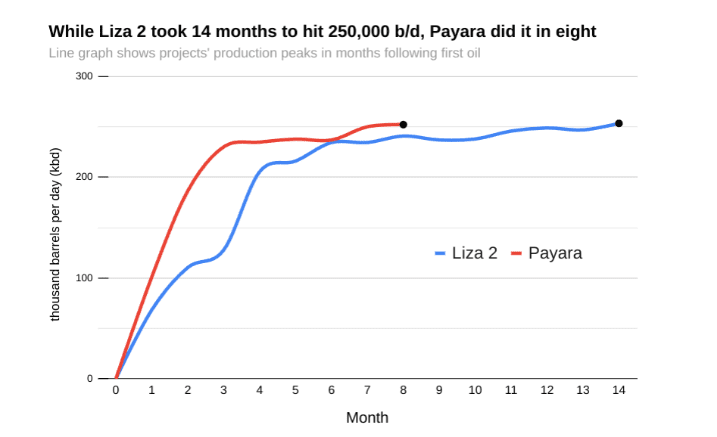

Oil production at ExxonMobil’s Payara development has been optimized in record time, delivering oil output in excess of 250,000 barrels per day (b/d) in its eighth month of production.

Payara, which achieved first oil in November 2023, first reached its initial target production of 220,000 b/d in January. Exxon confirmed Wednesday that planned optimization for this project is complete. In comparison, Liza 2, Exxon’s second development at the Stabroek Block, took five months to reach its initial target, and another nine to hit 250,000 b/d. This is according to government data.

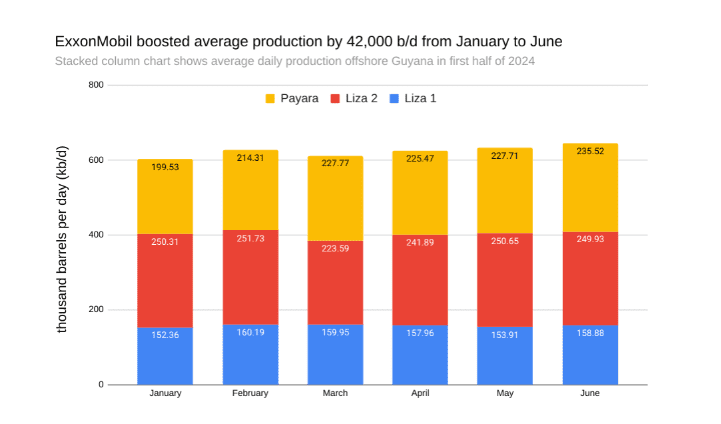

The Payara project contributed the most to Exxon’s oil production increase since the year began. The combined average output from the Liza 1, Liza 2 and Payara projects was 602,000 b/d in January. With Payara’s stabilization and optimization, total output from the three projects averaged 644,000 b/d in June.

Among the three projects, Exxon produced more than 113 million barrels of crude in the first six months of 2024, averaging 623,000 b/d. This so far outperforms a government projection of 202 million-barrel lifts in 2024, which equates to approximately 552,000 b/d.

Exxon is pursuing brief third-quarter shutdown periods to hook up a gas pipeline to the Liza projects. Even with the deferred production from this activity, the Stabroek Block is on track to exceed expectations for 2024. Exxon could produce 20 million barrels more than the government projected this year, if it maintains its half-year daily average. However, the company has said it will further optimize the Liza 2 project in the third quarter to increase production.

With production increasing every year, 1.4-1.5 million b/d could be achieved by the end of the decade, boosting revenues for the companies’ shareholders and the Guyana government.

