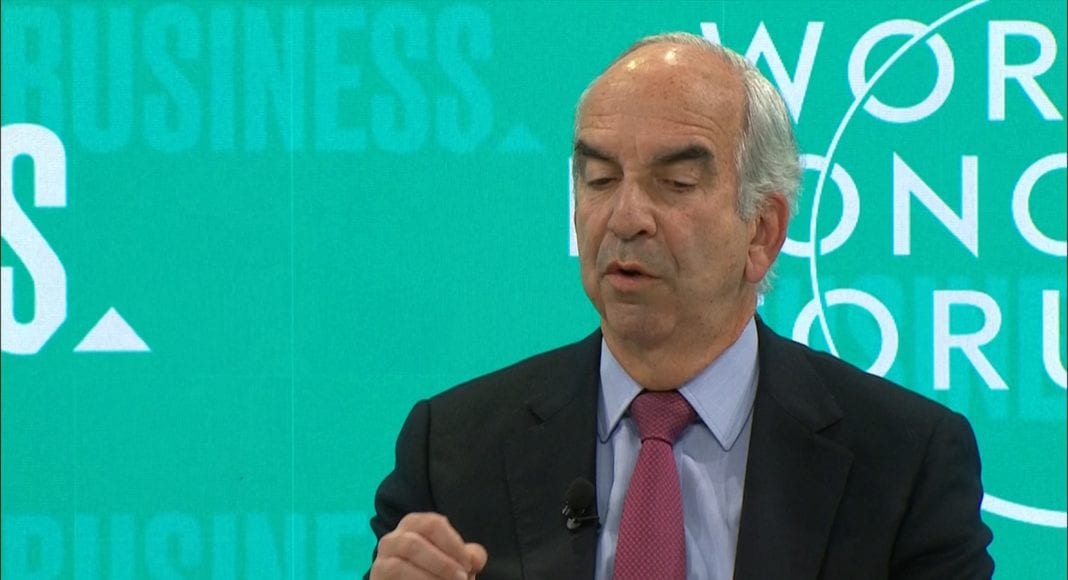

CEO of Hess Corporation John Hess said the fallout from the current oil price war between Russia and Saudi Arabia could lead to a worldwide economic recession and a reduction of US oil production in 2021.

Hess was on March 12, 2020 speaking via telephone on CNBC’s market and business-related talk show ‘Fast Money’ hosted by Brian Sullivan.

Since the Saudi-Russian oil price war began, oil prices have dipped frighteningly low to about $31 per barrel and this has been compounded by slowdowns due to coronavirus restrictions as the disease spreads globally. Saudi-led OPEC has said it will be ramping up production, having failed to convince Russia to cut production with a view to shore prices up in response to the global coronavirus pandemic.

“In the past oil prices have been hit either with a supply shock or a demand shock. Right now, we have two, and in terms of demand the fear from the coronavirus has had a huge impact on demand. Basically, this year we expected demand to be going up one million barrels per day. Now it is estimated to go down 500,000 barrels per day,” he said.

Hess noted that Saudi Arabia and Russia are playing “chicken” at the world’s expense. “The economic problems we are facing today are a lot more than oil and the oil price crash could be a catalyst that propels the world into an economic recession…and the deeper we get in the harder it is to get out,” said Hess.

Asked whether there is anything that the United States Government should do to help oil companies in this time of crisis brought on by the falling price of oil, Hess said that a government bailout to the oil companies is not the answer. He said instead the government should try to help ordinary people most affected such as those who lost their jobs or who have jobs and are not being paid as a result of falling markets.

He said the outcome of this crisis could be a reduction of the US rig count by at least 50 percent. “And as a consequence, oil production in the US will probably be down a million or a million and a half barrels per day,” he said.

Hess has a 30 percent stake in Guyana’s offshore deep-water Stabroek Block along with ExxonMobil the 45 percent operator and CNOOC, a 25 percent co-venture partner.