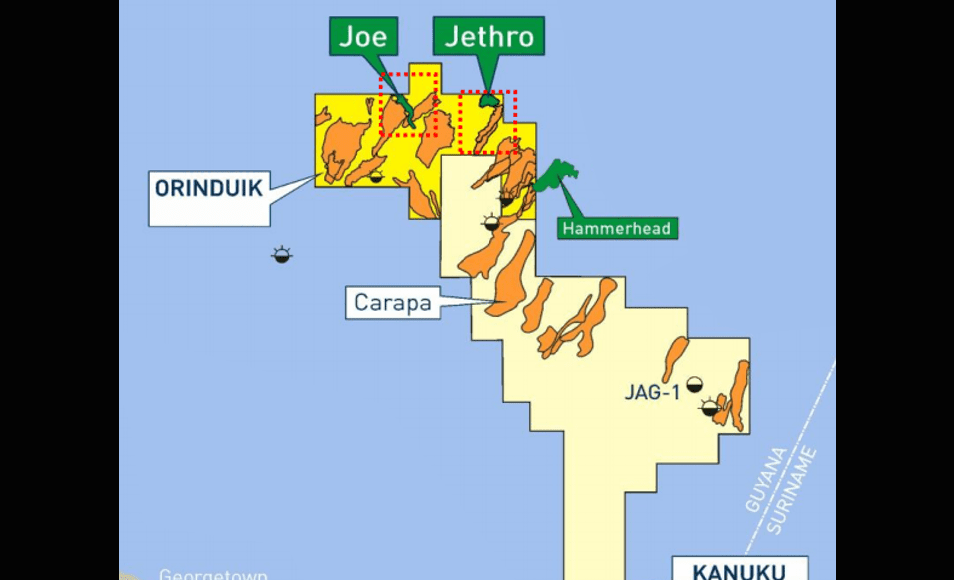

CEO of Eco Atlantic Oil and Gas Gil Holzman says that with the rare back to back oil finds in the Jethro-1 and Joe-1 wells in the Orinduik Block offshore Guyana, he believes that this is a portent of even greater things to come.

The discoveries at the Jethro-1 well and the Joe-1 well came about two weeks apart.

Eco Atlantic is a 15 percent stakeholder in the Orinduik Block along with Tullow Oil Plc. (50 percent) and Total (25 percent). The joint venture partners have made two discoveries in a matter of weeks and have concluded that the latest site could yield even more recoverable oil.

Holzman said that the massive success rate of ExxonMobil’s discoveries in the Stabroek Block – especially the Hammerhead discovery – is good news for Eco Atlantic and its partners as the areas of interest are being further de-risked.

“Following the two discoveries and the opportunity presented by Hammerhead, Orinduik now looks like a big pool of oil traps when looked at with fresh eyes. The data gathered in the last month or so really strengthens our ability to interpret the field for future development – where the real opportunity lies,” said Holzman.

He added, “Few firms enjoy two hits out of two wells – especially when these were not appraisal wells but exploration wells. When combined with Jethro, Joe’s success proves that our theory of shallow low-cost plays in Guyana exists. With two proven oil discoveries on our block in two separate horizons, and with multiple drilling targets in front of us, we are in a great place to develop a world-class asset.”

He said that in moving forward the partners are completing a detailed evaluation of the Jethro, Joe, and Hammerhead extension oil reservoirs on the Orinduik Block.

Elsewhere, Holzman said that a jack-up rig is due to drill a well called Carapa-1 on a nearby Guyana licence later this month with the results due in the final quarter of 2019.

He noted that with an opportunity in place for Orinduik’s cretaceous play to be proven alongside its tertiary plays, Eco will soon formulate a future drilling programme for the block with its partners. “Key to this will be last September’s Competent Person’s Report (CPR), which identified numerous exploration leads, many of which will have been de-risked significantly…” he said. Holzman added that once the results from the three different horizons; the upper tertiary which is now proven, the lower tertiary that we established from Jethro, and later Carapa towards the end of October, the partners will then get together and come up with an exploration and appraisal plan for the next year.

In concluding, he said that Eco Atlantic “is in a highly advantageous position” with funding the planned projects. “Thanks to a $12.5m payment from Total in the wake of its Orinduik farm-in deal last year and a $17m placing in April, the firm had CAD$39.7m (£24.11m, $29.96m) in cash and cash equivalents as at the end of June 2019,” Holzman said.

This, he pointed out, comes in spite of the company’s obligation to contribute $7m and $3m to the drilling of Jethro-1 and Joe-1, respectively.

Holzman further stated that this gives the business the scope to fund the drilling of up to six additional Orinduik wells at current prices.

“This is very exciting as the de-risking from Jethro and Joe gives us a few targets that we are very confident about going to drill and immediately encountering oil. We have a very successful team of experts from Tullow, Total and ourselves around the table and are highly enthused about the months to come – our confidence in Orinduik is increasing with every hole we drill,” he stated.