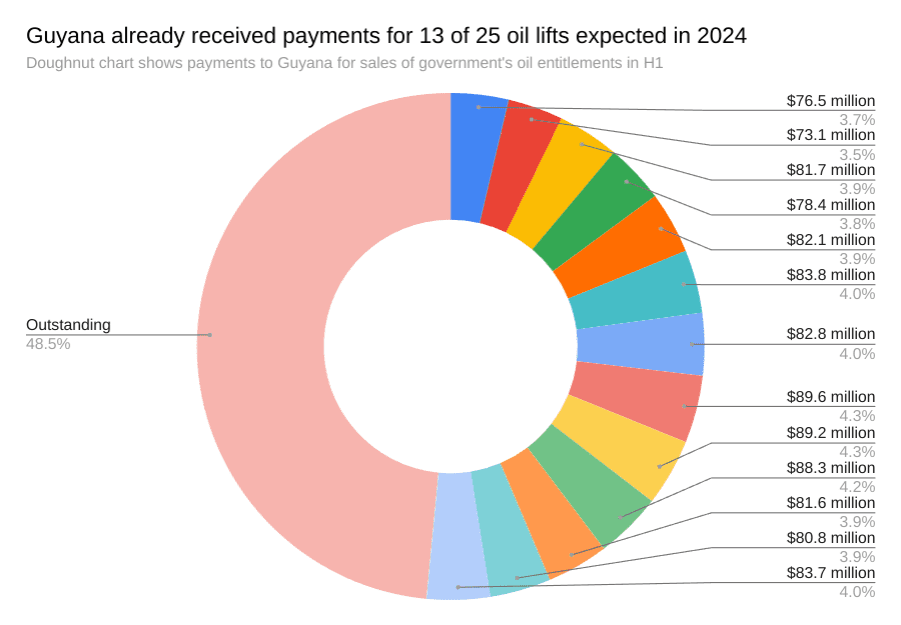

The government projected that it would receive US$2.08 billion in payments for 25 million-barrel lifts of crude. Payments for 13 lifts from 2024 were deposited into the oil fund in the first half of the year.

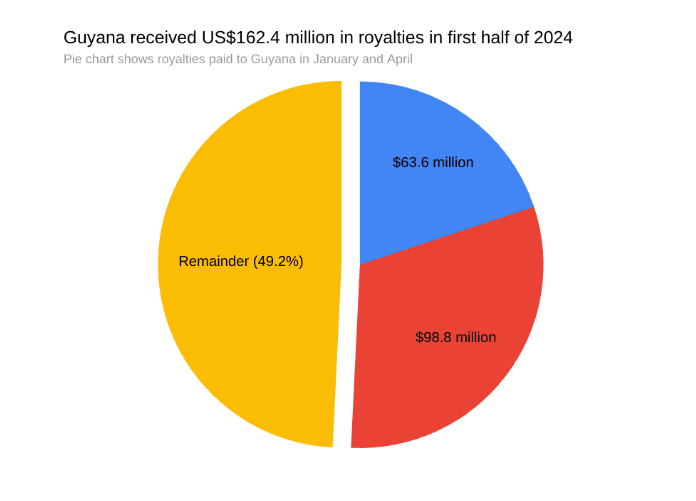

With the government projecting it would receive US$319.9 million in royalties, two of four quarterly payments were deposited into the oil fund in the first half of 2024. These amount to US$162.4 million. The remaining payments are expected in July and October.

The government, up to July, withdrew US$850 million from the Natural Resource Fund in 2024. Additional withdrawals, totaling US$736 million, are expected in the remainder of the year. The National Assembly earlier this year approved a total withdrawal of US$1.586 billion, after amending the law to allow for greater withdrawals to support its development agenda.

Based on the government’s expected 2024 inflows and withdrawals, the Fund could close the year with more than US$2.8 billion, with significant upside potential. Consequently, the Fund’s withdrawal rule is expected to allow more than US$2.2 billion in withdrawals next year to support the 2025 budget.

Exxon is the operator of the Stabroek Block with a 45% stake. Co-venturers Hess holds 30% and CNOOC 25%.

About Guyana’s Oil Ledger

Guyana’s Oil Ledger offers analyses of the latest oil production data and government oil fund receipts, published typically on a fortnightly basis. The column is authored by Kemol King, a journalist specializing in Guyana’s oil and gas sector.