The volatility of oil price is a key factor in making projections about revenue, and as such, keen attention should be focused in this area as Guyana moves towards first oil. In fact, Guyanese scientist and Director at Mid-Atlantic Oil and Gas Inc., Dr. Dennis Pieters believes that this should attract more attention than the contract between the South American country and US oil major ExxonMobil, currently is.

Over the past several months, the ExxonMobil Guyana Production Sharing Agreement has been in the spotlight over terms and conditions which some sections of the society say should have been more favourable to the country. While some have been calling for a renegotiation of the deal, both the government and the oil company have said that no real basis for such a move exits and have promised to respect the sanctity of contract.

“We talk all the time in Guyana about the contract we signed (but) nobody is talking about what the price of oil will be,” Dr. Pieters told those gathered for a conference on Tuesday, organized by the School of Entrepreneurship and Business Innovation (SEBI), held on the outskirts of Georgetown at the Ramada Princess Hotel.

He said the business of exploration and production comes with high uncertainty, noting that on average, oil companies have a 1 in 10 chance of making a discovery, then if they do, must contend with a number of unknowns, chief of which is oil price.

“Predicting the price of oil is an art…no one has been able to do it. So, within a 30-year period what are the chances of knowing what the price of oil will be?” he posited.

After the price crash of 2014 oil fell from above US$100 per barrel to around US$30 per barrel in 2016. While it is currently back up to around US$80, analysts in the industry were predicting a lower for longer scenario with a price of about US$50 over the next 5 years.

“Do you realize that if the oil is $40 and goes up to US$80, that’s double the revenue you’re going to get? So we should be paying more attention to the price rather than maybe even the contract that we signed,” he said.

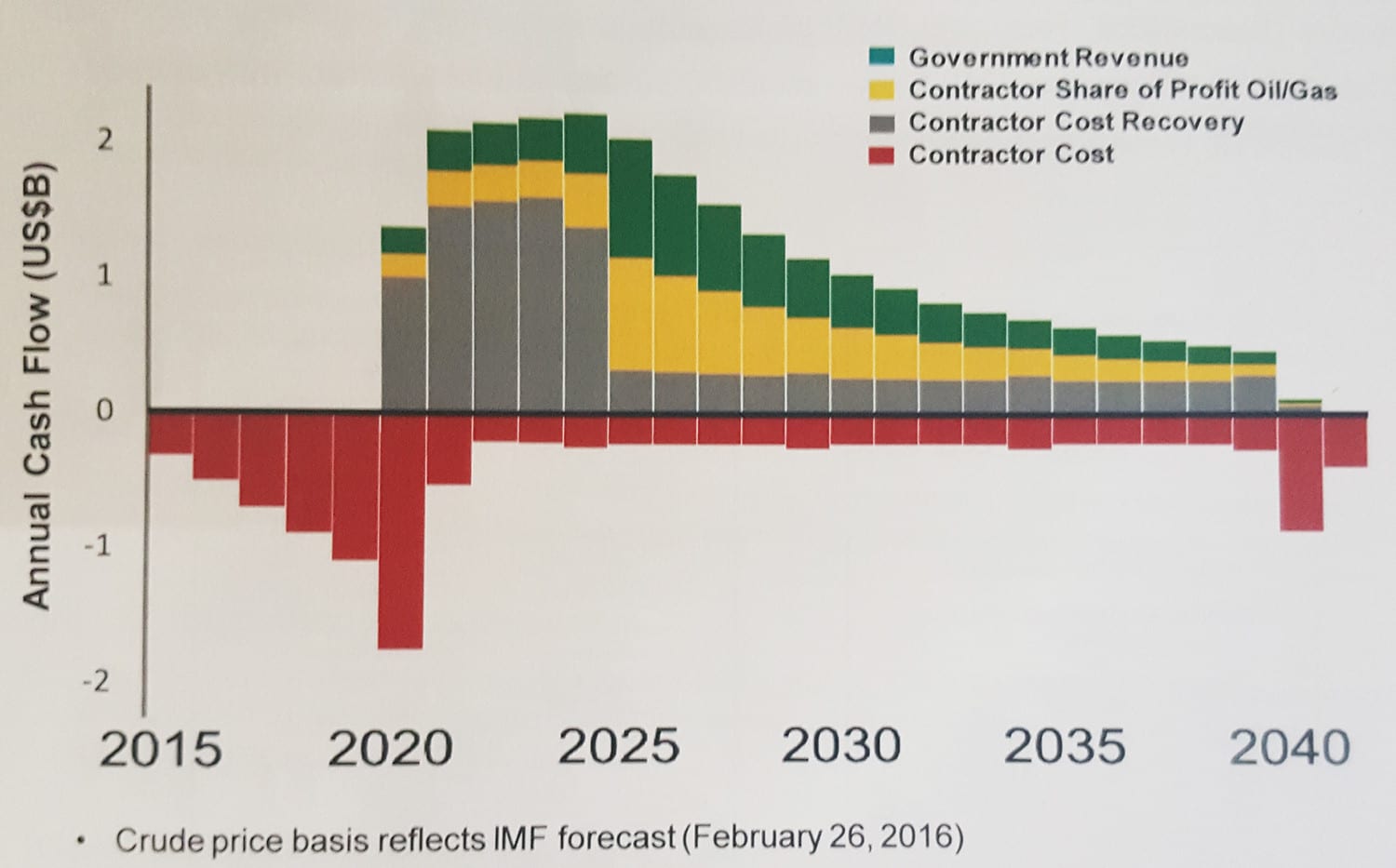

Oil companies start out in the red

Turning his attention to the standard used by oil companies to outline revenue and expenditure throughout the life of the project – which he described as the ‘cash flow model’ – Dr. Pieters said, “If you look at the plot of that you will see that in the first couple of years the capital that you spend, which is tremendous, has to come out first. So initially, you are in the red, you are in the negative…” he pointed out, nothing that after the first few years this begins to change and companies could then begin turning a profit.

Using the rate of return, he said ExxonMobil would have weighed Liza against other projects they have around world to determine its viability before making their Final Investment Decision. “When they looked at Liza they realized that that project, right away, ranked fairly high and so they said let’s go with it. You have to remember too that Liza was approved in about 2016 when oil prices were probably at the lowest point, which tells you that this project is very robust and very economic.”

Dr. Pieters is a pioneer in the use and understanding of reservoir engineering aspects of Horizontal wells. His training and knowledge has been applied to a number of projects in Reservoir Simulation (modeling), Reserve Analysis and Reservoir Management of Oil & Gas Fields spanning the globe.

Oil production is set to get underway in Guyana by March 2020 with the Liza Phase 1 development which will see around 120,000 barrels of oil per day being produced. The projected revenue for Guyana over the lifetime of the project is pegged at around US$7B but can be more or less, depending on oil price.